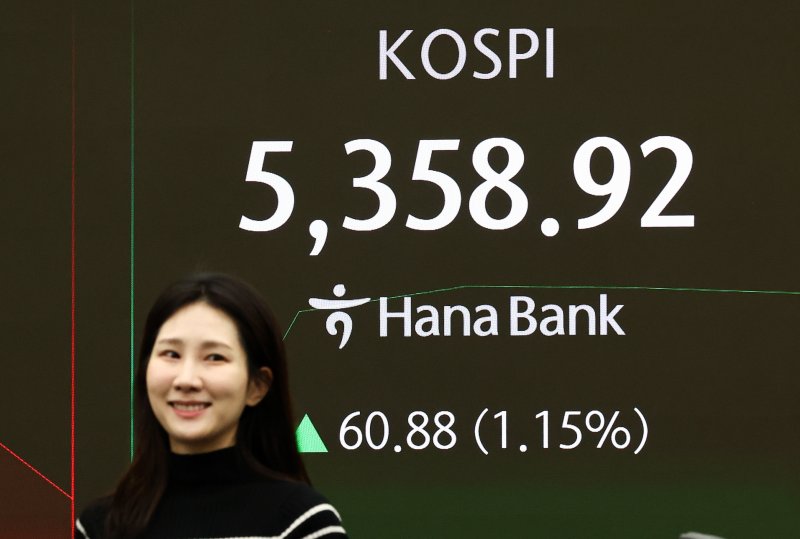

KOSPI sees tug-of-war as individuals sell while foreigners and institutions buy [Morning Market Brief]

- Input

- 2026-02-10 12:57:39

- Updated

- 2026-02-10 12:57:39

[Financial News] The KOSPI is moving sideways around the 5,300 level.

According to the Korea Exchange (KRX), as of 11:45 a.m. on the 10th, the KOSPI was trading at 5,313.84, up 15.80 points, or 0.30%, from the previous session.

In the main stock market, foreign investors and institutions were net buyers of 233.4 billion won and 373 billion won, respectively, while individual investors were net sellers of 688.9 billion won.

By sector, paper and wood (6.51%), transportation and warehousing (3.55%), and textiles and apparel (2.53%) were strong, while electricity and gas (-2.60%), medical and precision instruments (-1.23%), and transportation equipment and parts (-1.10%) were weak.

Among large-cap stocks, Shinhan Financial Group (4.18%), KB Financial Group (2.91%), and Naver (2.20%) were gaining, while Hanwha Aerospace (-5.95%), HD Hyundai Heavy Industries (-2.69%), and Hanwha Ocean (-1.95%) were declining.

At the same time, the KOSDAQ was trading at 1,117.67, down 9.88 points, or 0.88%, from the previous day. Individuals and institutions bought a net 260.7 billion won and 58 billion won, respectively, while foreign investors sold a net 297 billion won.

Lee Jae-won, an analyst at Shinhan Investment & Securities, said, "Despite the pressure on Korean semiconductor and large-cap stocks, the market’s focus is shifting toward dividend plays." He added, "In addition to the seasonal effect for dividend stocks at the start of the year, special dividends that companies are paying to qualify for separate taxation are also acting as an important factor."

koreanbae@fnnews.com Bae Han-geul Reporter