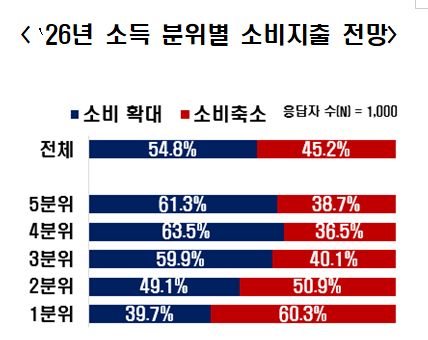

According to The Financial News, President Lee Jae Myung on the 22nd commented on the Korea Composite Stock Price Index (KOSPI) briefly surpassing the 5,000 mark during intraday trading, saying, "The National Pension Service holds shares in Korean companies, and the value of those holdings has increased by about 250 trillion won. We are now in a situation where at least most of the people here probably no longer need to worry about the fund being depleted." President Lee made these remarks on the 23rd at the "Listening to the Heart of Ulsan" town hall meeting held at UECO in Ulsan Metropolitan City. President Lee noted, "Yesterday, everyone was pleased and offered praise because the stock index broke through 5,000 points," adding, "But on the other hand, some people say, 'What does a rising stock market have to do with me?' and even, 'Why do my stocks only go down?' When Korean companies are properly valued, the first result is that the wealth of all our citizens increases." President Lee also plans to accelerate follow-up measures to invigorate the capital market. The previous day, he shared a post by Democratic Party of Korea (DPK) lawmaker Lee So-young on his social networking service (SNS) account and wrote, "Artificially depressing share prices just to save on inheritance tax is unacceptable; we will revise the law as quickly as possible." President Lee has reportedly instructed Kim Yong-beom, the presidential policy chief at Cheong Wa Dae (the Blue House), to review the matter. Lawmaker Lee last May introduced the so-called Stock Price Suppression Prevention Act as the lead sponsor. The bill is a proposed amendment to the Inheritance and Gift Tax Act. According to Lee, because a listed company’s inheritance and gift tax is calculated based on its share price, it is more advantageous for controlling shareholders when the price is low. As a result, it is very common for companies where the controlling shareholder holds a high equity stake to see their shares remain in a chronically undervalued state. To address this problem, the bill’s core provision is that when a company’s share price is less than 80% of its net asset value, inheritance tax should be calculated not on the market price but using the "unlisted company valuation method." President Lee also reportedly held a luncheon at Cheong Wa Dae with the Democratic Party KOSPI 5000 Special Committee, where they agreed on the need to swiftly proceed with the third amendment to the Commercial Act of the Republic of Korea. After the luncheon, Oh Gi-hyung, chair of the special committee, told reporters at the National Assembly of the Republic of Korea, "The party and Cheong Wa Dae share the view that we must continue institutional reforms to strengthen the basic fundamentals of the capital market." Regarding the third amendment to the Commercial Act of the Republic of Korea, which centers on making the retirement of treasury shares mandatory, Oh said, "We agreed that this can no longer be delayed," adding, "The party and Cheong Wa Dae will work together to communicate and persuade stakeholders in various domestic and international forums." President Lee has also reportedly called for speeding up efforts to abolish the crime of breach of trust. cjk@fnnews.com Choi Jong-geun Reporter

-

73 Members of Cambodia-Based Scam Ring Forcibly Repatriated to Korea and Taken to Police

-

'KPop Demon Hunters' Aims for More Oscar Glory, While Park Chan-wook's 'No Other Choice' Omission Called 'Shocking'

-

Busan moves to crack down on price gouging ahead of BTS concert... “Securing public lodging”

-

He Is Only 30, but... MPVA Explains Why Faker Could Be Buried in a National Cemetery