Semiconductors Soar, Builders Slump: KDI Forecasts 1.9% Growth This Year

- Input

- 2026-02-11 12:00:00

- Updated

- 2026-02-11 12:00:00

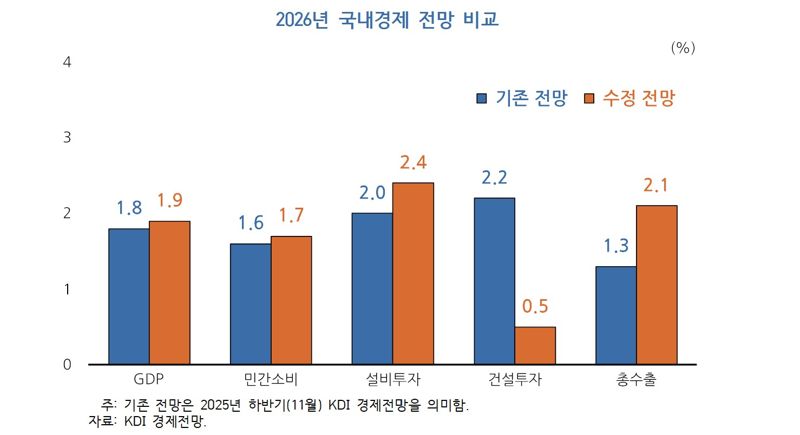

According to Financial News, the Korea Development Institute (KDI) has forecast economic growth of 1.9% for this year. This is 0.1 percentage points higher than the 1.8% projection made last November. The revision reflects booming semiconductor exports driven by global expectations for artificial intelligence (AI) and a recovery in private consumption. However, KDI sharply lowered its outlook for construction investment due to a slump in regional real estate markets. It also cited U.S. tariff policy and inflation as risk factors that could weigh on growth, suggesting the government’s 2% growth target may be under threat.

On the 11th, KDI released its "Revised Economic Outlook." The 0.1 percentage point upward adjustment over the past three months was mainly due to semiconductors and private consumption. By indicator, total exports were revised up from 1.3% in November to 2.1% this month, an increase of 0.8 percentage points. Private consumption was raised from 1.6% to 1.7%, up 0.1 percentage points. KDI publishes its revised economic outlook every February and August. The regular outlooks come out in May and November, and the revisions are meant to reflect changes in domestic and global economic conditions in between. Last year, total exports and private consumption grew by 4.1% and 1.3%, respectively. Compared with those figures, this year’s forecast implies slower export growth but a stronger increase in consumption.

“We raised our export forecast to reflect the strong semiconductor cycle, and as a result we also revised overall economic growth upward compared with the previous projection,” said Kyucheol Jung, head of economic forecasting at KDI. “However, export growth could slow compared with last year due to the negative impact of higher U.S. tariffs,” he noted. He added, “Private consumption is expected to be higher than last year, supported by cumulative interest rate cuts and improvements in real income.”

Investment indicators remain weak. Facility investment excluding semiconductors is expected to be sluggish, but a surge in semiconductor-related investment should lift overall facility investment by 2.4%, 0.4 percentage points higher than last year’s 2.0%. Construction investment is projected to grow only 0.5%, as the downturn in regional real estate markets persists despite some improvement in new orders. This is 1.7 percentage points lower than the 2.2% growth forecast in November. The reason is that new orders are not translating into actual project starts.

“The pattern of construction investment appears to be diverging somewhat from past data,” Jung explained. “In the past, once projects were awarded, ground-breaking would follow after a time lag, but that is not happening now,” he said. “This seems to reflect not only cyclical factors but also structural issues. The impact of population decline in regional areas is now fully emerging and is affecting construction investment,” he pointed out. He added, “In the November outlook, we expected construction investment to recover gradually, but the latest data suggest that the recovery is being pushed back further.”

A key issue is the gap with the 2.0% growth forecast released last month by the Ministry of Finance and Economy. The ministry argued that a recovery in construction investment would make 2.0% growth achievable, while KDI now judges that the construction rebound is being delayed. Persistent uncertainty over U.S. tariffs and the possibility of a correction in AI-related expectations are also cited as potential risks. A weaker currency could further dampen private consumption. KDI expects consumer prices to rise 2.1% this year, the same rate as last year.

Asked why KDI’s projection is lower than the roughly 2.0% forecasts at home and abroad, Jung responded, “Given that our estimate is also around 2%, I don’t think it is dramatically different.” He continued, “The inflation target is 2%, and prices are showing a stable pattern around that level. However, if the exchange rate rises further, it could create additional upward pressure on inflation,” he warned. He also said, “Core inflation, which excludes food and energy, is expected to rise 2.3%, higher than last year’s 1.9%, due to the recovery in consumption. But 2.3% is still within the vicinity of the price stability target.”

Meanwhile, KDI took a negative view of implementing a supplementary budget. It estimates potential growth at 1.6% this year and expects actual growth to exceed that level. “We currently project growth above the potential growth rate,” Jung said. “So we do not think a supplementary budget for economic stimulus is necessary,” he stated. On the current 2.5% base rate, he commented, “There is little need to use interest rates either to restrain the economy or to stimulate it. The current level is roughly a neutral rate.”

junjun@fnnews.com Choi Yong-jun Reporter