A 30-something civil servant borrowed 300 million won and put 500 million won into 'SK hynix'—how did it end?

- Input

- 2026-02-06 09:01:26

- Updated

- 2026-02-06 09:01:26

[Financial News] A case involving a civil servant who used leverage to invest as much as 500 million won in SK hynix shares is drawing public attention.

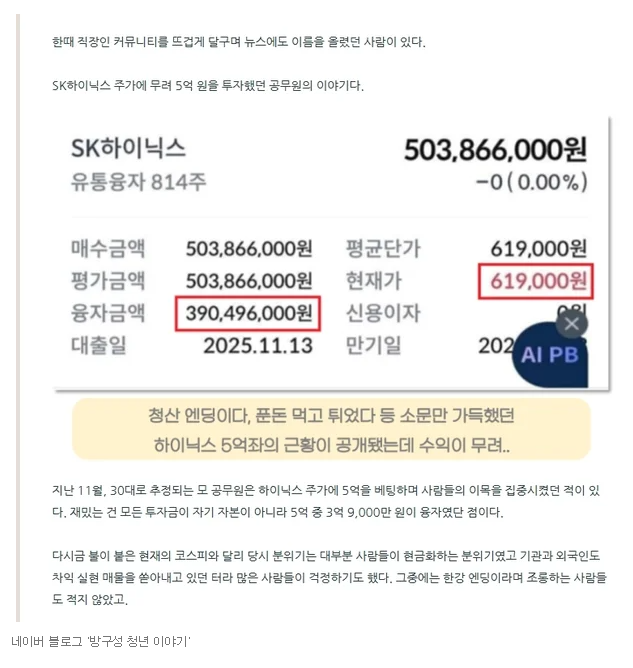

Blogger A recently wrote on his blog, "Last November, a civil servant B, believed to be in his 30s, drew attention by betting 500 million won on SK hynix shares," adding, "What is interesting is that not all of that money was his own capital. Of the 500 million won, 390 million won was financed through loans."

According to the materials A posted, B's total purchase amount of SK hynix shares was 538.66 million won. The average purchase price was 619,000 won per share, and he held 814 shares. Of the total investment, 390.496 million won was borrowed funds.

Describing the market situation at the time, A noted, "Unlike the current Korea Composite Stock Price Index (KOSPI), which has heated up again, back then most people were trying to move into cash. Institutions and foreign investors were dumping shares to take profits, so many people were worried," adding, "Among them, quite a few mocked B, talking about a so-called 'Hangang River ending,' a slang phrase implying suicide."

In fact, after B posted about his position, SK hynix's share price kept falling and dropped to around 501,000 won. Given that his average purchase price was 619,000 won, there were growing concerns that his position could be forcibly liquidated.

In the post, B explained, "When the share price fell to around 501,000 won, the securities firm contacted me because my collateral ratio had fallen short. Under the structure of margin trading, a certain amount must be posted as collateral, and in my case that amount was 80 million won."

He went on, "To avoid a forced sell-off, I converted that 80 million won from a financed position into fully paid cash shares. Because it was a margin trade, the monthly interest on 300 million won came to about 2.6 million won."

After the share price began to recover, B sold all of his holdings when he was up about 10%. He said, "From last year until now, I have earned about 140 million won in profits from trading semiconductor stocks," adding, "Looking back, when the price dropped to around 500,000 won, I almost went to the Hangang River. After that experience, I became able to laugh off ridicule and criticism."

He also stated that he expects the semiconductor sector to maintain an upward trend through 2028, and that once his funds are settled, he plans to put some into savings and use the remainder for further investments.

According to the disclosed account records, B achieved a return of about 10% from trading SK hynix. His realized profit was around 50 million won, and his cumulative profit from June 2025 to January 2026 totaled 141 million won.

Commenting on the case, A reflected, "I wondered whether I could ever invest like that, but the answer was no," adding, "From the start, I would not have used leverage at all, and back in November I would not even have looked at semiconductor stocks."

hsg@fnnews.com Han Seung-gon Reporter