"The money I got from selling my gold was voice-phishing proceeds?" Financial Supervisory Service issues consumer alert

- Input

- 2026-02-08 13:07:54

- Updated

- 2026-02-08 13:07:54

A person in their twenties living in Seoul, identified as A, agreed to a direct gold trade with a buyer, B, through OO Market and checked B’s ID in advance. However, when it came time to meet in person, someone else, C, showed up instead. C claimed to be B’s son and said he had come on B’s behalf. A became suspicious and tried to verify C’s identity, but once about 18 million won in payment was deposited into A’s account, which had been provided earlier for a reservation deposit, A handed over the gold. It was later confirmed that this payment was money stolen from a voice-phishing victim, and A’s account was designated as an account used for fraud and placed under a payment suspension.

With the price of one don of gold reaching about 1 million won, voice-phishing crimes disguised as direct gold trades are on the rise. The Financial Supervisory Service (FSS) announced that a new type of voice-phishing scam has recently become more common, in which money extorted from voice-phishing victims is transferred into gold sellers’ accounts. The gold sellers are then reported as scammers, while the actual voice-phishing criminals make off with the sellers’ gold. In response, the FSS has issued a consumer alert.

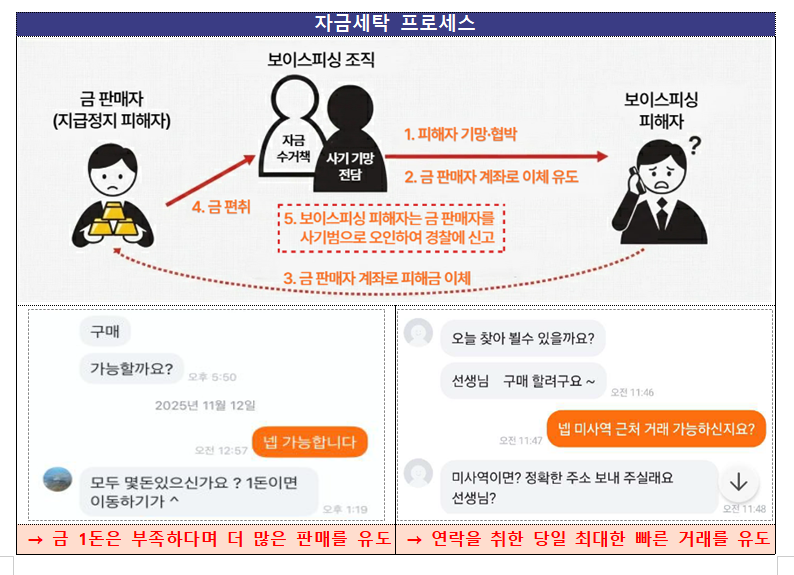

According to the FSS on the 8th,voice-phishing scammers approach people who are selling gold directly on online trading platforms and say they want to buy, then ask for the seller’s bank account number in advance under the pretext of transferring a reservation deposit before meeting in person..

While it appears that the seller is simply receiving a reservation deposit and building trust,in reality the scammer has obtained the seller’s account number in advance so that, at the moment the gold is handed over, the voice-phishing victim will transfer their stolen funds into the seller’s account..

At the same time,the scammer impersonates prosecutors, the FSS, or other authorities and instructs the voice-phishing victim to transfer money to the gold seller’s account at a specific time..The gold seller believes the money sent by the voice-phishing victim is legitimate payment for the gold and hands the gold over to the scammer.When the voice-phishing victim realizes they have been defrauded and reports the gold seller as the voice-phishing scammer,the gold seller becomes the named holder of an account used for fraud, and their financial transactions are restricted..

Because scammers would be more easily tracked by investigators if they received the stolen money directly by bank transfer from the voice-phishing victim, they instead use online trading platforms to find gold sellers whose accounts can be exploited for money laundering.

Complaints filed with the FSS about this new type of voice-phishing scam have surged recently, with 13 cases reported in November last year, 9 in December, and 11 in January this year.

First, the FSS advised thateven if you have to pay fees, it is safest to trade physical gold through a professional gold exchange rather than through direct person-to-person deals..

The FSS also noted that, on online platforms, scammers often use newly created accounts because their previous accounts were suspended due to past crimes. It advised consumers to be very cautious about dealing with counterparts who have no transaction history or poor buyer reviews.

In particular, if a supposed gold buyer asks for your bank account number before meeting in person on the grounds of paying a reservation deposit, or insists that you delete your listing before the trade to prevent you from changing your mind, you should strongly suspect a scam.

The FSS emphasized, "Not only gold but also silver and foreign currencies such as the US dollar require caution when traded directly through online platforms," adding, "In particular, foreign currency is often targeted when people sell leftover cash after overseas trips around the Lunar New Year holidays, so extra care is needed in those cases."

gogosing@fnnews.com Park So-hyun Reporter