Korea ranks 4th worldwide in outflow of high-net-worth individuals, doubling in a year

- Input

- 2026-02-03 12:00:39

- Updated

- 2026-02-03 12:00:39

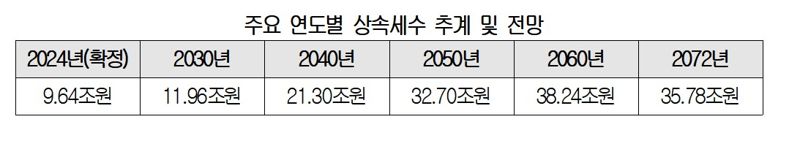

" It added, "Diversifying payment methods—such as extending the installment payment period, allowing payment in kind with listed shares, and lengthening the stock valuation period—can minimize tax revenue losses while facilitating business succession and reducing social side effects, making it a realistic alternative. " The payment diversification measures proposed by KCCI include: extending the current 10-year installment payment period for general inherited assets to 20 years or introducing a grace period of at least five years; allowing payment in kind using listed shares; and expanding the stock valuation period from two months before and after the base date to two to three years. ■ Outflow of high-net-worth individuals doubles in a year The overseas outflow of high-net-worth individuals in Korea has doubled over the past year.

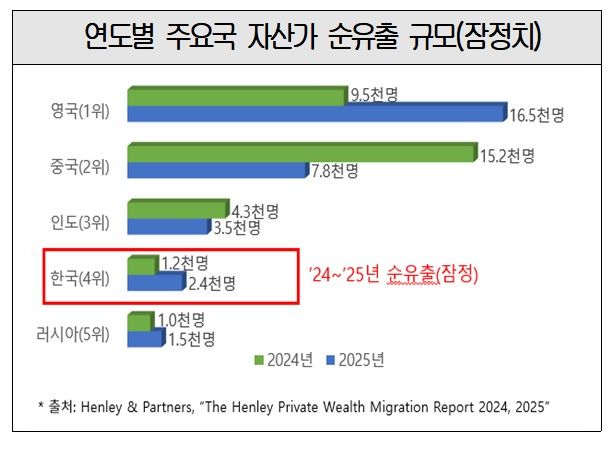

According to British immigration consulting firm Henley & Partners, the estimated net annual outflow of Korean high-net-worth individuals is projected to surge from 1,200 in 2024 to 2,400 in 2025, ranking fourth in the world after the United Kingdom, China, and India. A KCCI official analyzed, "Inheritance tax rates of 50% to 60% can act as a major factor accelerating capital flight overseas. " In practice, inheritance tax burdens have steadily increased for decades without fundamental reform of the system.

An analysis of Korean data from 1970 to 2024 found a clear negative correlation: the higher the ratio of inheritance tax revenue to Gross Domestic Product (GDP), the lower the economic growth rate. Under the current installment payment system, which applies when inheritance tax due exceeds 20 million won, only small and medium-sized enterprises (SMEs) and mid-sized companies receiving business succession benefits can pay in installments for up to 20 years or enjoy a 10-year grace period followed by 10 years of installments.

Individuals and large corporations, by contrast, are allowed only 10 years of installments with no grace period. The effective inheritance tax burden varies significantly depending on the installment period.

Critics note that what was once a tax felt only by the ultra-wealthy is now being felt even by the middle class. The number of people subject to inheritance tax jumped about 13-fold from 1,661 in 2002 to 21,193 in 2024. 14%.For general assets, the effective burden under a 10-year installment plan is about 70% of a lump-sum payment. 3%.In other words, the burden can differ by more than a factor of two depending on the period. A KCCI representative pointed out that the current system amounts to unreasonable discrimination against ordinary citizens and many companies.

The report concludes that extending the installment payment period would have significant economic spillover effects, as increased corporate investment and employment would more than offset any reduction in inheritance tax revenue in terms of GDP growth. Kang Seog-gu, head of the Economic Policy Team at KCCI, said, "The side effects of high inheritance tax burdens—such as reduced corporate investment, pressure from rising stock prices, and forced sales of management control—are growing more serious.

" He emphasized, "Even just improving the methods of paying inheritance tax can greatly ease the actual burden on taxpayers, which in turn can lead to increased corporate investment and a more dynamic economy. It is therefore necessary to introduce more flexible policies on payment methods.

"

According to British immigration consulting firm Henley & Partners, the estimated net annual outflow of Korean high-net-worth individuals is projected to surge from 1,200 in 2024 to 2,400 in 2025, ranking fourth in the world after the United Kingdom, China, and India. A KCCI official analyzed, "Inheritance tax rates of 50% to 60% can act as a major factor accelerating capital flight overseas. " In practice, inheritance tax burdens have steadily increased for decades without fundamental reform of the system.

ehcho@fnnews.com Jo Eun-hyo Reporter