[Editorial] "Owning Multiple Homes Is Not Always the Problem"

- Input

- 2026-02-18 19:33:38

- Updated

- 2026-02-18 19:33:38

Since he personally announced on the 23rd of last month that the temporary suspension of heavier capital gains taxes on multiple-home owners would end, Lee has continued to post messages related to the real estate market. Even during the Lunar New Year holiday, he said, "We are only seeking to normalize the real estate market, not forcing anyone to sell their home," and, "A house can be an investment asset, but fundamentally it is a means of residence." He also asked, "Do you really believe we should not regulate multiple-home owners, that we should protect them and maintain existing preferential treatment in areas such as finance and taxation?" and pledged, "I will shake off all fear, save every minute, and devote my utmost efforts." These remarks are widely seen as a declaration that he intends to confront political controversy head-on and focus all efforts on stabilizing the housing market.

Stabilization messages led by the president are being reflected in the market almost immediately. In weekly statistics from KB Real Estate, the number of sellers has risen sharply compared with buyers, pushing the buyer’s preference index down to its lowest level of the year. A survey by a private real estate big data platform also found that apartment listings in Seoul increased by 7.5% over the past ten days, exceeding 64,000 units. Given how sensitive the real estate market is to buyer and seller sentiment, it is clear that the president’s remarks are having a significant impact.

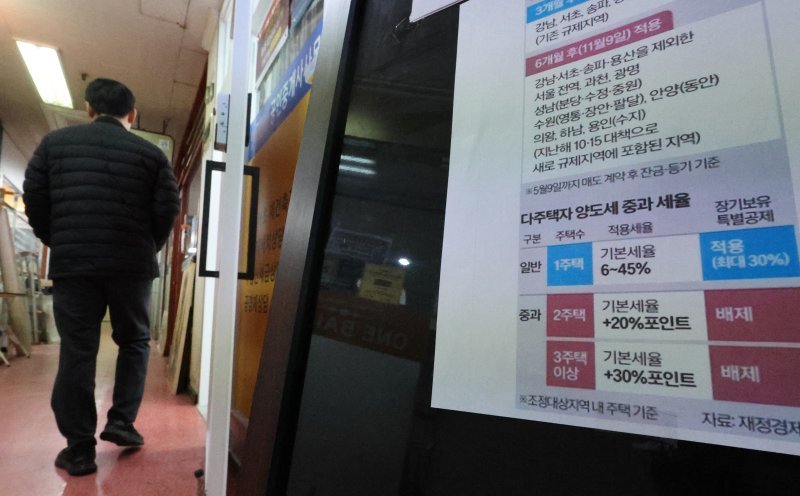

The government is also fleshing out policy in line with the president’s messages. On the 10th, it decided to end the temporary suspension of heavier capital gains taxes on multiple-home owners on May 9 as scheduled, while allowing an additional four to six months for final payment and registration after a sale. Right after the Lunar New Year holiday, it also began reviewing a plan to strictly apply regulations on the interest coverage ratio based on rental income (RTI) when extending the maturity of roughly 14 trillion won in loans to registered landlords. This follows the president’s question, "Is it fair to simply extend loan maturities for multiple-home owners?" As a result, the heavier interest burden could increase pressure on these owners to sell.

However, these changes do not automatically translate into improved housing stability for ordinary people. If policy focuses only on home prices, the burden on existing tenants and those seeking jeonse leases could grow. Signs are already emerging that the recent shortage of jeonse apartments that began in Seoul is spreading to major areas in the surrounding Gyeonggi Province. Higher interest costs caused by lending regulations may be passed on through higher rents, and in the event of loan defaults, tenants—who rank lower in repayment priority—could suffer losses.

In particular, some warn that once the heavier capital gains tax is reinstated on May 10, multiple-home owners may choose to hold onto their properties and raise rents instead of selling, causing listings to dry up again. In 2018, when the heavier capital gains tax was temporarily waived, listings did increase, but once the higher tax took effect, transactions shrank and home prices rose. If policymakers fail to learn from this experience, the impact of current measures will inevitably be limited.

Real estate is a basic living infrastructure that underpins people’s lives. Policy should not swing with short-term price movements or be swayed by political advantage and disadvantage at the expense of core principles. A sophisticated approach is needed, one that protects genuine homebuyers and prioritizes the housing stability of tenants, while coordinating tax, financial, and supply policies in an integrated way. The government must pursue predictable and accountable policymaking based not on ideology, but on data and signals from the field.