"Is upward mobility just like winning the lottery?... Growing interest in investing and personal finance in a downturn"

- Input

- 2026-02-16 07:00:00

- Updated

- 2026-02-16 07:00:00

[Financial News] Despite economic uncertainty, people’s determination to grow their assets appears to be strengthening. More investors are starting to see falling financial markets not as a "crisis" but as an "opportunity."

8 out of 10 say, "I want to live as middle class"

According to a recent survey titled "Outlook for Consumer Life and Economic Conditions in 2026" conducted by market research firm Embrain Trend Monitor on 1,000 men and women aged 19 to 59 nationwide, the desire for wealth is high, but expectations for upward mobility remain relatively low.Among respondents, 79.1% said they want to live as part of the middle class in Korean society, and 87.9% said they want to become rich. At the same time, 56.7% agreed with the statement, "Unless I win the lottery, it will be hard to escape my current standard of living." Only 41.6% said, "I expect to live a more financially comfortable life than I do now in the future." This suggests a growing perception that it will be difficult to improve income and asset levels in the short term.

Perception that "a falling financial market = an investment opportunity" stands out

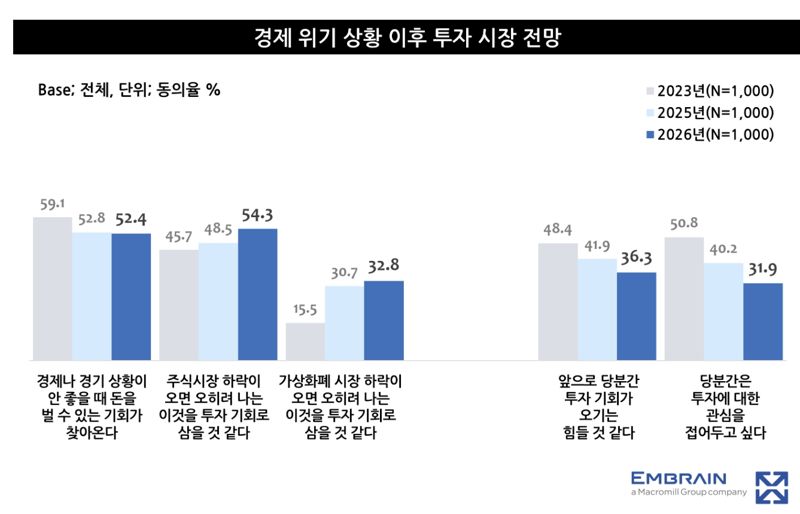

Even so, attitudes toward investing are shifting in a more proactive direction. A total of 52.4% of respondents said, "The worse the economy or business conditions get, the more opportunities there are to make money." Another 63.8% answered, "Even if there are temporary market fluctuations, if you are prepared, investment opportunities will definitely come."In particular, more people are viewing market downturns as buying opportunities.

The share of respondents who said they would treat a stock market downturn as an investment opportunity rose from 45.7% in 2023 to 48.5% in 2025 and 54.3% in 2026. For the cryptocurrency market, the figure more than doubled over the same period, from 15.5% to 32.8%.

By contrast, the share of people who said, "For the time being, I want to step back from investing" fell from 40.2% in 2025 to 31.9% in 2026.

Rising interest in personal finance

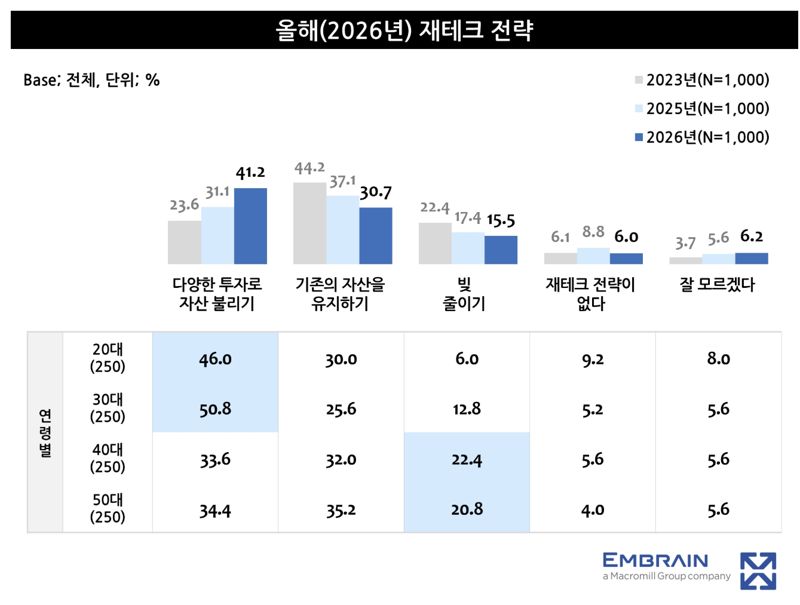

Changes are also visible in personal finance strategies. The proportion of respondents who said, "I want to grow my assets through various investments" jumped from 23.6% in 2023 to 41.2% in 2026.Meanwhile, the share of those who said they would simply "maintain their existing assets" dropped from 44.2% to 30.7%. This shift was especially pronounced among younger age groups.

This trend is also linked to the recent rally in the domestic stock market. As the Korea Composite Stock Price Index (KOSPI) surpassed the 5,500 mark for the first time in history, trading activity among individual investors has picked up.

According to Embrain’s big data analytics solution, Embrain Deep Data, the number of users who had installed major brokerage apps reached 24.06 million as of January 2026, continuing a steady increase over the past three years. Over the same period, the number of active users of securities apps stood at 18.96 million, up 16.8% from a year earlier.

Embrain commented, "While middle-aged and older adults still form the core of the securities market, younger generations seeking new investment opportunities are now entering the market in earnest," adding, "However, since the absolute size of this user group is still relatively limited, it will be important to watch whether this growth continues over time."

imne@fnnews.com Hong Ye-ji Reporter