"Where am I supposed to borrow 300 million won right now?" Tenants pushed out with no money

- Input

- 2026-02-12 06:00:00

- Updated

- 2026-02-12 06:00:00

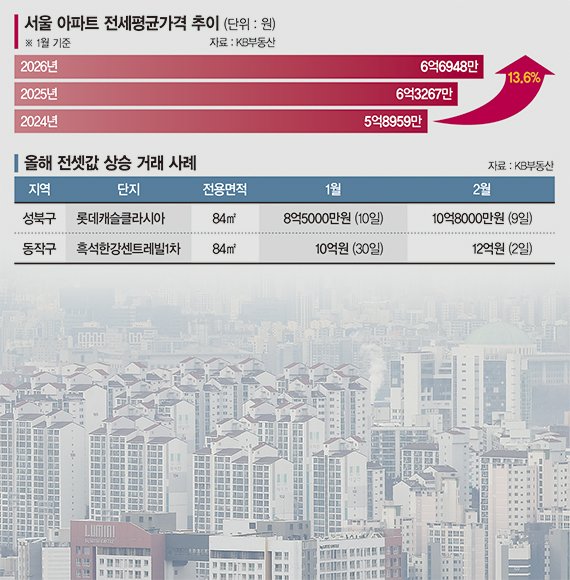

The burden on jeonse tenants in Seoul is rising steeply. As listings dry up and prices keep climbing, concerns are growing that the foundation for housing stability is being shaken. A said, "I endured the past three years while shouldering high interest on my jeonse loan," adding, "Now there are hardly any listings, and jeonse loans have become stricter, so I have almost no options left."■ Up 13% in two years... 51 straight weeks of gainsAccording to KB Real Estate on the 11th, Seoul’s apartment jeonse market has been on a rising streak for 51 consecutive weeks. In January this year, the average jeonse price for apartments in Seoul was 669.48 million won, up 5.8 percent from 632.67 million won a year earlier. Compared with January 2024, when the average was 589.59 million won, prices have surged 13.6 percent in just two years.

The price increase is taking on the character of a structural, entrenched trend. The average monthly jeonse price per 3.3 square meters of apartment space in Seoul, based on January figures, has risen steadily from 17.85 million won in 2024 to 19.22 million won in 2025 and 20.37 million won in 2026.

In practice, the 84-square-meter units at Lotte Castle Classia in the Gireum-dong neighborhood of Seongbuk District were changing hands in the 700 million won range last year. Last month, however, deals were struck at 850 million and 900 million won, and this month a new record was set at 1.08 billion won. That is an increase of more than 300 million won in a short period.

In Dongjak District, distortions have emerged to the point where jeonse prices for mid-sized apartments are now on par with those for larger units. An 84-square-meter unit at Heukseok Hangang Centreville Phase 1 recently traded at 1.2 billion won, hitting a new high, while a 114-square-meter unit in the same complex also signed at 1.2 billion won. Similar jumps of several hundred million won are being reported in key areas such as Songpa District and Yongsan District. A 124-square-meter unit at Raemian Chelitus in Yongsan District rose by 500 million won in roughly 50 days.

The upward trend in Seoul is now spreading into the Gyeonggi region. In Bundang, a 49-square-meter unit in Hansol Village Complex 1 climbed by 150 million won in just over a month, closing at 550 million won. The jeonse crunch that began in Seoul is spilling over into neighboring areas.■ Pressure reaches the outskirts... warning of a spring "jeonse crunch"Recently, jeonse prices have been rising even faster on the outer edges of Seoul. As of the week ending January 26, weekly growth in the apartment jeonse price index was highest in Dobong District (0.4 percent), followed by Nowon District (0.39 percent), Seongdong District (0.25 percent), Seongbuk District (0.23 percent) and Gangdong District (0.21 percent). After sharp increases along the Han River Belt, demand has been pushed outward, sending upward pressure on prices rippling across the city.

Market watchers are worried that the jeonse shortage could worsen further as the spring moving season approaches. Cuts to jeonse loan guarantee ratios have reduced the amount of funding tenants can raise, and under the financial authorities’ tighter control of household lending, some banks are raising interest rates on jeonse loans. Tenants are being squeezed by both rising prices and heavier financing costs.

As a result, tenants’ choices are narrowing. Ham Young-jin, head of the Woori Bank Real Estate Research Lab, said, "Aside from buying a home or moving out to the outskirts such as Gyeonggi Province, there are few alternatives," adding, "Many households are now having to consider downsizing to a smaller unit or trading down to a lower-tier housing type." He went on to say, "If marriage-related demand in March and April overlaps with the spring moving season, instability in jeonse supply and demand could become even more pronounced."

ming@fnnews.com Jeon Min-kyung, Lee Jong-bae and Choi Ah-young Reporter