[Questions on Higher Capital Gains Tax] Is a Home with a Tenant Also Eligible for the Grace Period?

- Input

- 2026-02-12 11:27:45

- Updated

- 2026-02-12 11:27:45

According to Financial News, the government will end the temporary suspension of higher Capital Gains Tax on multiple-home owners on May 9 as planned. However, to reduce market disruption, it will expand the scope of the grace period from "properties transferred" to "contracts signed." It will also temporarily ease the owner-occupation requirement under the Land Transaction Permit System for homes that are currently rented out. The aim is to encourage multiple-home owners to put properties located in Areas Subject to Adjustment on the market.

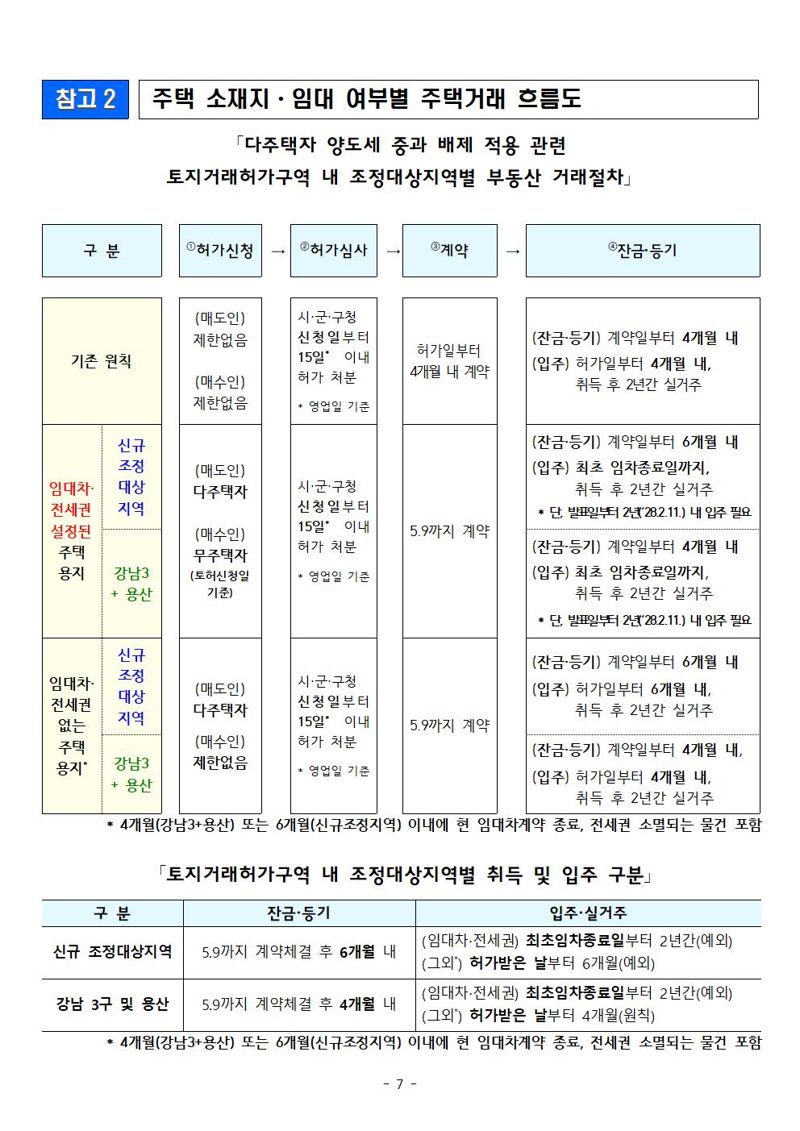

Among Areas Subject to Adjustment, properties in Gangnam, Seocho, Songpa and Yongsan districts in Seoul will not be subject to higher Capital Gains Tax if the sale contract is completed by May 9 and the transfer is finalized within four months from the contract date. Buyers must move into the home within four months from the date the local government issues the land transaction permit. In contrast, for regions newly designated as Areas Subject to Adjustment in October last year, higher Capital Gains Tax will not apply if the sale contract is signed by May 9 and the transfer is completed within six months from the contract date. This effectively grants an additional two months. In these areas, the buyer must move into the property within six months from the land transaction permit date.

To ensure that homes currently under lease can also be sold smoothly, the government has partially relaxed the owner-occupation requirement under the Land Transaction Permit System. For rented homes, the obligation to move in is deferred until the end of the initial lease term under the lease contract that was in effect as of the announcement date of the amendment (February 12). However, the buyer must move in for actual residence no later than February 11, 2028, which is within two years after the announcement.

On the 12th, at Government Complex Sejong, the Ministry of Economy and Finance announced the "End of Temporary Relief from Higher Capital Gains Tax for Multiple Homeowners and Supplementary Measures," which includes these details.

Below is a plain-language explanation of key questions about the grace period for higher Capital Gains Tax so that the public can easily understand the changes.Q: If only a preliminary contract or a prior agreement for obtaining a land transaction permit is made before May 9, will the higher tax still be suspended?A: A preliminary contract or a prior agreement before obtaining a land transaction permit does not count as a formal "contract." The contract requirement is considered met only when a sale contract is signed by May 9 and documentation proves that the seller has received the down payment.Q: If I sign a contract by May 9 but, as of the land transaction permit date, the remaining lease period is less than four months (for example, three months), do I have to move in immediately once the lease ends?A: If the remaining lease period is less than four months from the permit date, the existing rule still applies. You only need to move in within four months from the permit date and then reside there for two years.Q: In newly designated land transaction permit areas, the grace period allows settlement and registration within six months from the contract date. Under the current system, however, actual move-in is required within four months after the permit is issued. Is it still possible to complete settlement and registration within six months?A: Yes, it is possible. In newly designated areas, buyers may complete settlement and registration within six months from the contract date, and they must move in within six months from the land transaction permit date and reside there for two years. The government plans to revise the relevant regulations so that land transaction permits can be granted on the condition that the buyer moves in within six months.Q: From when can I apply for a land transaction permit that reflects the eased owner-occupation requirement for rented homes, and from when can such permits be granted?A: The relevant regulations are scheduled to be revised within February, and permits can be granted after the revision takes effect. Under the Real Estate Transaction Reporting Act, the permit review must be completed within 15 business days from the application date. Applicants should therefore file their applications while considering the time needed to obtain the permit. For example, if you apply on February 12, the permit can be granted by March 10, which is within 15 business days.

Q: Are there any additional documents that must be submitted to obtain a deferral of the owner-occupation requirement for a rented home subject to a land transaction permit?A: You will need documents such as a jeonse contract or lease agreement and a consent form for the use of personal information. This temporary deferral of the owner-occupation requirement applies when the seller is a multiple-home owner subject to higher Capital Gains Tax and the buyer, who does not own a home, purchases a property located in an Area Subject to Adjustment that is currently rented out or has a registered jeonse right. The documents are required to verify these conditions.

Q: When a person who has taken out a jeonse loan buys an apartment worth more than 300 million won in a regulated area, the jeonse loan is usually recalled. Despite the new measures, does this rule still make it practically impossible for a tenant with a jeonse loan to purchase a home?A: If the purchased apartment already has a tenant living in it, the jeonse loan will not be recalled until the remaining term of that lease expires. When a borrower with a jeonse loan acquires an apartment in a speculative district or a Speculative Overheating District with a market value exceeding 300 million won, the loan is normally recalled on the date the ownership transfer registration for that apartment is completed.

junjun@fnnews.com Choi Yong-jun and Jung Sang-gyun Reporter