COFIX benchmark for mortgage loans falls, ending four-month rise

- Input

- 2026-02-19 16:00:32

- Updated

- 2026-02-19 16:00:32

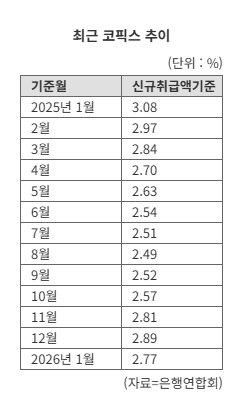

According to the Korea Federation of Banks (KFB) on the 19th, the COFIX based on new loan transactions for January this year was 2.77%, down 0.12 percentage points from 2.89% in December last year. The index had climbed from 2.49% in August to 2.52% in September and then continued to rise for four consecutive months before turning downward in January.

In contrast, the COFIX based on outstanding balances edged up from 2.84% to 2.85%, an increase of 0.01 percentage points.

COFIX is the weighted average interest rate on funds raised by eight major domestic banks. When COFIX declines, it means banks can obtain funds at lower interest rates; when it rises, their funding costs increase.

Specifically, both the new-transaction COFIX and the outstanding-balance COFIX are calculated using interest rates on products such as time deposits, installment savings, mutual installment savings, housing subscription savings, negotiable certificates of deposit, repurchase agreements, cover notes, and bank bonds (excluding subordinated and convertible bonds).

The "new outstanding-balance COFIX," introduced in June 2019, rose from 2.47% to 2.48%, up 0.01 percentage points. This index also reflects interest rates on other deposits, borrowings, and settlement-related funds.

Commercial banks are expected to apply the newly announced COFIX rates to variable-rate home mortgage loans as early as the 20th. Because the new-transaction COFIX is based on funds newly raised by banks in the previous month, it tends to reflect changes in market interest rates quickly. By contrast, the outstanding-balance and new outstanding-balance COFIX indices incorporate market rate movements more gradually.

coddy@fnnews.com Ye Byung-jung Reporter