Bitcoin Falls Below 100 Million Won: Trump Rally Fades, Fears of 'Crypto Winter' [Crypto Briefing]

- Input

- 2026-02-06 09:53:46

- Updated

- 2026-02-06 09:53:46

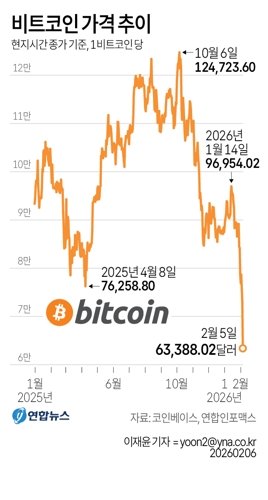

[Financial News] Bitcoin has surrendered all of its gains since the late-2024 Trump rally, breaking below the key psychological levels of 100 million won and $62,000 at the same time. A correction in U.S. tech stocks and weak employment data have triggered broad-based selling of risk assets, dealing a direct blow to the crypto market.

According to Investing.com and industry sources on the 6th, concern is mounting that the market may be slipping past a short-term correction and back into a renewed phase of Crypto Winter.

On dollar-based exchanges such as Coinbase, Bitcoin is down 14.05% over the past 24 hours, trading around the $62,000 level. It has plunged more than 33% over the past month.

The shock has also been fully transmitted to won-based crypto exchanges in Korea. Data from Upbit Data Lab show Bitcoin has fallen into the 93 million won range, a drop of 48% from its all-time high of 180 million won reached in October last year. The Fear & Greed Index has also slipped into the "extreme fear" zone.

The steep declines in domestic and overseas crypto assets suggest that liquidity, which had poured in on expectations of pro-crypto policies under the Trump administration, is now rapidly flowing out.

Weak macroeconomic indicators and growing risk aversion toward risk assets in general were cited as key drivers. Kim Joo-yeon, a researcher at Mirae Asset Securities, noted, "Concerns over a deterioration in U.S. employment, combined with the capital expenditure burden in the artificial intelligence (AI) industry and the resulting correction in big tech stocks, have dampened sentiment in the crypto market."

As a result, Strategy, the largest corporate holder of Bitcoin (classified as DAT), saw its unrealized losses swell amid the sharp drop in Bitcoin and tumbled 17.12% overnight. Crypto exchange Coinbase also closed down 13.34%.

U.S.-listed spot Bitcoin Exchange-Traded Funds (ETFs) are continuing to see net outflows. As institutional investors pull money out at a faster pace, downward pressure on prices is intensifying. Major altcoins other than Bitcoin, including Ethereum, Ripple (XRP), and Solana, have also fallen by around 10%, fueling concerns that a liquidity crunch in the market could worsen.

An industry official in the crypto sector said, "While policy expectations following Trump's election had already been priced in, the tangible fear of a macroeconomic slowdown has now swept over the market," adding, "In the short term, whether $60,000 holds as support will be a watershed that determines how long this Crypto Winter lasts."

elikim@fnnews.com Kim Mi-hee Reporter