"We Feel It in Our Bones" President Lee Vows to Revive Neighborhood Businesses, but the Golden Time Is Slipping Away [Another Day of Barely Open3]

- Input

- 2026-02-18 06:00:00

- Updated

- 2026-02-18 06:00:00

The sighs of restaurant owners echoing through empty kitchens after closing time have become a familiar scene. The record-high number of self-employed business closures is far more than just a statistic.Behind those numbers lie retirement savings poured in over a lifetime, tuition that once carried a child’s dreams, and the final safety net for entire families now gone.We took a closer look at their silent struggle. Editor’s note.

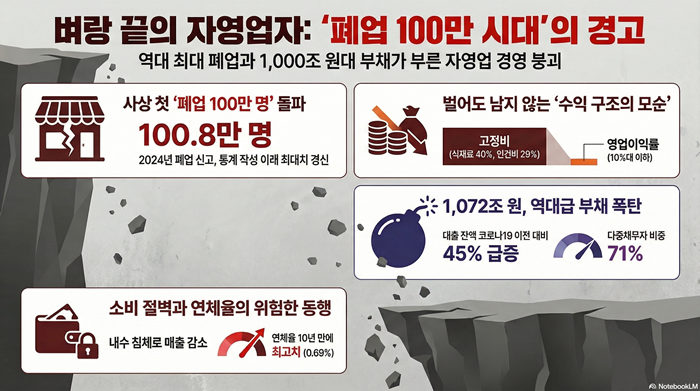

[Financial News] The self-employed sector has been pushed to the brink. Soaring prices and a slump in domestic demand are forcing neighborhood businesses to shut down, driving business closures to an all-time high.Outstanding loans to the self-employed have surpassed 1,000 trillion won, and delinquency rates are surging. The crisis is no longer limited to individual failures but is spreading into structural insolvency across the entire self-employed sector. As profit margins deteriorate and consumption collapses, calls are growing on the ground for measures that actually work.

"We’re Closing Again Today": The Dawn of the Era of 1 Million Closures

The severity of the crisis is clearly reflected in the data. According to the National Tax Service, 1,008,282 business owners, both individuals and corporations, filed for closure in 2024. It is the first time since statistics began in 1995 that the number has exceeded 1 million. Following 986,487 closures in 2023, the pace is accelerating, leading analysts to say Korea has fully entered an "era of 1 million closures."

At the root of this wave of shutdowns is a distorted profit structure. A management survey by the Korea Agro-Fisheries & Food Trade Corporation (aT) and others shows that food costs account for about 40.4% of restaurant operating expenses. When labor (29.4%), rent (8.7%), and fixed costs such as delivery platform fees and gas are added, operating profit margins for owners often remain in the low 10% range or below. Despite grueling work, many earn less than the minimum wage in real terms, a structural contradiction that is driving self-employed owners to the breaking point.

Consumers Have Shut Their Wallets, and Restaurant Districts Are Empty

The most fundamental problem is that consumers have stopped spending.Statistics Korea’s 2024 service industry production index shows that, in some months, the index for restaurants and bars has declined year-on-year. While sales are falling, operating costs such as food ingredients and delivery platform fees are rising. Many point to this double burden as a key factor deepening the management crisis for the self-employed.Debt levels among the self-employed are already believed to have passed the critical threshold. According to the Bank of Korea (BOK), outstanding loans to the self-employed stood at a record 1,072.2 trillion won at the end of the third quarter of 2025. That is more than a 45% increase from the end of 2019, before COVID-19, when the figure was 738 trillion won.

Delinquency is also a serious concern. As of the end of May 2024, the delinquency rate on bank loans to individual business owners had climbed to 0.69%, the highest level in about a decade. Financial vulnerability is acute as well. At the end of the first quarter of 2023, 71.3% of total self-employed loans were held by multiple borrowers using three or more financial institutions. Experts warn that any further interest rate hikes or economic downturn could trigger a chain reaction of business failures.

Government Listening to the Field—Will More Varied Policies Follow?

President Lee Jae-myung has declared that "the answer to policy is not on the desk but in the field" and has made the recovery of neighborhood commercial districts his top priority since taking office.On the 11th, Lee visited Muhan Market in Chungju, North Chungcheong Province, where he bought traditional holiday foods and listened to merchants’ concerns. Two days earlier, on the 9th, he toured Tongin Market in Jongno-gu, Seoul to gauge how the economy feels on the ground. During that visit, Lee remarked, "Exports are recovering and stock prices are rising, but when you actually sit down and have a meal at a restaurant, you feel in your bones why people say they are struggling." He also stressed, "Policy outcomes must be confirmed not in statistics but in people’s daily lives. If the public cannot feel any improvement, we cannot yet say the economy has gotten better," underscoring once again the need for field-centered policies.Despite the government’s multifaceted efforts, people on the ground still feel little improvement.Analysts say this is because Korea differs from major advanced economies in how forcefully and directly it implements policy. Other countries often rely on strong legal mandates to protect the self-employed or provide flexible, direct support such as rent subsidies at the local government level.

Take delivery fees as an example. New York City has imposed a legal cap on platform commissions, limiting certain items to 23%, and even after easing some rules to allow up to 43%, it has kept caps in place for basic delivery services. Korea, by contrast, has stuck to a framework of "voluntary co-prosperity talks" based on market autonomy.

In the area of commercial leases, France guarantees tenant rights through a Commercial Rent Index (ILC) that is linked to inflation and through protections for business goodwill. Korea, on the other hand, relies more on indirect support, combining legal caps on rent increases with measures such as a "good landlord" tax credit to encourage voluntary participation by landlords.

"It’s Really Just Too Hard": Self-Employed on the Edge

Given this situation, many in the field say they need policies they can use immediately. A self-employed man in his 50s, who runs a gukbap (rice soup) restaurant in Seoul and gave only his surname Kim, said, "The government is making various efforts, but for owners, the best policies are the ones we can feel right away," adding, "When I think about the restaurant’s operating costs and sales coming due, my chest already feels tight with anxiety."

Another self-employed owner in his 50s, who asked to be identified only as Park, said, "Closing the business is not the end. You still have to deal with all the incidental costs that arose when you opened the restaurant," and confessed, "Once you settle all that, you’re left wondering what you’re supposed to live on. The stress from that is overwhelming."Experts argue that small business owners must be treated not merely as a group to be protected, but as key players in the industrial ecosystem.At a forum titled "The Era of Great Transition: 10-Year Strategy for the Future of Small Business Owners and the Self-Employed," held at the National Assembly Members’ Office Building, Jung Eun-ae, a research fellow at the Korea Small Business Institute (KOSBI), advised that "the entire policy framework based on local commercial districts needs to be overhauled."

Jung noted, "Traditional commercial districts are becoming polarized due to regional population decline, oversupply of retail space, and a surge in online consumption," and pointed out, "Right now, Onnuri Gift Certificates can be used in only about 1,900 commercial districts nationwide." She added, "We need to strategically reset which districts receive public support and differentiate how that support is provided." Citing Japan as an example, she stressed, "Instead of randomly supporting struggling districts at the bottom, we need investment-style interventions that focus on mid-tier districts with growth potential." She also suggested, "Local commercial-district governance must be composed of actors with real expertise and accountability, and structures should be created in which business associations and regional credit guarantee foundations share both profits and risks."

Choi Jae-seop, a professor in the Department of Distribution and Marketing at Namseoul University, called for a shift in industrial policy perspective. "The self-employed account for more than 20% of all employed people," he said, "but they face structural challenges such as an increase in one-person businesses without employees, growing small-scale operations, and more older people starting businesses." He emphasized, "We need policies aimed not at simple protection, but at fostering a sustainable industry."

hsg@fnnews.com Han Seung-gon Reporter