Foreign Investors Turn Net Sellers of 98 Billion Won in Korean Stocks in January, While Buying 3.6 Trillion Won in Bonds

- Input

- 2026-02-13 08:54:56

- Updated

- 2026-02-13 08:54:56

[Financial News] Foreign investors turned net sellers in the Korean stock market last month for the first time in a month. U.S.-based funds dumped nearly 8 trillion won worth of shares, but inflows from the United Kingdom and other European countries offset much of the overall selling. In the bond market, however, foreign investors made net purchases of more than 3 trillion won, mainly in government bonds, extending their net buying streak to a third consecutive month.

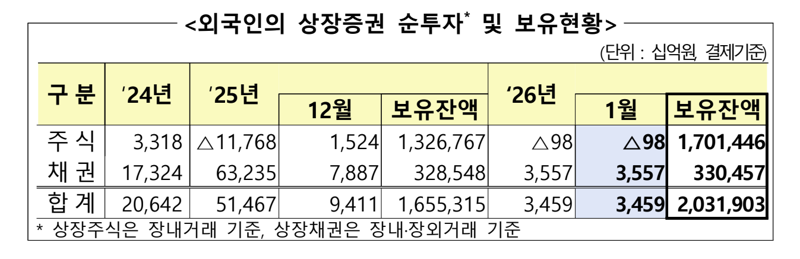

According to the report "Trends in Foreign Investment in Korean Securities in January" released by the Financial Supervisory Service (FSS) on the 13th, foreign investors were net sellers of 98 billion won in listed stocks last month, while making net purchases of 3.557 trillion won in listed bonds. As a result, a total of 3.459 trillion won in foreign funds flowed into the domestic capital market on a net basis.

In the stock market, foreign investors were net buyers of 361 billion won on the KOSPI market but sold a net 459 billion won on the KOSDAQ market, resulting in an overall net selling position. By region, outflows from the Americas were notable, totaling 8.1 trillion won. By country, investors from the United States alone were net sellers of 7.795 trillion won.

In contrast, European funds absorbed much of the selling from the United States, with investors from Ireland and the United Kingdom leading the buying. They made net purchases of 2.3 trillion won and 1.8 trillion won, respectively, bringing total net buying from Europe to 6.3 trillion won.

Despite the net selling, the value of foreign investors’ stock holdings jumped sharply, reaching 1,701.4 trillion won at the end of January, up 374.7 trillion won from the previous month. This increase was driven by a rise in the combined market capitalization of the KOSPI and KOSDAQ, which boosted the valuation of foreign-held shares.

Foreign investors’ "buy Korea" stance continued in the bond market. In January, they made net purchases of 7.071 trillion won in listed bonds while 3.514 trillion won worth of bonds matured and were redeemed, resulting in net investment of 3.557 trillion won. This marked the third consecutive month of net bond investment since November last year.

As of the end of January, foreign investors held 330.5 trillion won in Korean bonds, accounting for 11.9% of the total listed balance.

elikim@fnnews.com Kim Mi-hee Reporter