"We’ve Given Up on the U.S. and Europe"... How the Weak Yen Redrew the Vacation Map, and How Long Japan Will Stay Cheap [Kim Kyung-min’s Timely Hit]

- Input

- 2026-02-03 14:46:37

- Updated

- 2026-02-03 14:46:37

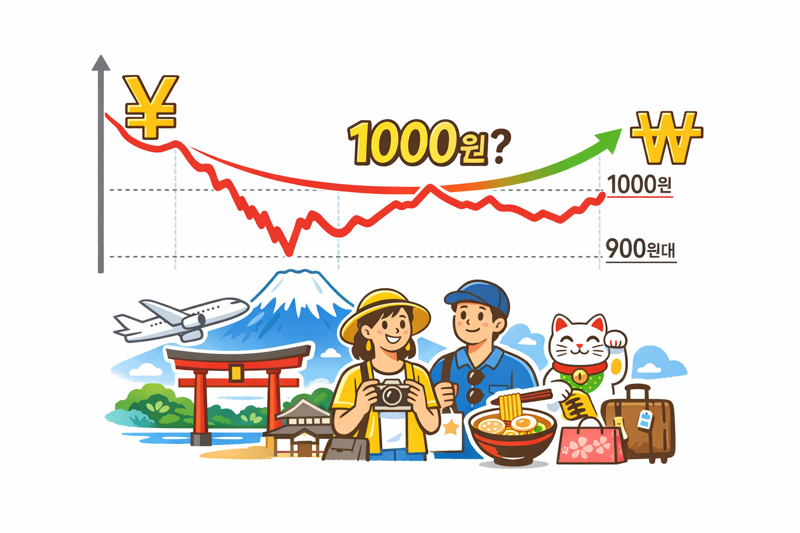

[Financial News]"Just looking at the airfares to the United States or Europe takes my breath away. In the end, Japan is the only affordable option for this year’s vacation again!"This is a common refrain among office workers these days. It is nothing new that exchange rates, rather than scenery or food, have become the primary criterion for choosing a destination. A rate in the low 900 won range per 100 yen that has persisted for more than a year is an unusually “bargain-basement” zone, even by the standards of the past decade. However, the foreign-exchange market does not see this weak yen as Japan’s new normal. The prevailing view is that, although it may take time, the rate will eventually climb back and recover the 1,000-won level per 100 yen. In this era of the so‐called “king dollar” and “king euro,” how much longer can we enjoy the benefits of a weak yen?

"We’ll Take 100 Years to Sell"... Ueda’s Cautious Exit Strategy

As of the end of January, the Bank of Japan (BOJ) held exchange-traded funds (ETF) on its books worth 37.1808 trillion yen (about 347 trillion won) and real estate investment trusts (REIT) worth 654.7 billion yen. At market value, the ETF holdings alone amount to a hefty 83.2 trillion yen.

The BOJ has already begun unwinding its ETF holdings, a legacy of Abenomics, signaling the end of the era of aggressive monetary easing. It has halted new purchases of ETFs and REITs, and at its Monetary Policy Meeting in September 2024 it announced plans to dispose of 330 billion yen in ETFs and 5 billion yen in REITs annually. In January, the BOJ actually sold 5.3 billion yen of ETFs and 100 million yen of REITs. That is only about 0.02% of its total holdings—tiny in numerical terms, but a clear signal to the market.

BOJ Governor Kazuo Ueda said at a press conference, "It is important not to shock the market," adding, "At a simple calculation, it would take 100 years to dispose of everything." In other words, the numbers on the balance sheet have begun to move, but the scale is still far too small to shake the market.

Nihon Keizai Shimbun (The Nikkei) described this as "a strategy of putting the brakes on the weak yen, but not slamming them." Japan is not trying to sharply strengthen the yen right away, but it is also signaling that it will not leave the weak yen in place forever.

"The Low 900-Won Range Feels Uncomfortable"... Japan’s Hidden Maginot Line

The Japanese government’s response is another factor supporting a floor for the yen. In 2024, Japan poured about 9.8 trillion yen into foreign-exchange intervention. In April alone, it mounted a "volume offensive," spending as much as 5.9 trillion yen in a single day. At the time, the dollar–yen rate was around 160 yen per dollar, which translated into roughly 930–940 won per 100 yen.

A senior official at Japan’s Ministry of Finance (MOF) told local media that "the problem is not the level of the exchange rate, but the speed and volatility," and added, "We will respond appropriately to excessive movements." The market has interpreted this as: if the yen falls quickly, authorities will step in; if it drifts down slowly, they will stand by. As a result, the exchange rate in the low 900-won range per 100 yen has come close to what Tokyo perceives as an "uncomfortable" zone, suggesting a determination not to allow the floor to sink much further.

"Ultimately, the Remote Control Is in America"... A Scenario for a Return to 1,000 Won in 2027

The most powerful force propping up the weak yen is still U.S. interest rates. Even after its rate hike, Japan’s policy rate remains below 1%, while the United States has maintained a high-rate stance. But the market’s focus has now shifted from "Will they cut?" to "How quickly will they cut?"

Above all, pressure for rate cuts from U.S. president Donald Trump, who favors a "weak dollar," and the policy stance of the next chair of the Federal Reserve (the Fed), soon to come into view, could be powerful catalysts for a yen rebound. Trump has vowed to push for very low interest rates and weaken the dollar, which would likely translate directly into a stronger yen.

Goldman Sachs recently wrote in a report that "once U.S. rate cuts come into clearer view, the dollar–yen exchange rate will face medium-term downward pressure." UBS likewise predicted that "the point at which the BOJ’s gradual normalization coincides with U.S. rate cuts will mark the starting line for a yen rebound."

Broadly speaking, markets see a return to the 950–980 won range per 100 yen around 2027 as the first target. If policy normalization continues, many project a medium- to long-term path in which the rate recovers to about 1,000 won per 100 yen sometime in 2027–2028.

Why Now Is the Time to Enjoy the Weak Yen

In short, today’s weak yen is less a new baseline for Japan’s economy than a temporary "time-sale" price tag attached during a policy transition. The BOJ has already changed course, the government is managing the downside, and the U.S. interest-rate wall is gradually coming down.

The pace may be slow enough to frustrate markets, but the fact that the BOJ has shifted from being a "big buyer" to a seller is no trivial matter. Local foreign-exchange experts say, "There is still some shelf life left for cheap trips to Japan, but the market’s calculators are already punching in the next set of numbers."

The yen has already passed its low in the 850-won range last year and moved into the 900-won era. Now, the figure of 1,000 won per 100 yen is quietly reappearing on travel planners. Even so, Japan will likely remain a high value-for-money destination through at least this year.

km@fnnews.com Kim Kyung-min Reporter