Major Tenants Leaving Seoul Offices: CBD Vacancy Rate Could Hit Double Digits

- Input

- 2026-02-08 18:31:32

- Updated

- 2026-02-08 18:31:32

According to commercial real estate research firm Corebeat and other sources on the 8th, if public institutions move out to regional cities, the vacancy rate in the CBD could surge to as high as the 10% range.

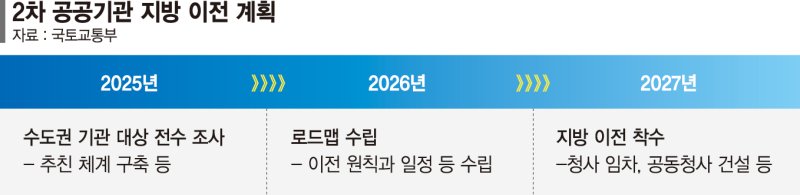

The government plans to fully launch the second round of public institution relocations starting in 2027. To that end, it intends to draw up a detailed roadmap this year after conducting research studies and public hearings.

Corebeat reports that 125 out of 159 public institutions in the Seoul metropolitan area are concentrated in Seoul. A Corebeat official noted, "Public institutions are core tenants and major buyers in the Seoul office market," and added, "As big-ticket players in the commercial real estate sector, their relocation to regional areas is expected to bring a new wave of change to Seoul’s office market."

What is particularly notable is the large volume of new office supply scheduled in central Seoul through 2030. A series of mega office projects are set to be completed in the Seun District and in the Gwanghwamun and Euljiro areas.

Corebeat’s analysis estimates that from 2025 to 2030, about 68 new office buildings totaling roughly 6.44 million square meters (1.95 million pyeong) will be supplied in Seoul. Of these, the CBD alone will see a record-high 31 office buildings come on the market.

Industry sources say most of these new buildings will be prime-grade offices. As a result, once the relocation of public institutions accelerates, many expect the oversupply in the Seoul office market to worsen further.

For now, Seoul’s office vacancy rate remains stable at around 2–3%. Some observers argue that vacancies may not rise sharply, but many analysts counter that the combination of expanding supply and the relocation of public agencies will inevitably weigh on the office market. By contrast, in the regional cities receiving these institutions, demand is expected to grow for mixed-use developments that combine offices, residential units, and retail facilities.

Kim Yong-nam, CEO of Global PMC, observed, "With the second round of public institution relocations coinciding with an oversupply of space, Seoul’s commercial real estate market, particularly the office sector, is likely to reach an inflection point."

ljb@fnnews.com Lee Jong-bae Reporter