Japan’s Rapidus Expands Private Investment to 1.5 Trillion Won, Betting on Semiconductor Revival

- Input

- 2026-02-05 09:55:51

- Updated

- 2026-02-05 09:55:51

Tokyo – Financial News correspondent Seo Hye-jin – Private investment in Japanese semiconductor foundry Rapidus Corporation is expected to exceed 160 billion yen (about 1.49 trillion won), higher than the company’s original plan. After the Government of Japan decided to provide 2.9 trillion yen (about 27.01 trillion won) in support for cutting-edge semiconductors to promote domestic production, private companies are now adding their own capital, throwing their weight behind the revival of Japan’s semiconductor industry.

According to the Nihon Keizai Shimbun (The Nikkei) on the 5th, Rapidus Corporation plans to announce its private investment plan for this year later this month. The company had initially aimed to raise 130 billion yen (about 1.21 trillion won) from the private sector last year, but the new plan is expected to exceed 160 billion yen.

The number of shareholder companies will also increase from the current eight to more than 30. Many firms concluded agreements with Rapidus Corporation by the end of last month and intend to complete their investments within this fiscal year. Rapidus Corporation is expected to finalize and release its consolidated private investment plan within this month.

By company, SoftBank Group and Sony Group will each invest 21 billion yen, making them the largest corporate shareholders. In addition, Fujitsu will contribute 20 billion yen, existing shareholder NTT will add 10 billion yen, and Toyota Motor will inject an additional 4 billion yen.

SoftBank Group established a new company called "Saimemory" at the end of 2024 to develop high-performance memory. Over the longer term, it is also considering equipping AI semiconductors produced by Rapidus Corporation with memory supplied by Saimemory.

NTT is developing the next-generation communications infrastructure "IOWN." If the technology that replaces electrical signals with optical signals in IOWN is applied to semiconductors, it could significantly reduce power consumption.

International Business Machines (IBM) is expected to become the first overseas company to invest in Rapidus Corporation. IBM plans to complement its existing technology partnership with capital support to help secure stable mass production.

Nikkei noted, "At the same time, there also appears to be an intention to reduce dependence on TSMC, the world’s largest semiconductor foundry company."

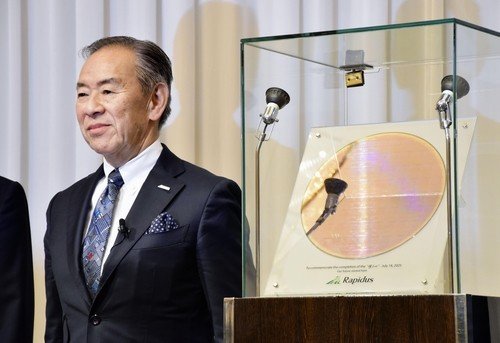

The increase in private funding beyond the initial target is largely attributed to the technological progress Rapidus Corporation has demonstrated. In July last year, the company confirmed the operation of a 2-nanometer semiconductor device for the first time, and in December it test-produced and unveiled an interconnect layer designed to efficiently link AI semiconductors.

Government support efforts have also played a positive role. According to Nikkei, officials from the Ministry of Economy, Trade and Industry (METI) joined negotiations with major companies and worked to persuade them, fostering a sense among firms that do not directly need cutting-edge semiconductors that they "cannot stand aside from a national project."

The Government of Japan regards domestic production of advanced 2-nanometer semiconductors as a key milestone for economic security. Based on funds raised from both the public and private sectors, Rapidus Corporation plans to prepare for mass production of its target 2-nanometer products at its Hokkaido plant in fiscal year 2027.

Rapidus Corporation estimates that it will need more than 7 trillion yen (about 65.21 trillion won) by 2031. Of that total, it is aiming to secure around 1 trillion yen (about 9.32 trillion won) from private-sector investment.

sjmary@fnnews.com Seo Hye-jin Reporter