Korean Tire Makers Beat U.S. Tariffs, Poised for Record Annual Sales Last Year

- Input

- 2026-02-04 16:02:34

- Updated

- 2026-02-04 16:02:34

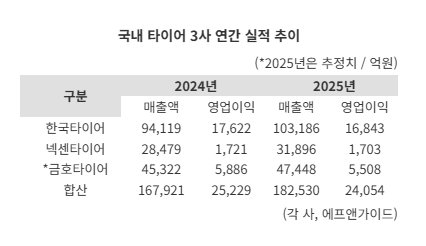

According to the tire industry on the 4th, Hankook, which released its earnings the same day, posted annual sales of 10.3186 trillion won last year, up 9.6% from a year earlier. It was the first time since the company’s founding that sales exceeded 10 trillion won. Operating profit came to 1.6843 trillion won, with an operating margin of 16.3%.

Nexen Tire, which also announced its results on the same day, reported sales of 3.1896 trillion won last year, a 12.0% increase from 2.8479 trillion won a year earlier. Operating profit slipped 1.1% from 172.1 billion won in 2024, but net profit climbed 19.3% over the same period to 151.2 billion won.

Including Kumho Tire, the combined sales of the three Korean tire makers are projected to reach 18.253 trillion won this year. That would be an 8.7% increase from 16.7921 trillion won a year earlier and the highest level on record. According to FnGuide, Kumho Tire, which is scheduled to announce its earnings on the 6th, is expected to post annual sales of 4.7448 trillion won for last year, up 4.7% from 4.5322 trillion won a year earlier.

One key factor behind the growth of Korean tire makers last year, despite U.S. tariffs, was stronger demand for replacement (RE) tires. As tariffs on auto parts were imposed starting in May last year, tire prices rose, and Korean manufacturers, which have a high share of RE sales, adjusted their prices and effectively benefited from the price increase. Replacement tires typically reflect market prices faster than original equipment (OE) tires supplied to automakers, and OE accounts for only the mid-20% range of total sales at the three Korean tire makers.

Tires for electric vehicles also helped drive sales growth. Because EVs are heavier than internal combustion engine vehicles, their tire replacement cycle is generally more than a year shorter, making them a high value-added product for tire companies. Hankook currently operates the EV-dedicated tire brand “iON,” Kumho Tire sells EV tires under the brand “EnnoV,” and Nexen Tire uses the dual-use EV tire certification mark “EV Route.”

This year, the three tire makers plan to increase local sourcing and production to ease the burden of tariffs. Hankook is pushing to expand its plants in Tennessee in the United States and in Hungary in Europe. Nexen Tire also intends to raise utilization rates at its European plants, focusing on its Czech Republic facility, to prepare for the spread of protectionist, country-first policies. Kumho Tire, which is already targeting Southeast Asia by expanding its Vietnam plant, is expected to move ahead in earnest with construction of its first European production plant in Poland, aiming to start operations in 2028.

An industry official said, "With tariff pressures persisting, tire companies will seek to protect profitability by expanding production in overseas markets such as North America and Europe," adding, "Rising demand for EV tires is another factor that supports expectations for strong earnings going forward."

eastcold@fnnews.com Kim Dong-chan Reporter