FSC’s FIU: “Stablecoin issuers will face bank‐level regulation”

- Input

- 2026-02-05 10:30:00

- Updated

- 2026-02-05 10:30:00

[Financial News] Financial authorities have decided to impose Anti-Money Laundering (AML) obligations on stablecoin issuers that are comparable to those on traditional financial institutions. The scope of the virtual asset travel rule, which requires the exchange of sender and recipient information, will be fully extended to cover small transactions under 1 million won. Separate response measures will become mandatory when dealing with personal wallets or overseas service providers.

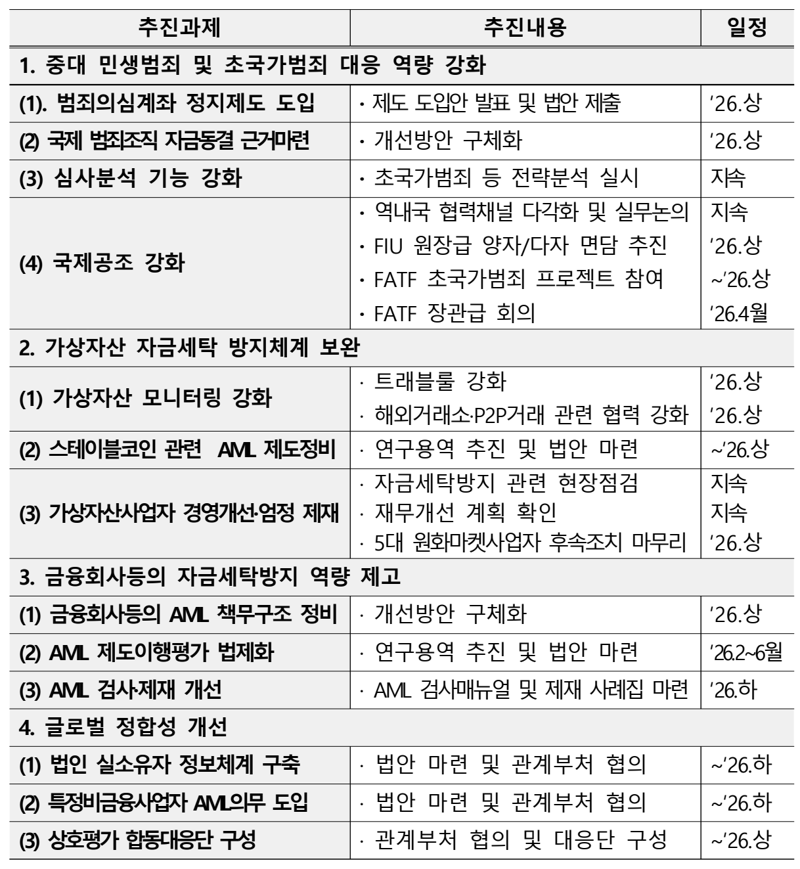

The Financial Intelligence Unit (FIU) of the Financial Services Commission (FSC) convened the “AML/CFT Policy Advisory Committee” on the 5th and announced the “2026 Anti-Money Laundering Key Work Plan” reflecting these measures.

The new plan marks the 25th anniversary of the Act on Reporting and Use of Specified Financial Transaction Information. It focuses on strengthening the response to serious crimes affecting people’s livelihoods and improving the AML framework for virtual assets.

Ahead of legislating and institutionalizing stablecoins, the FIU plans to overhaul and build an AML framework tailored to them. The core measure is to impose on stablecoin issuers obligations equivalent to those of “financial institutions and others” under the Act, including Know-Your-Customer (KYC) procedures, suspicious transaction reporting (STR), and internal control requirements.

In particular, stablecoin transactions involving personal wallets and overseas service providers, which have been criticized as a regulatory blind spot, will be subject to mandatory response measures based on a risk-based approach (RBA), such as enhanced due diligence (EDD). In addition, issuers will be required to embed functions that allow funds to be frozen or tokens to be burned at the time of issuance, so that the FIU can immediately exercise freezing powers when stablecoins are used for criminal purposes.

To increase transparency in virtual asset transactions, travel rule regulations will also be significantly tightened. The travel rule, which currently applies only to transactions of 1 million won or more, will be extended to transfers below 1 million won, and the obligation to obtain and retain information will apply not only to the sending exchange but also to the receiving exchange.

For transactions with overseas exchanges and personal wallets, the FIU will codify a so‐called whitelist regime that allows only “low‐risk transactions,” such as when the sender and recipient are the same person, on a limited basis. The FIU also plans to enhance its ability to respond to emerging schemes by adopting virtual asset analytics tools such as Chainalysis and building an artificial intelligence (AI) screening and analysis system.

To better combat crimes that harm people’s livelihoods, an “account suspension scheme for suspected serious livelihood‐related crimes” will be introduced through amendments to the Act on Reporting and Use of Specified Financial Transaction Information. Under this scheme, the FIU will be able to directly freeze accounts suspected of involvement in crime at the request of investigative agencies. Target offenses will include drug trafficking, illegal gambling, and terrorist financing.

To make internal controls at financial institutions more effective, the position of the AML reporting officer will be explicitly defined as an executive‐level role, including compliance officers. The currently voluntary “AML implementation assessment” will be converted into a legal obligation, and a basis for sanctions will be established for submitting false data.

The FIU will also refine the system in line with international standards set by the Financial Action Task Force (FATF). To prevent money laundering through shell and front companies, it will build a database (DB) of information on corporate beneficial owners and allow financial institutions and investigative agencies to cross‐check that data.

In addition, the FIU will work with relevant professional bodies to introduce AML obligations for designated non‐financial businesses and professions (DNFBPs), such as lawyers, certified public accountants, and tax accountants, when they intermediate virtual asset or financial transactions.

Lee Hyung-joo, head of the FIU, stated, “It is a critical moment to strengthen our capacity to respond to newly emerging money‐laundering challenges, including transnational crime.” He added, “Tasks that do not require legal amendments will be implemented immediately, and we will seek to submit revisions to the Act on Reporting and Use of Specified Financial Transaction Information to the National Assembly within the first half of this year.”

elikim@fnnews.com Kim Mi-hee, Lee Joo-mi Reporter