"My salary is zero but my health insurance premium is 230,000 won. How does that make sense?" A 1.5 billion won apartment retiree’s misconception [Retiree X’s Plan]

- Input

- 2026-02-21 08:30:00

- Updated

- 2026-02-21 08:30:00

[The Financial News]"When I was working, I never really thought about my health insurance premium. After retiring, that became the first fixed expense I really felt."This is one of the most common comments among late‐50s retirees who have left their main job. After retirement, regular income shrinks or disappears altogether, yet the National Health Insurance bill arrives almost immediately. And the amount is often much higher than what they paid while employed.

"My income has gone down, so why has my premium gone up?" This question many retirees have is not a personal misunderstanding. It is the inevitable result of the way National Health Insurance is calculated changing the moment you retire.

Three out of ten people are local insured

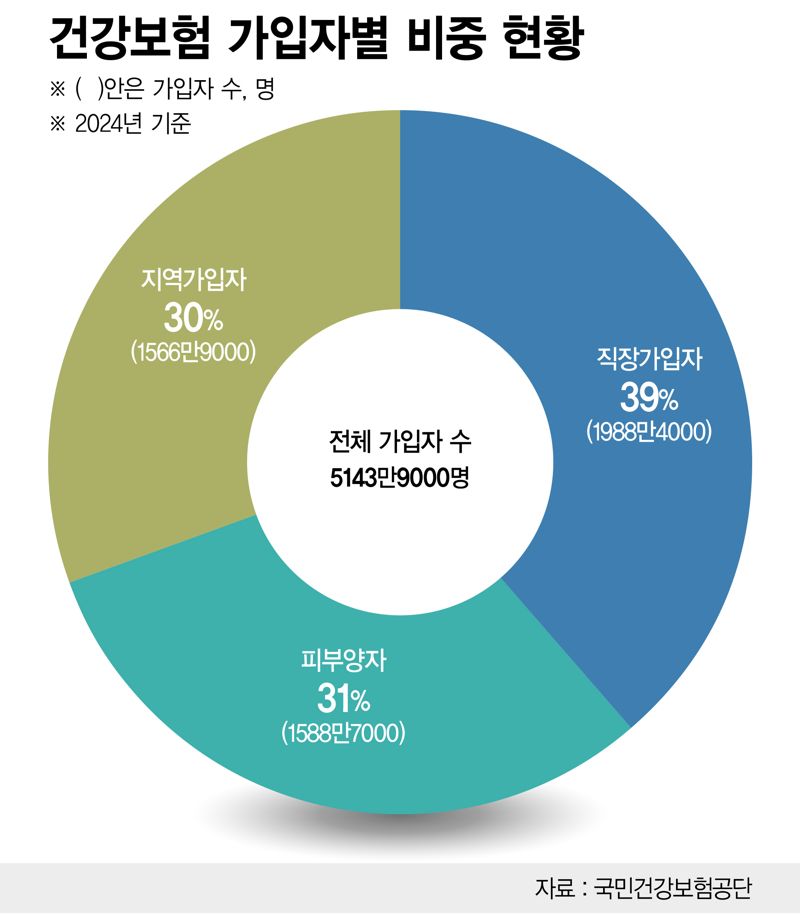

According to the National Health Insurance Service (NHIS) and the NH Investment & Securities 100-Year Life Research Institute, as of the end of 2024 the total population covered by National Health Insurance is about 51.439 million.

Among them, employee insured persons account for 39% of everyone covered by National Health Insurance, or roughly 4 out of 10 people. About 31% are registered as dependents who mainly rely on an employee insured person for their livelihood, and the remaining 30% are classified as local insured.

If an employee insured person does not find another job after retirement or cannot be registered as a dependent, they are converted to a local insured.

In 2026, the contribution rate itself will also rise. The National Health Insurance contribution rate for 2026 is set at 7.19%, up 0.10 percentage points from the previous year.

Why does the health insurance bill show up first after retirement?

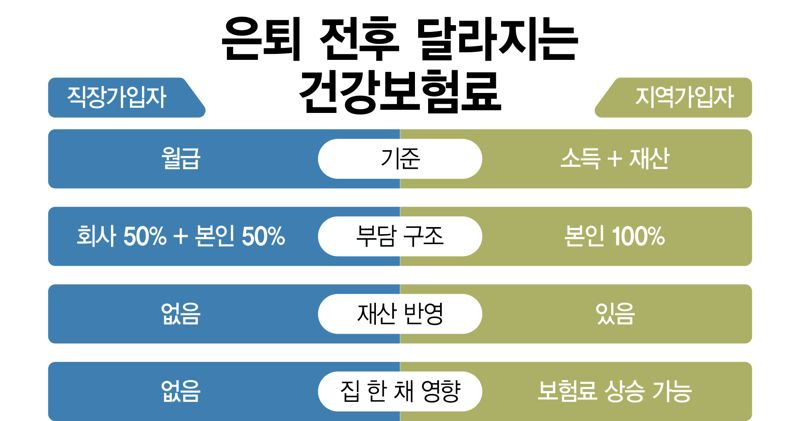

The reason the health insurance premium hits so hard right after retirement is simple: your status changes. While you are working, you are an employee insured person, but once you retire, most people become local insured. From that moment, the basis for calculating your health insurance premium changes completely.

▶Employee insured person: the premium is based on monthly salary (wages), and the company and the individual split the cost 50:50.▶Local insured: the premium is based on "income + assets," and the individual pays 100%.Put simply, the portion of the premium your company used to pay on your behalf is now entirely on you. On top of that, your home and other assets, which were not previously counted, start being treated like a "monthly salary" for calculation purposes.

Why am I paying a premium when I have no income?

This is the part retirees find hardest to understand. There are many cases where they have no wage income and their pension has not started yet, but they are still charged 200,000 to 300,000 won a month in premiums.

The reason is thatthe NHIS treats "assets" not just as property, but as a capacity to generate a certain level of monthly income.For local insured, the asset score includes land, housing, buildings, ships and aircraft. If you do not own a home, your jeonse or monthly rent deposit is also converted at a certain rate (30%) and added to your asset score.In other words, regardless of whether cash is actually coming in, the system assumes that "because you have assets, you have the ability to pay."

The NHIS converts your home or land into an "asset score," then translates that into a notional monthly income and applies the premium to that amount.

Simulation: a retiree with one home—what will the bill look like?

Consider a hypothetical case of 58‐year‐old Kim Hyun-sik, who owns a single apartment worth 1.5 billion won on the market (with an officially assessed value of 1 billion won) in Seongdong District, Seoul. Before retirement, he was an office worker earning 4 million won a month. His total health insurance premium then was 287,600 won, but because his company paid half, he personally paid 143,800 won per month.

After retirement, he became a local insured. He has no other income. His only asset is that one apartment. Yet his health insurance premium actually went up.

For a 1.5 billion won apartment in Seoul, the property tax base (about 60% of the officially assessed value) is roughly 600 million won. After subtracting the basic deduction of 100 million won, 500 million won becomes subject to the health insurance calculation. The NHIS converts this asset into a monthly income capacity in the 2 million won range. Applying the 7.19% contribution rate, the actual bill comes out to around 180,000 to 230,000 won per month.

His salary has dropped to zero, but his premium has risen by 50,000 to 70,000 won a month. That is about a 39% increase compared with when he was working. On an annual basis, this means an extra burden of 600,000 to 800,000 won.

For local insured, a home is no longer just an asset; it becomes a basis for calculating a monthly premium.

Clearly eased after 2024, but...

The government has adjusted the system to reduce the burden on retirees.

From February 2024, it implemented the abolition of the automobile-based health insurance contribution and expanded the basic deduction for assets of local insured to 100 million won.As a result, some policyholders have indeed seen their premiums go down.

However, for groups whose asset scores remain high—such as single‐home owners in the greater Seoul area—the perceived reduction is limited. Many say, "It only went down by the amount related to the car."

Dependent status: the most powerful tool, but also the most fragile

The most powerful way to bring your health insurance premium down to zero is to become a dependent. If you are covered under a working spouse or child as a dependent, you do not pay a premium.

But being a dependent is not a permanent status; it is a set of conditions. Every year, the NHIS automatically re‐evaluates eligibility based on income and assets.

■ Key criteria for dependents (as of 2026)Income: 20 million won or less per yearProperty tax base:Up to 540 million won: income up to 20 million won allowed

Over 540 million won and up to 900 million won: income must be 10 million won or less

Over 900 million won: in principle, not eligible

Once you exceed these thresholds, you are switched to a local insured without a separate notice, and the bill arrives first. Loss of dependent status is especially common when public pensions start, when large amounts of financial income mature in the same year, or when officially assessed property values rise.Over 540 million won and up to 900 million won: income must be 10 million won or less

Over 900 million won: in principle, not eligible

Dependent eligibility is not just an individual issue, but a household variable

Many retirees use 15 million won a year as a benchmark when planning their pension. That figure is mainly about minimizing tax. But that is a tax rule; health insurance premiums follow a completely different logic.

▶Public pension (National Pension Service, Public Officials Pension): counted for premium calculation and dependent eligibility review

▶Interest and dividend income: aggregated

▶IRP and Private Annuity Savings and other private pensions: under current rules, not included in health insurance premium calculations

This is why a plan optimized only for tax can lead to unexpected burdens from health insurance premiums.

In particular, when planning around dependent status, you need to look at the income structure of both spouses together. If one spouse fails to meet the income criteria and loses dependent status, that spouse becomes a local insured. In that case, the household’s total National Health Insurance burden can rise sharply.

Five realistic cards retirees can play

Health insurance premiums are not something you can solve just by "cutting back." The key is not extreme frugality, but using the system to reduce what you pay.

▶Voluntary Continuous Enrollment (36 months):If you apply within two months of retirement, you can keep paying the same premium you paid as an employee.▶Check your property tax base: assess your chances of qualifying as a dependent based on the property tax base, not the actual transaction price.

▶Manage maturity of financial income: spread out maturities so that interest and dividend income in any one year does not exceed 20 million won.

▶Separate tax and health insurance strategies:build a plan that addresses both tax savings and health insurance premium control.

▶Run simulations:use the National Health Insurance Service premium estimator on the NHIS website to get advance estimates.

Four burning questions, answered

Q1. I retired, so why did my premium go up?A. While you were employed, your company paid half the premium; after retirement, you pay the full amount. On top of that, your assets are now treated like income in the calculation.

Q2. If I’m a dependent, is my premium really zero?A. In principle, yes. But if you exceed the income or asset thresholds, you automatically lose dependent status.

Q3. Is the premium I paid because of my car now completely gone?A. Yes. Since February 2024, the automobile-based contribution has been abolished.

Q4. If I lose dependent status, will my premium jump immediately?A. It varies widely by case. However, when people are first converted, temporary relief measures have been applied in the past.

The health insurance premium is not a "utility bill" but a "report card"

A health insurance premium is not just another utility bill. It is a report card that expresses a retiree’s life in numbers.

People assume that when their salary stops, their spending will naturally fall. In reality, things are different. The moment you retire, your status changes, and your home starts being treated as a kind of "virtual salary" in the calculation.Once your pension starts, it counts as income, and if financial income is concentrated in a single year, your dependent status can be shaken.Retirement planning does not end with calculating your pension amount. If you do not calculate your health insurance premiums first, the bill can blow up your carefully crafted plan.

On the day your salary drops to zero, the first thing to arrive may not be a medical bill, but a health insurance premium notice.The first cost of retirement may not be treatment expenses, but your health insurance premium.

Checking your "health insurance premium resilience"

After retirement, the more you understand about health insurance premiums, the more you can reduce them. These are the key items you need to prepare.□ Do you know your exact property tax base?You need to check the property tax base—about 60% of the officially assessed value—which is the actual basis for calculating health insurance premiums, rather than just looking at market prices or official appraisal values.□ Do you have a strategy to stagger the maturity of financial income (interest and dividends)?Make sure that overlapping maturities of deposits and savings in a single year do not push your financial income above 20 million won by spreading accounts across years or using tools such as an ISA.□ Have you marked the application deadline for Voluntary Continuous Enrollment on your calendar?If the premium as a local insured after retirement would be higher, you must apply within two months of retirement to keep paying the same premium you paid as an employee.□ Have you used the National Health Insurance Service premium estimator to check your expected amount?

The old formula of "retirement equals exit" is breaking down. In an era where average life expectancy is 83, and Generation X is entering full‐scale retirement, the very concept of retirement is being redefined. Retiree X’s Plan, which tells the stories of their "second act in life,"[Retiree X’s Plan]will be delivered to readers every Saturday morning. Subscribe to the reporter profile page to receive it conveniently.

kkskim@fnnews.com Kim Ki-seok Reporter