Doosan’s march toward 2 trillion won in operating profit speeds up...Will Chairman Park Jung-won pull it off?

- Input

- 2026-02-09 06:59:00

- Updated

- 2026-02-09 06:59:00

According to Financial News, analysts now see Doosan Group reaching the 2 trillion won mark in operating profit this year. In the fourth quarter of last year, orders for AI accelerator-related products began to recover, and the company is reportedly in price negotiations to reflect the surge in raw material costs. From the second half, when mass production of Copper Clad Laminate (CCL) for Nvidia’s Vera Rubin platform ramps up in earnest, operating profit is expected to improve sharply.

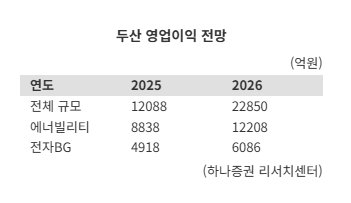

Industry data on the 9th show Doosan’s operating profit is projected to jump to 1.2088 trillion won in 2025 and 2.285 trillion won in 2026. Over the same period, Doosan Enerbility’s operating profit is forecast to rise from 883.8 billion won to 1.2208 trillion won, while the Electronics BG (Business Group) is expected to increase from 491.8 billion won to 608.6 billion won. The operating margin of the Electronics BG is projected to reach 27% in 2025 and 29% in 2026.

This represents an acceleration compared with previous forecasts, which had Doosan’s operating profit at 1.2913 trillion won in 2025 and 1.9684 trillion won in 2026, only surpassing the 2 trillion won threshold in 2027 at 2.1457 trillion won.

Kim Min-kyung, an analyst at Hana Securities, said, "On the Vera Rubin platform, the number of logic chips per rack will increase, signal transmission speeds will improve, and low-loss requirements will become stricter. This will highlight the effects of material upgrades, larger Printed Circuit Board (PCB) areas, more layers, and the resulting rise in average selling prices (ASP) and shipment volumes." She added, "Beyond AI accelerators, network customers are also expected to ramp up mass production of 800G switches from the second half of 2026." She further projected, "For CCL used in 800G switches, both ASP gains from adopting low-loss materials and volume effects from more layers will occur at the same time." CCL is a key material that connects semiconductor chips to the mainboard.

Kim noted, "On the back of solid AI demand, Doosan is expanding its network CCL capacity. It aims to secure additional capacity equivalent to about 50% of its current level by the first half of 2027," and stressed, "Despite competitors’ attempts to enter the compute tray CCL market, Doosan has maintained its monopolistic position and once again proved its technological moat."

Since last year, Doosan’s Electronics BG has been the exclusive supplier of CCL for compute trays used in rack-scale servers based on the Nvidia Blackwell GPU, securing high pricing and profitability.

Meritz Securities estimates that Doosan’s sales to Nvidia will surge 70.1%, from 652.5 billion won in 2025 to 1.1099 trillion won in 2026.

Meritz Securities also analyzed that, although the number of Graphics Processing Units (GPU) shipped per wafer will decline as Nvidia increases die size, content per compute tray measured in CCL terms can still grow. This is due to more substrate layers (from 22 to 26) and upgraded specifications for key materials, such as the adoption of HVLP4. Starting with Vera Rubin, a cableless structure will be applied, and connections between different zones will shift to a design that uses a midplane PCB to route signals.

Kim Soo-hyun, head of the research center at DS Investment & Securities, stated, "The server board design used in Nvidia’s next-generation AI platform ‘Vera Rubin’ is highly likely to retain the existing Bianca design for Nvidia’s next-generation AI server boards." He emphasized, "If that happens, Doosan’s status as the primary supplier of these boards is virtually locked in. Regardless of whether material verification is completed in the first quarter, the company is already believed to have entered the preparation stage for supplying mass-production samples."

SK Siltron, which Doosan is currently seeking to acquire, is the world’s third-largest player in the wafer market by share. If the acquisition goes through, Doosan is expected to benefit even more from the semiconductor boom. Hana Securities also sees potential expansion of the customer portfolio after the deal as an additional catalyst.

SK Siltron’s customer base is centered on top-tier global memory makers, with Samsung Electronics accounting for 27.7% and SK hynix for 26.5%. Even during the slowdown that followed the peak of the semiconductor cycle, the company has consistently generated more than 600 billion won in annual Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

It is viewed as a business model that maintains a structurally high EBITDA margin of over 30%, supported by a stable customer base and recurring demand, rather than one whose earnings swing sharply with short-term market cycles.

ggg@fnnews.com Kang Gu-gwi Reporter