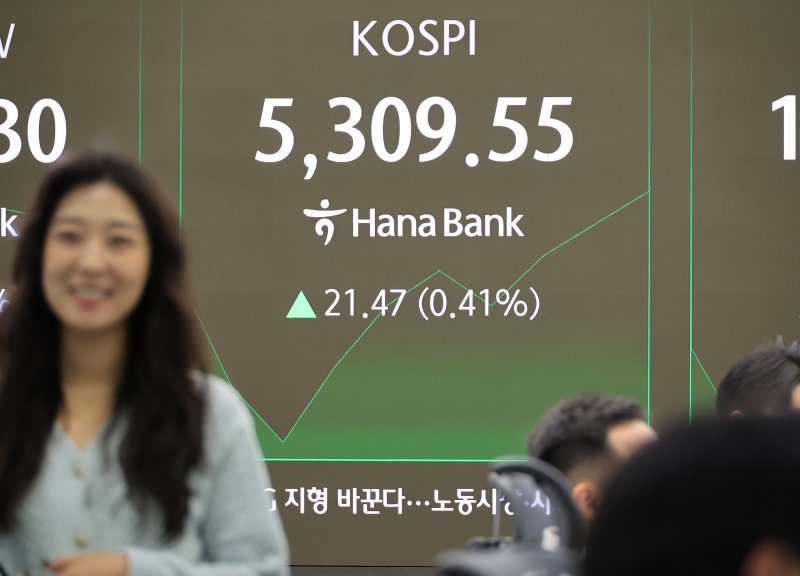

KOSPI Hits All-Time Intraday High, Fluctuates Around 5,330 on Retail and Institutional Buying

- Input

- 2026-02-04 11:02:34

- Updated

- 2026-02-04 11:02:34

The Korea Composite Stock Price Index (KOSPI) set a new intraday all-time high on the back of strong buying by retail and institutional investors.

As of 10:35 a.m. on the 4th, the KOSPI was trading at 5,333.19, up 45.11 points, or 0.85%, from the previous session.

The index opened at 5,260.71, down 0.52% from the previous close, but soon pared its losses. In morning trading, it climbed to the 5,337 level, marking a new intraday record high.

In the KOSPI Market, retail investors were net buyers of 516.6 billion won, while institutions purchased 260.3 billion won. Foreign investors showed net selling of 854.8 billion won.

By sector, electricity and gas rose 5.83%, construction gained 3.58%, and machinery and equipment advanced 2.61%. In contrast, electrical and electronics fell 1.17%, medical and precision instruments slipped 1.03%, and IT services declined 0.85%.

Among large-cap stocks by market capitalization, Samsung Electronics dropped 1.97%, SK hynix lost 2.09%, and Hanwha Aerospace edged down 0.15%. Hyundai Motor climbed 2.75%, LG Energy Solution added 2.30%, Samsung Biologics rose 0.4%, and SK Square gained 2.2%.

Overnight, the U.S. stock market closed lower, led by declines in tech shares. This came despite expectations that a government shutdown would end after the Federal Government of the United States' budget bill passed the United States House of Representatives. Concerns grew over potential earnings deterioration at competing software firms following Anthropic's launch of an AI automation tool, as well as worries about the profitability of hardware companies amid a sharp rise in memory prices.

The domestic market opened lower in response to the overnight weakness in the U.S. stock market and has since been moving in a narrow range around flat. The fact that Advanced Micro Devices (AMD) delivered an earnings surprise after the close but was still down about 7% in after-hours trading is also weighing on local sentiment.

Han Ji-young, a researcher at KIWOOM Securities, said, "The domestic stock market is enjoying a liquidity-driven boom, as retail investors' chase buying, fueled by Fear of Missing Out (FOMO), is accelerating." Han added, "This large pool of retail liquidity is expected to concentrate on the leading semiconductor sector and index-tracking products such as the KOSPI 200 Index and the KOSDAQ 150 Index Exchange-Traded Fund (ETF)."

At the same time, the KOSDAQ Index was trading at 1,151.56, up 7.23 points, or 0.63%, from the previous session. The index had opened at 1,139.02, down 0.46% from the prior close.

In the KOSDAQ Market, retail investors and institutions bought 65.3 billion won and 96.3 billion won, respectively, lifting the index. Foreign investors showed net selling of 134.7 billion won.

nodelay@fnnews.com Park Ji-yeon Reporter