Dunamu yet to decide on paying fine as deadline nears, watching Naver major deal [Crypto Briefing]

- Input

- 2026-02-04 16:17:47

- Updated

- 2026-02-04 16:17:47

[Financial News] The deadline for Dunamu to pay the administrative fine imposed by the Financial Intelligence Unit (FIU) is approaching in the middle of this month, but the company has not yet decided whether it will challenge the decision. As it weighs its options ahead of a major deal with Naver, market observers believe it is more likely to pay the fine.

According to the virtual asset industry on the 4th, the deadline for Dunamu to file an objection and pay the 35.2 billion won fine imposed by the FIU is fast approaching, yet the company has not decided whether to pay or contest it. A Dunamu representative stated, "No decision has been made yet on whether we will pay."

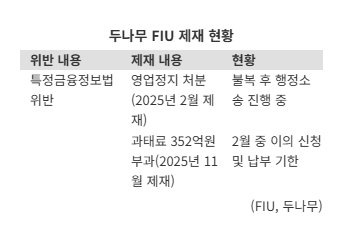

In November last year, the FIU decided to impose a 35.2 billion won fine on Dunamu. The agency said it had found that the company violated the Act on Reporting and Use of Specified Financial Transaction Information (the "Specified Financial Information Act") by dealing with unregistered overseas virtual asset service providers and breaching customer due diligence (KYC) obligations.

Inside Dunamu, opinions are split over whether to pay. One camp argues the amount is excessively high and should be challenged. Separately from the fine, Dunamu has also received a business suspension order for violating the Specified Financial Information Act and is currently pursuing administrative litigation over that sanction.

At a hearing held in December last year, Dunamu’s legal representative argued, "Even though other exchanges faced the same issues, only Dunamu was subjected to preemptive action," pointing to a lack of fairness.

On the other hand, many argue that Dunamu should minimize controversy ahead of a comprehensive share swap with Naver Financial. To complete this major deal, the company must secure shareholder approval at the general meeting of shareholders scheduled for May, and some warn that if the dispute escalates into further administrative litigation, the issue could drag on unnecessarily.

Another variable is that the deal must pass reviews by authorities including the Financial Supervisory Service (FSS), the FIU, the Financial Services Commission (FSC), and the Korea Fair Trade Commission (KFTC). The FSS is reportedly examining not only formal requirements for the major deal between Dunamu and Naver, but also the level of shareholder protection, internal controls, and system stability.

Both inside and outside the industry, many see it as more likely that Dunamu will pay. Unlike a business suspension order, which requires proof of intent or gross negligence to impose, a fine can be levied simply for violating the Specified Financial Information Act, so it is viewed as a relatively lighter sanction. Korbit, which is pursuing a merger and acquisition with Mirae Asset Financial Group, was also fined 2.73 billion won by the FIU last December for violating the same Act, but chose not to contest the decision and paid the fine.

Dunamu also argued at the hearing, "Under the Specified Financial Information Act, a fine can be imposed for violating Article 8 regardless of whether there was intent or gross negligence," and claimed, "Issuing a business suspension order based solely on a single violation of Article 8 is a serious problem."

A source in the virtual asset industry said, "Dunamu is agonizing over the issue internally," adding, "If there were no deal with Naver, it likely would have challenged the decision immediately, but with such a large transaction ahead, discussions are leaning toward reducing risk."

yimsh0214@fnnews.com Lim Sang-hyuk Reporter