"I Bought In Because of Atlas..." Foreign Investors Dump 5 Trillion Won in Hyundai Motor While Retail Investors Keep Betting

- Input

- 2026-02-17 07:00:00

- Updated

- 2026-02-17 07:00:00

According to the Korea Exchange (KRX) on the 17th, foreign investors have sold nearly 755 billion won worth of Hyundai Motor shares so far this month. It is the third most heavily sold stock after SK hynix and Samsung Electronics.

Looking at the full year to date, the foreign sell-off in Hyundai Motor is even clearer. Since the start of the year, foreigners have dumped more than 5.277 trillion won of Hyundai Motor shares. They have been net sellers almost every single day, with only four days as exceptions.

This is a stark contrast to last year, when foreigners were aggressively buying Hyundai Motor. As recently as December, foreign investors purchased nearly 265 billion won of the stock. It was one of their top buys after semiconductor bellwethers such as SK hynix and Samsung Electronics.

As heavy-hitting foreign investors accelerated their selling, the stock’s upward momentum also stalled. On the 13th, Hyundai Motor closed at 499,000 won, down 1.38% from the previous session. At the end of last year, the share price was stuck in the high-200,000 won range, but on the back of the Consumer Electronics Show (CES) effect it climbed to an all-time closing high of 549,000 won on the 21st of last month. It has since fallen about 9.1% from that peak and has recently been moving sideways in the high-400,000 won range.

The shares thrown away by foreigners are being scooped up by retail investors. Individuals have bought nearly 5.3 trillion won worth of Hyundai Motor stock so far this year, making it their number one net-buy name. They have purchased even more than SK hynix (3.991 trillion won) and Samsung Electronics (2.139 trillion won), signaling strong interest.

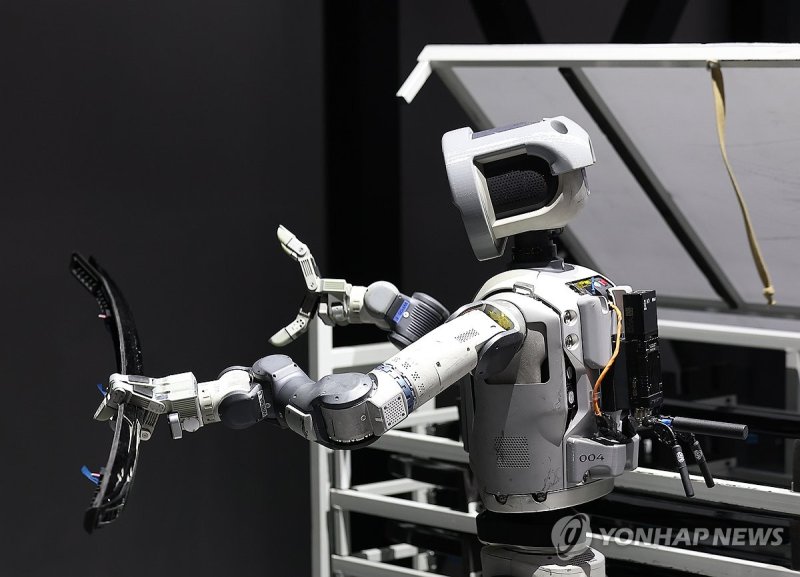

Kim Sung-jin, an analyst at KB Securities, stated, "Hyundai Motor Group is leading the robotics field in terms of mechanical sophistication, simulation and training capabilities, commercialization strategy, and mass-production strategy," adding, "Hyundai Motor is the most promising alternative that can share in the future value of autonomous driving and robotics, which Tesla has so far monopolized."

Lim Eun-young, an analyst at Samsung Securities, noted, "Among global automakers, only Tesla and Hyundai Motor Group possess all three technologies: autonomous driving, robotics, and batteries," and went on, "Hyundai Motor’s valuation is about one-twentieth that of Tesla, so its appeal as an undervalued stock is likely to stand out."

This year’s earnings outlook is also positive. Yoon Hyuk-jin, an analyst at SK Securities, explained, "Operating profit is expected to increase 15.3% year-on-year," and said, "Stable earnings in the automotive division are anticipated, driven by an improved hybrid mix in the North American market and the entry into a new-model golden cycle with vehicles such as the Tucson and Avante full model changes."

zoom@fnnews.com Lee Jumi Reporter