Diverging Bets on KOSDAQ: Retail Investors Expect Gains, Institutions Bet on a Decline

- Input

- 2026-02-14 07:30:00

- Updated

- 2026-02-14 07:30:00

As the KOSPI continues to hit record highs day after day, investors are placing diverging bets on whether the rally will spill over into KOSDAQ. While expectations are rising for policy-driven benefits, some analysts also warn that KOSDAQ’s upside could be limited.

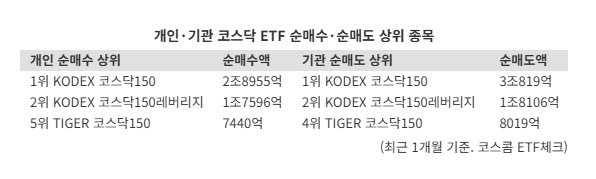

According to ETF Check, a data service by Koscom, on the 14th, three out of the top five Exchange-Traded Funds (ETF) most heavily bought on a net basis by retail investors over the past month were products tracking the KOSDAQ Index.

The most purchased product was the Samsung KODEX KOSDAQ 150 ETF, with net buying of 2.8955 trillion won. The KODEX KOSDAQ 150 Leverage ETF ranked second with 1.7596 trillion won in net purchases, and the Mirae Asset TIGER KOSDAQ 150 ETF came in fifth with 744 billion won in net buying.

Institutional investors, by contrast, have been offloading KOSDAQ-related ETFs. Among the top five ETFs sold on a net basis by institutions, three were also KOSDAQ index-tracking products.

The Samsung KODEX KOSDAQ 150 ETF topped the net-selling list with 3.0819 trillion won in sales. The KODEX KOSDAQ 150 Leverage ETF followed with 1.8106 trillion won in net selling, while the Mirae Asset TIGER KOSDAQ 150 ETF ranked fourth with 801.9 billion won sold.

After KOSDAQ ushered in the so-called “Cheon-sdaq” era last month, when the index broke above the 1,000-point level, expectations have been building for a possible run toward 3,000. At the same time, the renewed vigor in the KOSDAQ market appears to have prompted some investors to take profits.

KOSDAQ, which had been relatively sluggish, saw sentiment shift on the back of a sharp rally last month. The KOSDAQ Index jumped 24.20% in a single month, slightly outpacing the KOSPI’s rate of increase of 23.97%. Last year, by comparison, the KOSPI surged 75.63%, while KOSDAQ rose only 36.46%. However, so far this month, KOSDAQ has fallen 3.77%, showing signs of a correction.

Brokerages generally expect KOSDAQ to remain on a slower upward trajectory, but they also see room for strength supported by government policies.

Kang Jinhyuk, an analyst at Shinhan Investment & Securities, said, "If you look at the KOSDAQ market revitalization policies currently being pursued, measures to open up inflows from retail, foreign, and institutional investors are being announced one after another." He added, "Roughly a year after the government unveiled measures to improve the delisting system in January last year, it has now come out with even stronger policies."

However, one key limitation is that, unlike the KOSPI, KOSDAQ lacks clearly defined market leaders. The fact that its price-to-earnings ratio (P/E ratio) is relatively high is also seen as a factor that could cap further gains.

Jung Da-un, an analyst at LS Securities, noted, "On the KOSPI, earnings forecasts have exploded higher, driven by Samsung Electronics and SK hynix, but it is difficult to expect the same pattern on KOSDAQ." Jung continued, "Even from a valuation perspective, the KOSPI is trading at 9.6 times PER despite hitting record highs, which is still below its long-term average of 10 times, whereas KOSDAQ is not in that position."

Jung added, "Considering the earnings outlook for KOSDAQ relative to the KOSPI, the upside potential for KOSDAQ appears to be limited," but also said, "That said, there is still a possibility of fresh inflows of funds supported by government policy."

jisseo@fnnews.com Reporter Seo Min-ji Reporter