Refiners on Edge Over Petrochemical Restructuring: "Rising Capital Expenditure Burden" [fn Market Watch]

- Input

- 2026-02-16 06:15:00

- Updated

- 2026-02-16 06:15:00

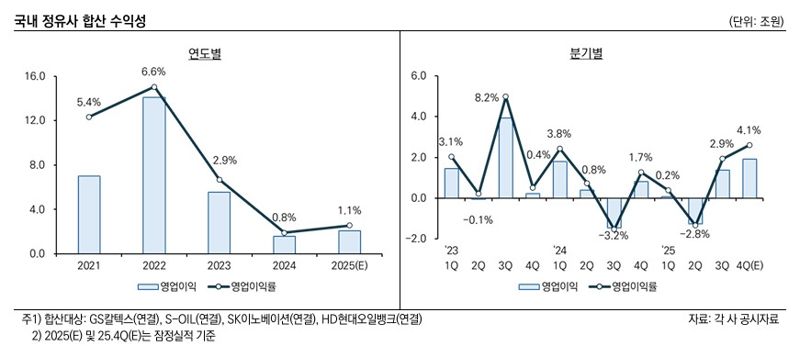

According to Korea Investors Service (KIS) on the 16th, the combined operating profit on a consolidated basis of the four major domestic refiners in the fourth quarter of last year came to 1.9 trillion won. Their provisional combined operating profit for the full year was 2 trillion won. The four companies are GS Caltex, S-Oil, SK Innovation and HD Hyundai Oilbank.

Kim Moon-ho, a researcher at KIS, said, "The four refiners showed a recovery in the second half of last year after weak earnings in the first half," adding, "Higher refining margins for key petroleum products led the improvement in refining performance."

The Singapore complex refining margin has been on the rise since November last year, supported by improved supply-demand conditions as the pressure from net additions of global refining capacity eased, as well as stronger sanctions on Russian petroleum products.

He noted, "In particular, the expansion of margins for diesel and gasoline, which are the main products of domestic refiners, had a positive impact on the earnings recovery," but added, "In non-refining segments, profits from lubricants were not enough to offset continued losses in petrochemicals and batteries."

In the petrochemical segment, oversupply of olefin products and weaker profitability in aromatics products deepened the downturn in results compared with the previous year. In addition, SK Innovation's battery business posted an operating loss of 400 billion won for the year, affected in part by the removal of U.S. electric vehicle purchase subsidies.

Against this backdrop, KIS stated that it plans to monitor how the restructuring of the petrochemical industry will affect the refining sector, as well as the degree to which each company can control its financial burden.

Kim said, "Restructuring of the petrochemical industry based on vertical integration centered on refiners is now in full swing," and continued, "From a financial perspective, refiners participating in vertical integration are expected to face short-term investment outlays due to acquisitions of petrochemical companies with naphtha cracking centers (NCCs) and new cash injections."

He went on, "As of the end of September last year, the four refiners' combined net debt on a consolidated basis stood at about 50 trillion won, which is higher than in the past due to investments in batteries and petrochemicals. Large-scale spending as part of the restructuring process is therefore likely to add further financial pressure."

He also stressed, "Along with existing debt burdens, the progress of restructuring, the level of support from the government and financial institutions, and how well each company can manage its financial burden will be key items to monitor."

khj91@fnnews.com Kim Hyun-jung Reporter