Government to Delay End of Heavier Capital Gains Tax Suspension for Multi-Homeowners by 4–6 Months

- Input

- 2026-02-12 11:03:27

- Updated

- 2026-02-12 11:03:27

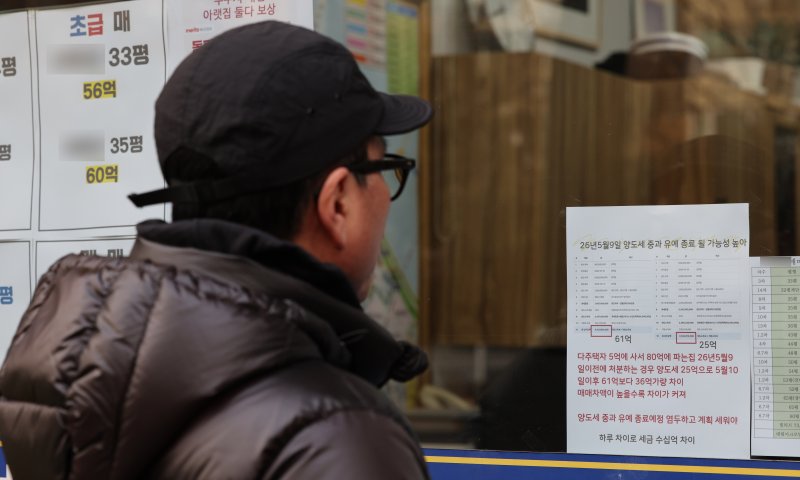

According to Financial News, the government will end the temporary suspension of the heavier capital gains tax on owners of multiple homes on May 9 as originally planned. However, to ease market anxiety and inconvenience for the public caused by a sudden policy shift, it will allow more time to complete sales for properties in both existing and newly designated adjustment areas if a sale contract is signed before the end date. In such cases, the deadline to transfer ownership will be extended by 4 to 6 months from the contract date, and capital gains tax will not be applied at the higher rate if the sale is completed within that extended period.

On the 12th, the government announced that it will pre-announce for public comment draft amendments to the Enforcement Decree of the Income Tax Act and the Enforcement Decree of the Act on Report on Real Estate Transactions, which include these supplementary measures, starting on the 13th.

Cho Man-hee, Director General for Tax Policy at the Ministry of Finance and Economy, said at a joint briefing held at Government Complex Sejong, "The intention is to protect tenants’ housing stability within land transaction permit zones while still giving owners of multiple homes who genuinely wish to sell an opportunity to do so."

The core of the supplementary measures is to differentiate between existing and newly designated adjustment areas and grant sellers additional time through an extension of the deadline. Circumstances will vary by individual, but the government has judged that an extra 4 to 6 months should be sufficient in most cases.

Under the current rules, sales completed by May 9 are exempt from the heavier tax rate. For homes located in Gangnam, Seocho, Songpa, and Yongsan districts in Seoul, which were designated as adjustment areas as of October 15 last year, the heavier capital gains tax will not apply if a sale contract is signed by May 9 and the property is sold within four months from the contract date. The sale contract must be verifiable through documentation showing that the down payment has been received.

For homes subject to the land transaction permit system, buyers must still move into the purchased property within four months from the date on which the land transaction permit is granted, in line with existing rules.

For newly designated adjustment areas, the requirement to sign a sale contract by May 9 is the same. However, unlike existing adjustment areas, sellers will have six months from the contract date—two months longer—to complete the sale without being subject to the heavier capital gains tax.

Cho explained, "In these cases, because buyers are given an additional two months, they will be allowed to move into the home within six months from the date the land transaction permit is granted."

The newly designated adjustment areas include all districts of Seoul other than Gangnam, Seocho, Songpa, and Yongsan, as well as 12 locations in the greater Seoul metropolitan area such as Gwacheon and Gwangmyeong.

The government will also partially ease the obligation to live in the property under the land transaction permit system for homes that are currently rented out.

The owner-occupancy requirement will be deferred until the end date of the initial lease contract that is in effect as of today, February 12, when the amendment was announced. However, owners will still be required to move in and live in the property within two years of the announcement date, that is, by February 11, 2028.

In line with the supplementary measures for ending the suspension of the heavier capital gains tax, the government will also extend the deadline for the obligation to file a move-in report when a mortgage loan is executed.

Currently, borrowers must file their move-in report within six months from the date the mortgage loan is executed. Under the new rule, this deadline will be extended to the later of either six months from the loan execution date or one month after the end of the lease contract. This relaxation, however, will apply only when an owner of multiple homes sells a home located in an adjustment area to a buyer who does not own a home.

skjung@fnnews.com Jeong Sang-geun Reporter