OTC trading of fractional investments nears launch as KDX and NXT win preliminary approval [Crypto Briefing]

- Input

- 2026-02-13 16:06:19

- Updated

- 2026-02-13 16:06:19

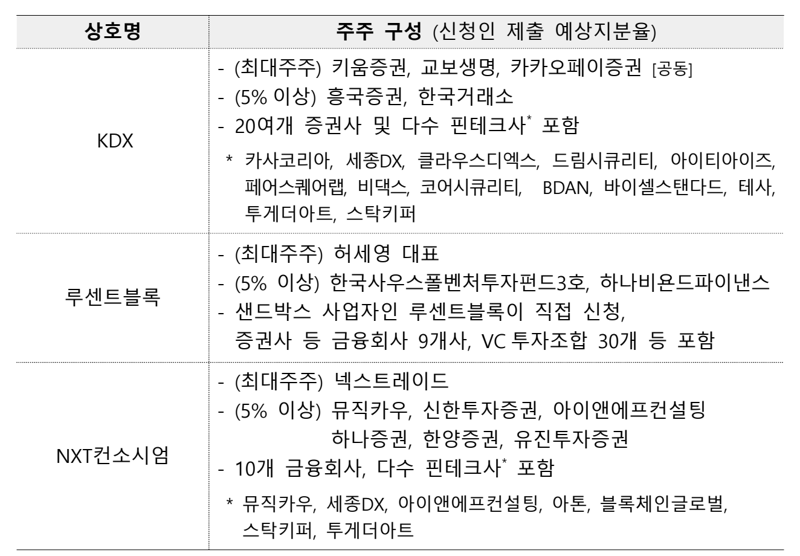

[Financial News] The Financial Services Commission (FSC) held a regular meeting on the 13th and selected KDX and the NXT consortium as preliminary licensees for over-the-counter (OTC) marketplaces for fractional investments (distribution platforms). However, the NXT consortium, which LucentBlock has accused of technology misappropriation, was granted only conditional approval. If the Korea Fair Trade Commission (KFTC) later launches an administrative investigation, the review process for final authorization will be suspended.

The FSC stated, "According to the review by the external evaluation committee, the NXT consortium ranked first with 750 points, followed by KDX with 725 points." LucentBlock, a sandbox operator that applied directly for authorization, scored 653 points and was eliminated.

According to the FSC, the decisive factors in this review were capital soundness and the specificity of business plans. KDX was assessed as having "sufficient capital and a concrete plan for raising contributed funds." In contrast, LucentBlock was criticized for having "significantly lower equity capital than its competitors and a highly uncertain funding plan." In addition, shares held by LucentBlock’s largest shareholder and related parties amount to 51%, leading evaluators to conclude that it "has the characteristics of a private company and does not fit the governance structure required for an OTC marketplace," which resulted in a low score in the conflict-of-interest prevention category.

Although the NXT consortium took first place and obtained preliminary approval, it did so with conditions attached. If the Korea Fair Trade Commission (KFTC) initiates an administrative investigation into the technology misappropriation allegations raised by LucentBlock, the review process for final authorization will be halted immediately. An FSC official explained, "If the KFTC launches an administrative investigation into NXT over the alleged technology misappropriation and the suspension period becomes prolonged, or if grounds for disqualification are confirmed, we plan to revisit our licensing policy for OTC marketplaces for fractional investments at an FSC regular meeting."

Newly licensed OTC marketplaces will face much higher entry requirements than existing issuance businesses, which only require equity capital of 1 billion won and two IT staff. The new platforms must have at least 6 billion won in equity capital and eight IT specialists.

An FSC official said, "KDX and the NXT consortium, which have received preliminary approval, must meet the physical and human resource requirements and apply for final authorization within six months," adding, "Once final authorization is granted, they will be allowed to begin operations."

The authorities plan to launch a "token securities (Security Token Offering, STO) consultative body" within this month to upgrade the technology infrastructure and distribution framework. Around February next year, when the Token Securities Act—amendments to the Act on Electronic Registration of Stocks and Bonds and the Financial Investment Services and Capital Markets Act—takes effect, the newly licensed exchanges are expected to be able to trade trust beneficiary securities and investment contract securities in the form of token securities.

Meanwhile, securities issued by LucentBlock, which failed to win approval, will be transferred to and traded on the exchanges that obtain final authorization once they begin operations. To prepare for the possibility that LucentBlock does not receive an issuance license, a wind-down plan has been put in place under which Hana Securities and real estate trust companies will manage and sell the assets and distribute returns to investors.

elikim@fnnews.com Mihee Kim, Sanghyuk Lim Reporter