"11 Trillion Won Poured In"...Policy-Driven Flows Spread Across Top KOSDAQ Large Caps

- Input

- 2026-02-22 12:52:24

- Updated

- 2026-02-22 12:52:24

[Financial News] Expectations for government policy and institutional funds are combining to shift the KOSDAQ market’s center of gravity toward index heavyweights. While thematic rotation continues in areas such as sectors and concepts, analysts say the final destination of actual money is concentrated in large-cap names, including those in the KOSDAQ 150.

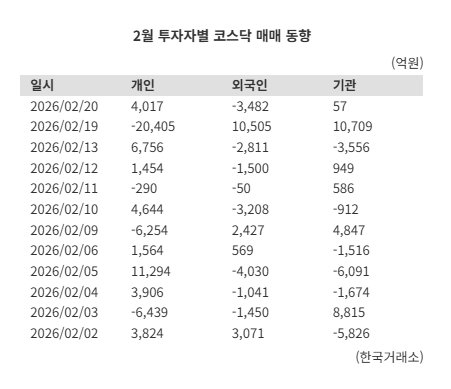

According to the Korea Exchange on the 22nd, institutions recorded net purchases of about 11.1 trillion won in the KOSDAQ market over the past month, based on closing prices as of the 20th. Of this, 99.2% went into stocks included in the KOSDAQ 150. This indicates that policy-driven flows have not spread broadly to small and mid caps, but have in effect been concentrated in the main index constituents.

Since the start of this month, both foreign and institutional funds have been flowing into the KOSDAQ market, reshaping the supply–demand structure. On the surface, there appears to be ongoing thematic rotation in areas such as biotech, robotics, and secondary batteries. In reality, however, capital is being funneled not into the broader market but into the top tier of KOSDAQ by market capitalization.

An asset management industry official stated, "Capital inflows driven by policy expectations are being confined to leading KOSDAQ names rather than specific theme stocks," adding, "Given the changing policy environment, the trend of flows concentrating on stocks with high index weightings is likely to continue for some time."

Against this backdrop, attention is also turning to policy momentum. Following revisions to the Ministry of Planning and Budget’s guidelines for evaluating fund management, expectations are rising for passive inflows from pension funds. Experts observe that as performance evaluation standards for pension fund managers improve, allocations to benchmark-tracking indices could increase. Because the KOSDAQ 150 is a primary target for such passive funds, expectations are building for structural benefits.

In addition, the Korea Exchange’s plan to swiftly delist distressed companies is raising hopes for qualitative improvement in the market. Cleaning up troubled stocks and tightening listing requirements could enhance trust in the KOSDAQ market. As a result, experts say investors are showing a stronger preference for large-cap stocks with relatively solid balance sheets and clearer earnings visibility.

Seol Tae-hyun, a researcher at DB Securities, noted, "Various themes such as solar power, secondary batteries, and digital health are rotating and showing upward moves, but the actual direction of flows is more structural," and added, "Unlike short-term theme trading that chases momentum, policy-driven flows are building long-term positions around the main index constituents."

Market participants view the current trend not as a simple theme-driven rally, but as the early stage of a re-rating phase for the indices. With policy expectations and institutional and foreign buying all working together, they explain that valuation pressures on leading groups such as the KOSDAQ 150 are easing.

Looking at the top net-buy names, foreign and institutional purchases are not concentrated in a single theme but are broadly spread across major KOSDAQ large caps. These include Alteogen, EcoPro, Leeno Industrial, WONIK IPS, Samchundang Pharm, and ISC—companies in different industries, but all with high index weightings and strong earnings visibility. The securities industry is watching to see whether policy-driven flows can move beyond a short-term, theme-centered rally and lead to a structural improvement in the core KOSDAQ indices.

A brokerage firm official commented, "In the past, KOSDAQ bull phases repeatedly saw certain themes surge sharply, but recently buying has been spreading across a wide range of large-cap names," and added, "As expectations for passive inflows from pension funds align with signs of structural improvement in the market, a more stable, index-centered uptrend is taking shape."

dschoi@fnnews.com Choi Doo-seon, Bae Han-geul Reporter