"Delisted if the share price fails to top 1,000 won"... Penny stocks tumble in succession

- Input

- 2026-02-17 07:30:00

- Updated

- 2026-02-17 07:30:00

[Financial News] Share prices of so-called "penny stock" companies, whose stocks trade below 1,000 won, have been falling across the board. The decline is seen as a result of weakened investor confidence after the financial authorities introduced new delisting criteria targeting penny stocks. Some of these stocks experienced sharp intraday surges and plunges.

According to the Korea Exchange (KRX) on the 17th, share prices fell for 35 out of 47 stocks trading below 1,000 won on the Korea Composite Stock Price Index (KOSPI) market as of the 13th. On KOSDAQ, prices declined for 135 out of 150 penny stocks. A number of penny stocks showed high volatility. Newintech, a KOSDAQ-listed company, hit the upper price limit after jumping 29.39% right after the market opened, but later reversed course and ended the session down 19.35% from the previous day. SCONN also soared 21.4% in the morning, only to give up gains in the afternoon and close down 3.97%.

The broad decline in penny stocks is largely attributed to the Financial Services Commission (FSC)'s announcement on the 12th of tougher delisting rules. The FSC has created a new delisting requirement specifically for companies whose share prices remain below 1,000 won. Under the new rule, a listed company whose share price stays under 1,000 won for 30 consecutive trading days will be designated as an issue under management. If, during the following 90 days, its share price fails to rise above 1,000 won for at least 45 consecutive trading days, the company will be delisted. The new criteria will take effect on July 1 this year.

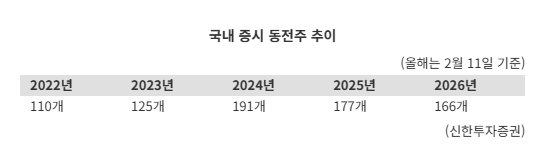

In fact, after delisting conditions were eased in 2022, the number of delisted companies decreased, while the number and proportion of penny stocks with poor liquidity surged as their exit from the market was delayed. In 2021, there were 57 penny stock companies on KOSDAQ, accounting for 3.7% of the market, but by 2024 that figure had risen to 191, or 10.7%. As of the 11th, just before the FSC announcement, there were 166 penny stocks.

The government has also added a "post-reverse-split price below par value" condition to prevent companies from circumventing delisting through reverse stock splits. Even if a reverse split lifts the market price above the 1,000-won threshold, the company will still be delisted if the closing price remains below its par value. According to Shinhan Investment & Securities, as of the 11th, 26 out of 166 penny stock companies had closing prices below their par value.

Kang Jinhyuk, an analyst at Shinhan Investment & Securities, said, "In any scenario, expectations that companies will try to boost their share prices to avoid delisting can trigger short-term volatility," adding, "On the actual announcement day, the 12th, some penny stocks hit the upper price limit and posted sharp gains."

Financial authorities are steadily expanding the scope of delisting criteria. They have decided to move up the schedule for raising the market capitalization thresholds that were announced last year as part of the revenue and market cap-based delisting standards. Originally, companies with a market cap below 20 billion won were to become subject to delisting from January 2027, and those below 30 billion won from January 2028. This has been brought forward so that the 20 billion won threshold will apply from this July, and the 30 billion won threshold from January next year.

Based on simulations by the Korea Exchange, between at least 100 and as many as 220 companies on KOSDAQ are expected to become subject to delisting this year.

nodelay@fnnews.com Reporter Park Ji-yeon Reporter