[On the Ground] "I should have bought when prices plunged"... Inquiries for silver bars surge amid whipsawing silver prices

- Input

- 2026-02-04 15:46:02

- Updated

- 2026-02-04 15:46:02

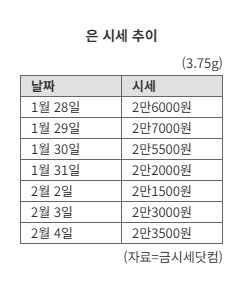

According to the Geumsise.com price information site that day, the retail price of silver, based on 3.75 g, was 23,500 won, down about 9.62% from 26,000 won on the 28th of last month, a week earlier. Previously, at the New York Mercantile Exchange (NYMEX), the international silver price plunged more than 30% in a single day on the 30th of last month local time. As silver futures collapsed, on the 2nd, domestic Exchange-Traded Funds (ETF) and Exchange-Traded Notes (ETN) that track domestic silver futures prices fell by the daily limit of ±30%.

Even as silver prices swing wildly, demand for silver bars appears to remain strong. At the shop run by Mr. Park (67), who has been in the gold and silver business for 20 years, only six silver bars were left in the display case. Some stores have even been taking pre-orders, asking customers to put down deposits of 10–20% of the price.

Mr. Park said, "We practically can't keep 1 kg silver bars in stock; they sell out as soon as we get them," adding, "When a customer comes in wanting to buy in bulk, we have to place an order with the factory, and even then, no one knows whether it will take one month or two months for the bars to arrive."

Despite the chilly weather, a steady stream of customers were visiting the jewelry district to look at silver bars. Mr. Kim (63), who said he has been practicing what he calls "silver-tech"—a combination of silver and investment—by steadily buying silver bars with his mother in her 90s since the first half of last year, decided to move in and buy on the dip after hearing that silver prices had suffered a historic plunge.

Mr. Kim said, "Last week, a 1 kg silver bar cost in the 8 million won range, but today I was told I can buy it in the 6 million won range, so I thought, 'What a windfall,'" adding, "I'm already in a position where I could lock in more than double my money, and I figure I can pass the bars on to my children. So I'm planning to buy silver bars with the mindset of 'averaging down'—like in stocks, buying more to lower my average purchase price."

The backdrop to the sudden swings in silver prices is what some are calling the so-called "Warsh effect." As Kevin Warsh, a former member of the Federal Reserve System (Fed) Board of Governors, was nominated as the next Fed chair, concerns grew that interest rate cuts could be delayed. The resulting strength of the dollar has put downward pressure on precious metals such as gold and silver, analysts say. On top of that, the Chicago Mercantile Exchange (CME) raised maintenance margins on silver futures by as much as 15% in a short period, which led to forced liquidations among highly leveraged investors and further amplified the price crash, according to some assessments.

However, some observers argue that even if former Governor Warsh is appointed, the medium- to long-term upward trend in silver prices could remain intact. They point out that, given the Trump administration's expansionary fiscal policies and the rising debt of the federal government, there is still lingering pressure for interest rate cuts.

Experts stress that while silver remains an attractive investment, investors must be cautious about its volatility. Hwang Byung-jin of NH Investment & Securities noted, "If expansionary fiscal policy continues, the so-called 'debasement trade'—hedging against a decline in currency value—remains valid," but he also advised, "Since silver prices have surged sharply in a short period since the start of the year, investors need to manage risk with the possibility of heightened volatility in mind."

jyseo@fnnews.com Seo Ji-yoon Reporter