"Money Is Being Sucked Into Speculation... The State Must Prevent a Bubble Collapse" [Real Estate A to Z]

- Input

- 2026-02-14 15:00:00

- Updated

- 2026-02-14 15:00:00

[Financial News] During the Moon Jae-in administration, there was an attempt to create a body similar to a "Real Estate Supervisory Service," but it was scrapped after controversy. The government also reviewed a plan to abolish Capital Gains Tax benefits for rental business operators and instead impose normal taxation after a certain period (six months) following deregistration, but this was never implemented. Under the new government, policies that failed to clear the legislative hurdle during the Moon Jae-in administration are now gradually becoming reality.

"Prevent a bubble collapse"... Outline of the "Real Estate Supervisory Service" emerges

The Real Estate Supervisory Service is the most prominent example. The ruling party and government have explained the purpose of its establishment. They start from the view that illegal acts in the real estate market constitute "serious crimes that violate multiple laws." At the same time, investigative authority is dispersed and powers are limited, so they argue that a permanent body dedicated to cracking down on such violations is needed.

The ruling party and government stated that a "national-level integrated management and supervision system is needed so that money is not sucked into unproductive speculation and we do not repeat Japan-style real estate bubble collapse." This is how they described the background to the bill.

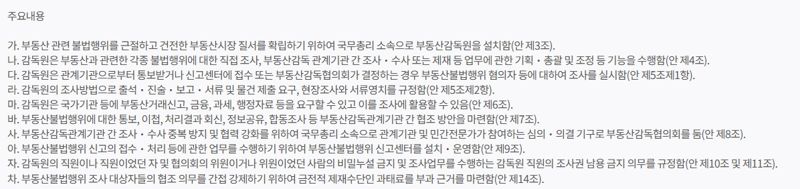

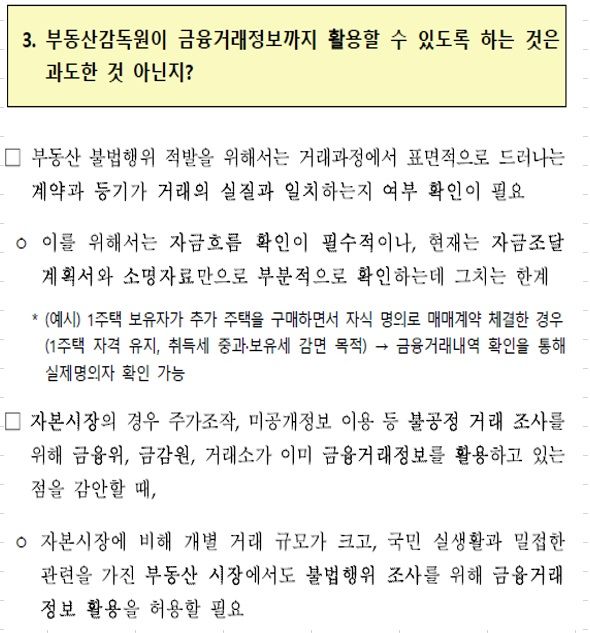

According to the bill that has been introduced, there are 10 main provisions. First, the supervisory service will function as the control tower for illegal real estate activities. If the Real Estate Supervision Council makes a decision, it can launch investigations into suspects. The bill also states that investigators may request information on the financial transactions and loan status of those under investigation.

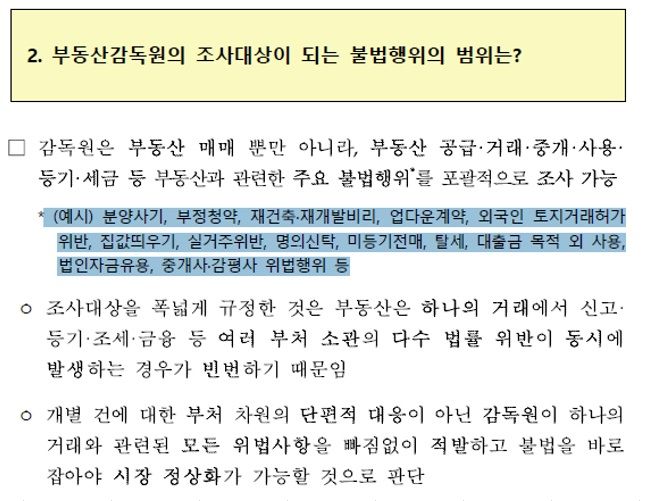

Government briefing materials on the Real Estate Supervisory Service show that it will have a staff of around 100 people. It will be able to investigate not only sales transactions, but also corruption in redevelopment and reconstruction projects, pre-sale fraud, and illegal acts by real estate agents and appraisers. In short, it will comprehensively look into major violations related to supply, transactions, brokerage, use, registration, and taxation.

Special judicial police officers assigned to the Real Estate Supervisory Service will have broader authority than existing special judicial police officers at the Ministry of Land, Infrastructure and Transport and local governments. They will be able to investigate criminally punishable offenses among major violations under 26 real estate-related laws.

Regarding concerns about excessive powers and overreach, the government said, "To prevent abuse of authority, any request for data must first undergo deliberation by the Real Estate Supervision Council, and the data obtained can only be used at the internal investigation stage," adding, "In addition to this, several other safeguards have been put in place."

"Where did the acquisition funds come from?"... Source-of-funds checks become stricter

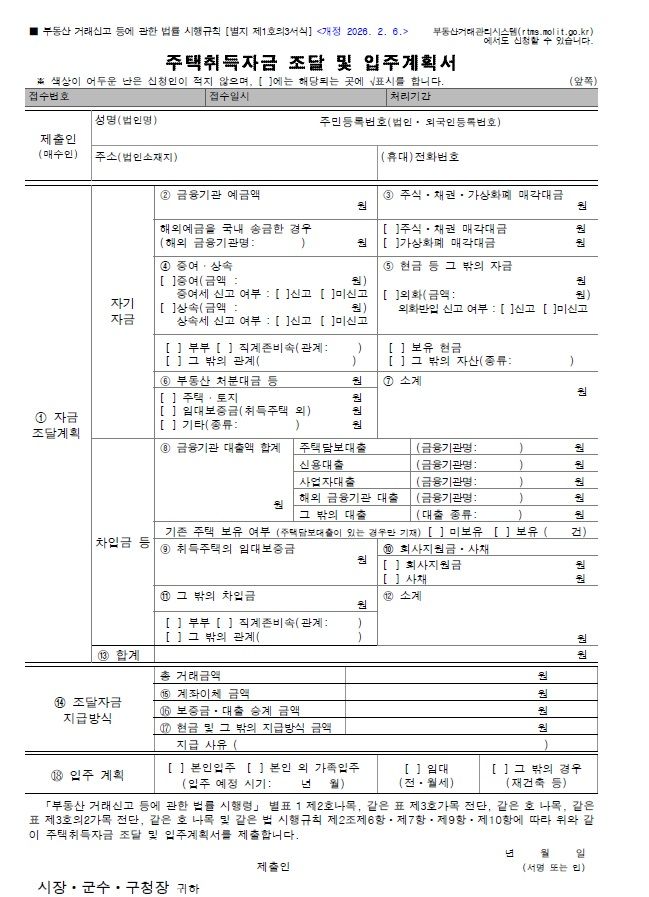

As the outline of the supervisory service becomes clearer, the basic tool for its investigations—source-of-funds inquiries—has also become more detailed. This is because, as of the 10th, the format of the "Housing Acquisition Funds and Move-in Plan" form has been revised.

Previously, in 2020, the Moon Jae-in administration made it mandatory to submit a Funds Procurement Plan for all housing transactions in regulated areas. The latest change goes a step further by subdividing the items in that Funds Procurement Plan.

The Funds Procurement Plan is divided into own funds and borrowed funds. In the past, it focused mainly on aggregate amounts. Under the revised plan, the item "proceeds from sale of stocks and bonds" is changed to "proceeds from sale of stocks, bonds, and virtual assets." Buyers must now separately state how much comes from selling stocks and bonds, and how much from selling coins.

For bank deposits, if overseas deposits are remitted into Korea, the name of the financial institution and the amount must be specified. Items related to gifts and inheritances have also been subdivided. Applicants must state the amount received as a gift or inheritance and whether it has been reported for tax purposes. If a home is purchased with foreign currency, the amount and whether the foreign currency was reported upon entry must be indicated. All these changes are intended to make it easier for supervisory and tax authorities to trace the source of funds.

Meanwhile, as the new government continues to ratchet up the intensity of its real estate policies, some warn that potential side effects on the market must be taken into account. One expert noted, "In the course of successive reforms such as tightening loan limits, expanding regulated areas, and imposing stricter rules on multiple-home owners, we are already seeing side effects like a decline in rental listings, even just looking at the jeonse and monthly rental market."

ljb@fnnews.com Lee Jong-bae Reporter