Effect of October 15 Housing Market Measures Fades... Seoul Apartment Occupancy Outlook Index at 107.6

- Input

- 2026-02-10 11:00:00

- Updated

- 2026-02-10 11:00:00

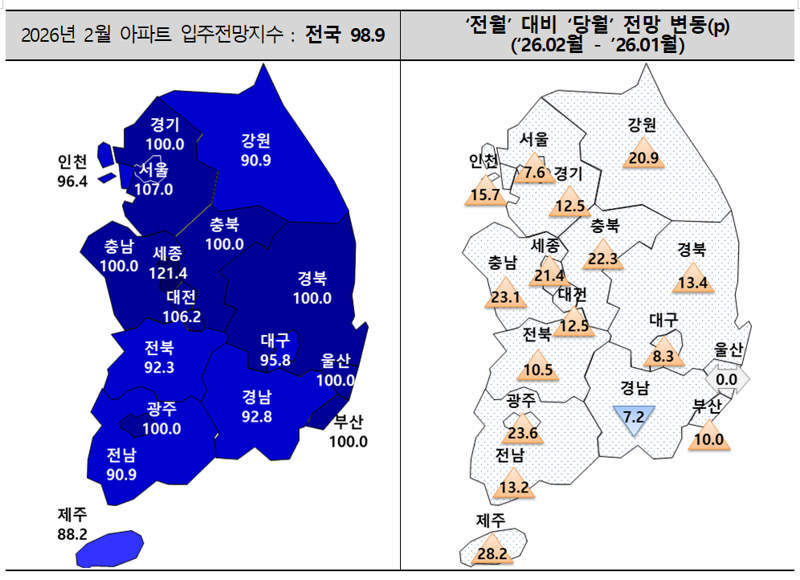

On the 10th, a survey of housing developers by the Housing Industry Research Institute (HIRI) found that the nationwide apartment occupancy outlook index for February stood at 98.9, up 13.8 points from 85.1 a month earlier. By region, the index was 101.3 in the Seoul metropolitan area, 103.9 in the metropolitan cities, and 94.4 in the provincial regions, rising 11.9, 12.7, and 15.6 points, respectively, compared with January.

Within the Seoul metropolitan area, Seoul’s occupancy outlook index reached 107.6, up 7.6 points from the previous month. In January, apartment prices in Seoul rose by more than 1% mainly in districts such as Gwanak, Dongjak, and Gangdong, where many apartments priced under 1.5 billion won are eligible for mortgage loans, bringing the housing sales price index back to its level before the October 15 Housing Market Stabilization Measures. The fact that these districts all have a high concentration of new units supplied through redevelopment and reconstruction projects also played a role.

The occupancy outlook index for Gyeonggi Province was 100, the highest level in seven months since July last year, when it was 118.7. This was attributed to rising prices in areas within commuting distance of Seoul—such as Bundang in Seongnam, Gwangmyeong, and Suji in Yongin—driven by higher apartment prices in Seoul and expectations of reduced future supply.

Incheon’s occupancy outlook index came in at 96.4, marking a third consecutive month of gains.

Across the five major metropolitan cities and Sejong, occupancy expectations rose sharply as developers’ hopes for additional government measures were reflected in the survey. The index climbed in Gwangju to 100.0 (from 76.4, up 23.6 points), in Daejeon to 106.2 (from 93.7, up 12.5 points), in Busan to 100.0 (from 90.0, up 10.0 points), in Daegu to 95.8 (from 87.5, up 8.3 points), and in Sejong to 121.4 (from 100.0, up 21.4 points). Ulsan remained flat at 100.0, but positive expectations have continued there since December.

HIRI noted, "However, as government measures are focused on managing housing demand and new supply in the Seoul metropolitan area, there remains a policy gap regarding unsold units outside the capital region, while demand continues to weaken due to regulations on multiple-home owners. It is therefore necessary to keep in mind that the recovery in occupancy rates may prove to be only a temporary rebound."

going@fnnews.com Choi Ga-young Reporter