Semiconductors and precious metals surge, pushing export and import prices higher for 7 straight months

- Input

- 2026-02-13 06:00:00

- Updated

- 2026-02-13 06:00:00

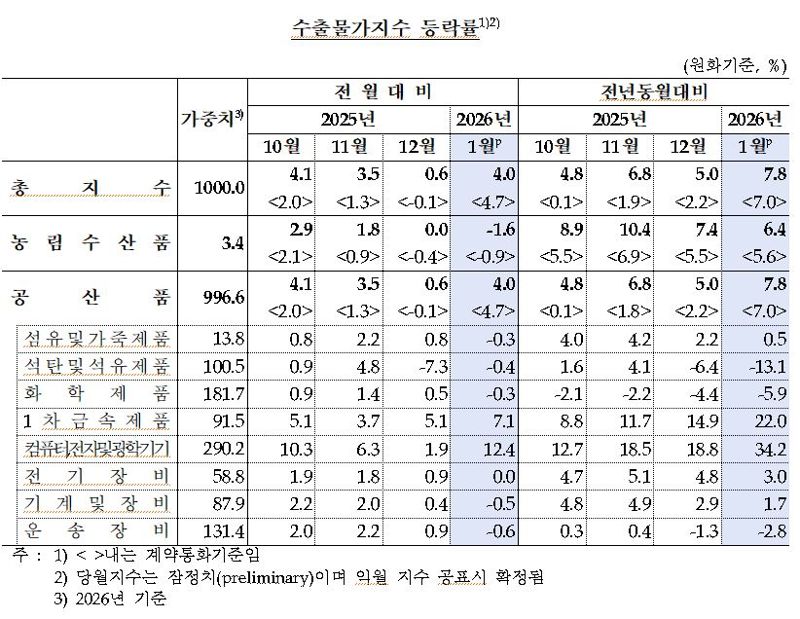

According to the "Export and Import Price Index and Trade Index for January 2026" released by the Bank of Korea (BOK) on the 13th, the export price index in won terms rose 4.0% in January from the previous month. This marks seven straight months of gains, following increases of 0.8% in July, 0.6% in August, 0.5% in September, 4.1% in October, 3.5% in November, and 0.6% in December last year.

Compared with a year earlier, the export price index climbed 7.8%. It has now been rising for five consecutive months since September last year.

Prices of agricultural, forestry, and fishery products fell 1.6% from the previous month, while manufactured goods rose 4.0% over the same period. Within manufactured goods, the increase was particularly sharp for computers, electronic and optical equipment including semiconductors (up 12.4%), and for primary metal products centered on nonferrous metals such as gold, silver, and copper (up 7.1%). Looking only at semiconductors, DRAM prices jumped 31.6% and flash memory prices rose 9.9% from the previous month.

In contract currency terms, which exclude exchange rate effects, export prices in January rose 4.7% from the previous month and were up 7.0% from a year earlier.

A decline in the won–dollar exchange rate and a slight drop in international oil prices based on Dubai crude oil—from 62.05 dollars per barrel in December last year to 61.97 dollars in January—acted as downward factors. Even so, higher prices for primary metal products and mining products offset these effects.

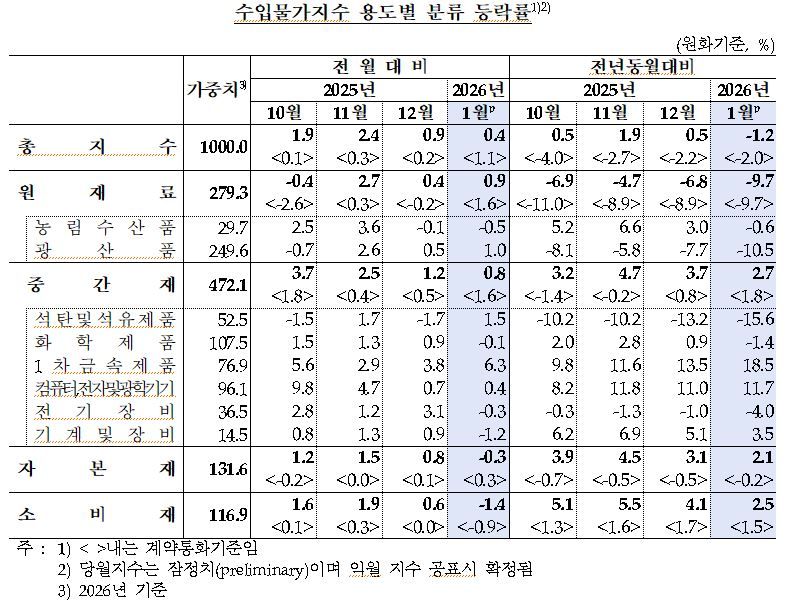

For raw materials, crude oil prices fell, but prices of copper ore and liquefied natural gas (LNG) rose, pushing overall raw material prices up 0.9% from the previous month, mainly due to mining products. Intermediate goods climbed 0.8%, led by a 6.4% increase in primary metal products. In contrast, prices of capital goods and consumer goods fell 0.3% and 1.4%, respectively.

In contract currency terms, import prices rose 1.1% from the previous month but were 2.0% lower than a year earlier.

In January, the export volume index jumped 28.3% year-on-year, driven by higher shipments of computers, electronic and optical equipment, and transportation equipment. The export value index surged 37.3% over the same period, the fastest growth since June 2021, when it rose 40.5%.

Moon-hee Lee, head of the Price Statistics Team in Economic Statistics Department 1 at the BOK, noted, "As investment demand related to artificial intelligence (AI) continues, the increase in export volumes of semiconductors and computer memory devices has expanded, and automobile exports also grew thanks to more working days and strong demand for eco-friendly vehicles."

The import volume index rose 14.5% from a year earlier, led by increases in primary metal products and computers, electronic and optical equipment. This is the largest gain in three years and five months since August 2022, when it climbed 15.7%. The import value index increased 12.5%.

The net barter terms of trade index, which measures the amount of imports obtainable per unit of exports, rose 8.9% as export prices increased 7.0% year-on-year while import prices fell 1.8%. On a month-on-month basis, the index was up 4.5%.

The income terms of trade index, which reflects both the net barter terms of trade (up 8.9%) and the export volume index (up 28.3%), surged 39.7% from a year earlier.

The income terms of trade index is an indicator that measures an economy's ability to increase imports based on its export earnings. When this index rises, it means the capacity—the quantity—to import goods with the total value of exports has improved.

taeil0808@fnnews.com Reporter Tae-il Kim Reporter