The paradox of Hyundai Motor’s soaring share price: ‘Younger sibling’ Kia offers a higher dividend yield

- Input

- 2026-02-19 05:59:00

- Updated

- 2026-02-19 05:59:00

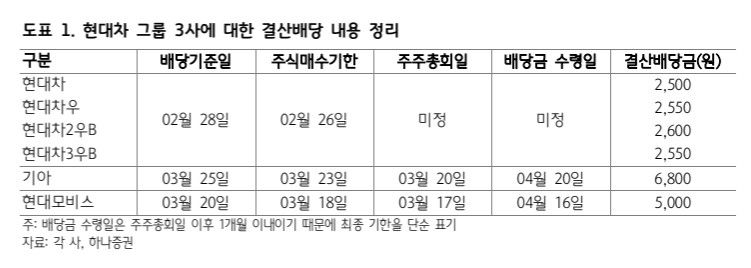

On the 19th, Song Sun-jae, an analyst at Hana Securities, released a report titled “Dividend strategy for the three Hyundai Motor Group companies through 2026.” He estimated year-end dividend yields at 4.1% for Kia, 1.1% for Hyundai Mobis, 1.0% for Hyundai Motor preferred shares and 0.5% for Hyundai Motor common shares. The assumed year-end dividends per share are 2,500 won for Hyundai Motor common stock, 6,800 won for Kia and 5,000 won for Hyundai Mobis common stock.

For Hyundai Motor common shares, the total annual dividend, including the 2,500 won year-end payment, comes to 10,000 won per share, implying an annual dividend yield of 2.0%. Preferred shares are expected to receive 10,050–10,100 won per share annually, with an anticipated dividend yield of about 3.8%.

Kia pays only a year-end dividend. For 2025, it plans to distribute 6,800 won per share, up 300 won from the previous year. Based on the current share price, the expected dividend yield is 4.1%.

Hyundai Mobis’s year-end dividend is 5,000 won per share, corresponding to a dividend yield of 1.1%. Including the 1,500 won interim dividend, the expected annual dividend yield comes to 1.5%.

Song explained, "Because share prices have surged, expected dividend yields themselves have fallen, making dividend investing less attractive than in the past." He added that dividend increases are not particularly large, and with share prices already high, dividend yields and shareholder-return measures no longer provide the same lift to stock prices as they once did. Dividend yield is calculated by dividing the dividend per share (the numerator) by the current share price (the denominator). As the share price — the denominator — rises, the yield naturally declines.

The three Hyundai Motor Group companies have set a total shareholder return ratio target of 30–35%. Hyundai Motor and Kia are aiming for 35%, while Hyundai Mobis is targeting 30%. This total shareholder return ratio combines the dividend payout ratio with share buybacks and cancellations. Looking only at the payout ratio, Hyundai Motor is at 25%, Kia at 35% and Hyundai Mobis at 16%. The remaining portion will be achieved through share repurchases and cancellations. Hyundai Motor plans to buy back 400 billion won worth of its own shares between January 30 and April 27 this year.

The record dates to qualify for the 2025 year-end dividends are February 28 for Hyundai Motor (with a purchase deadline of February 26), March 25 for Kia (March 23 purchase deadline) and March 20 for Hyundai Mobis (March 18 purchase deadline). Shareholders listed on the shareholder register as of these record dates will receive their dividends within one month after the 2025 year-end general shareholders’ meetings — the date for Hyundai Motor is yet to be set, while Kia’s meeting is scheduled for March 20 and Hyundai Mobis’s for March 17.

ehcho@fnnews.com Eun-hyo Cho Reporter