"They only tell you to buy, so why read them?" Why securities firm reports have lost investors' trust

- Input

- 2026-02-13 14:53:49

- Updated

- 2026-02-13 14:53:49

"Reading securities firm reports does not generate extra returns"

Kim Jun-seok argues that in the Korean stock market, the usefulness of securities firm reports effectively disappeared around 2013.

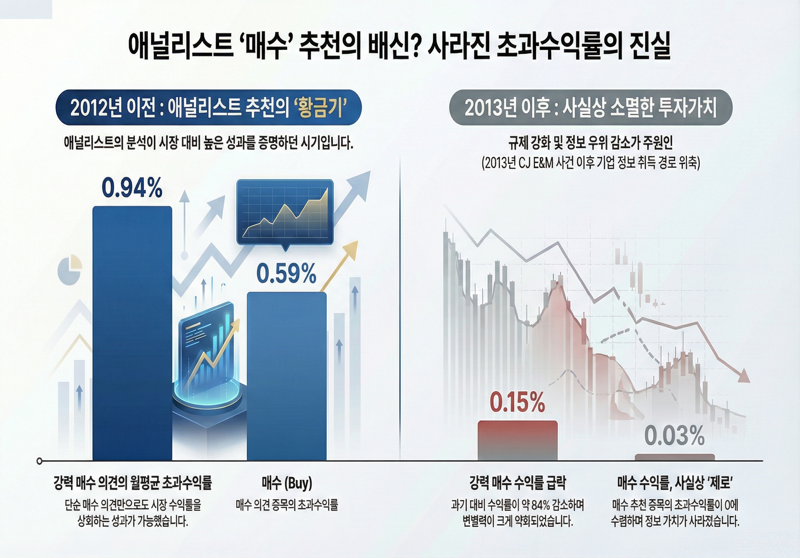

From 2000 to 2012, portfolios of stocks rated "Buy" by analysts generated an average monthly excess return of 0.59%, while those rated "Strong Buy" delivered 0.94%, both showing strong statistical significance.

However, an analysis of data from 2013 to 2024 shows that the excess return for "Buy" calls plunged to 0.03%, and "Strong Buy" to 0.15%, losing statistical significance. A long-short strategy that buys the stocks with the best recommendations and target price signals and shorts those with the worst also lost its edge: before 2012 it produced 1.14% excess return per month, but after 2013 this dropped to 0.07%, effectively eliminating its ability to generate profits.

The study attributes this shift largely to the CJ E&M insider information leak case in October 2013 and the subsequent tightening of regulations on market-disrupting conduct. Kim explained, "As stricter regulations cut off analysts’ informal channels to corporate inside information, opportunities to earn excess returns by exploiting information asymmetry disappeared."

In a market environment where the vast majority of reports carry some form of "Buy" recommendation, the study notes that investors are better off focusing on the relatively rare negative signals rather than on positive opinions. Kim stated, "Because analysts tend to show an optimistic bias to maintain relationships with companies, the discriminating power of 'Buy' recommendations has weakened. In contrast, lower ratings or declines in the target-price gap have functioned as strong sell signals with high reliability," adding, "Simply avoiding stocks that analysts evaluate negatively has had a significant effect in protecting portfolios from losses."

What information in securities firm reports is actually worth reading?

The study still found some information to be meaningful. A prime example is the target-price gap, or expected return. Stocks in the group with both the lowest recommendation level and the lowest target-price gap (the LL group) significantly underperformed the market. Even for reports issued after 2013, the value-weighted excess return of this bottom LL group was -0.69%, continuing to lag the market. This suggests that instead of following analysts’ buy recommendations, a "negative screening" strategy that filters out stocks they are relatively lukewarm on or assign conservative target prices to can be effective.

The report also notes that analysts’ information still proves valuable for mid-cap stocks, where information asymmetry remains. Kim said, "For large-cap stocks, information is quickly reflected in market prices, but for mid-caps there is a time lag before analysts’ research is fully priced in, or information is relatively scarce, so reports tend to retain their influence."

The Korea Capital Market Institute commented, "The disappearance of the investment value of recommendations and target prices points to a weakening in analysts’ informational edge, analytical capability, objectivity, and accuracy," and urged, "It is necessary to strengthen the independence of research functions, reduce overly optimistic outlooks, and deliver more accurate opinions."

fair@fnnews.com Han Young-jun Reporter