"Take Profits Before the Holidays"... Will the Surging KOSPI Break the Old Rule and Hold Above 5,000?

- Input

- 2026-02-10 07:30:44

- Updated

- 2026-02-10 07:30:44

[Financial News] As the Lunar New Year holiday approaches, the domestic stock market is staging a strong rebound and regaining momentum. Instead of the traditional pattern of share prices weakening ahead of a long break, both the KOSPI and KOSDAQ are surging in tandem.

\r\n

Losses Quickly Recovered... Mood Shifts as "Holiday Risk" Fades

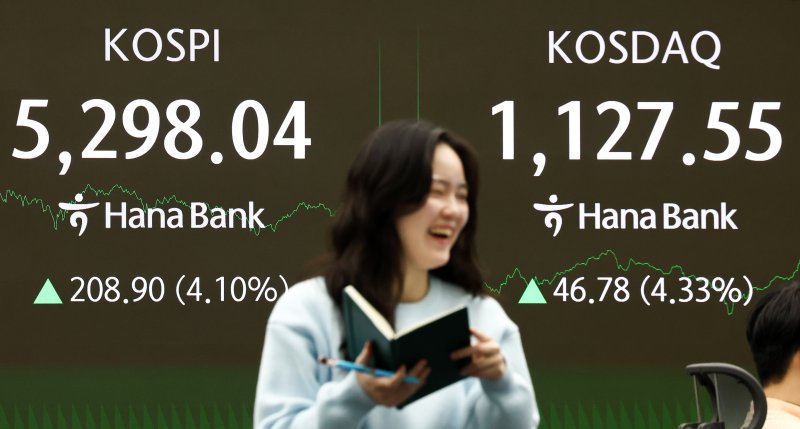

\r\nAccording to the Korea Exchange (KRX) on the 10th, the previous day the KOSPI closed at 5,298.04, up 208.90 points (4.10%) from the prior session. The index opened at 5,299.10 and at one point broke through the 5,300 level during trading, swiftly recouping the losses that had pushed it down to the 5,000 range intraday on the 6th.

Large-cap stocks by market capitalization also rallied across the board. Samsung Electronics touched 170,000 won during the session, marking a new 52-week high, while SK hynix climbed as high as 904,000 won, briefly reclaiming the 900,000-won level. On the demand side, institutions bought a net 2.7121 trillion won and foreigners a net 448.6 billion won, driving the rebound in the index.

The KOSDAQ joined the rally as well. The index closed at 1,127.55, up 46.78 points (4.33%) from the previous session, with foreigners and institutions net buying 166.1 billion won and 484.4 billion won, respectively.

\r\n

\r\nThe domestic market has repeatedly experienced what is known as "holiday risk." Ahead of major holidays such as Lunar New Year or Chuseok, share prices tend to fall and then rebound after the break. This pattern stems from a temporary drag on the market as foreign and institutional investors pull back before the holidays.

Historical data show that foreigners and institutions have often turned net sellers starting about three trading days before the holidays. Among investors, the advice that "in a sharply rising market, you should consider taking profits before the holidays" has long been treated as common wisdom.

\r\n

Rebound Driven by AI Hopes... Foreign Outflows Remain a Wild Card

\r\nThis year, however, the market is gaining strength as trading behavior diverges from past patterns ahead of the Lunar New Year break. Analysts point to expectations surrounding AI and bargain hunting as key reasons behind this unusual shift in flows.

In particular, the strong rebound of semiconductor and other tech stocks in the U.S. stock market has boosted investor sentiment at home. Some observers also argue that foreign investors have stepped up their "bets" despite lingering uncertainty over the nomination of Kevin Warsh as the next chair of the Federal Reserve (the Fed).

Han Ji-young, a researcher at Kiwoom Securities, said, "This week, the main factors that will drive volatility in the domestic indices are whether the rally in leading U.S. AI stocks continues, the release of key economic indicators such as January employment data and the Consumer Price Index (CPI), and changes in foreign investor flows." Han added, "Investors should keep in mind the potential for profit-taking after the short-term surge in the indices and the possibility of foreign capital outflows." Han also noted, "With earnings announcements coming up for leading domestic sectors, including Hanwha Aerospace, Doosan Enerbility and Mirae Asset Securities, there is a strong chance that a rotation among sectors centered on earnings will continue."

bng@fnnews.com Kim Hee-sun Reporter