Daily Trading Value Tops 50 Trillion Won for First Time as Market Volatility Surges

- Input

- 2026-02-02 15:46:20

- Updated

- 2026-02-02 15:46:20

[The Financial News] The daily trading value of the Korean stock market has surpassed 50 trillion won for the first time on record. Analysts note, however, that as index volatility increases, retail investors are turning over their positions at a much faster pace.

According to the Korea Exchange (KRX) on the 2nd, the Korea Composite Stock Price Index (KOSPI) closed at 4,949.67, down 5.26% from the previous session, falling back below the 5,000 mark. The KOSDAQ market also dropped 4.44% to finish at 1,098.36, breaking below the 1,100 level. A wave of profit-taking following the recent steep rally hit the market at once, sharply amplifying intraday volatility.

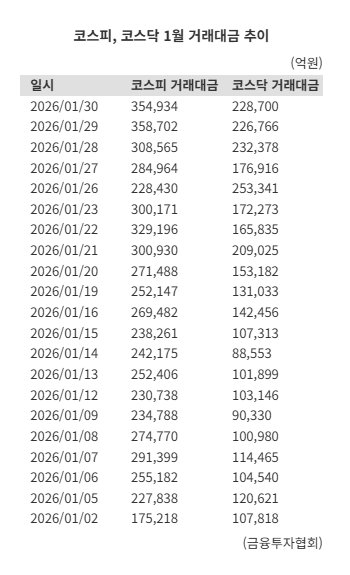

Trading value remains at an all-time high. The Korean stock market’s average daily trading value last month came to 57.9 trillion won on a cumulative basis. In particular, as of the 28th of last month, the five-day moving average of trading value reached 71.7 trillion won, setting a new record. The average daily trading value of Exchange-Traded Funds (ETF) also totaled 12.6 trillion won last month, up 91.8% from the previous month and 129.4% compared with last year’s annual average of 5.5 trillion won.

Brokerage houses interpret the surge in trading value not just as a sign of an active market, but as evidence that the nature of the market itself is changing. In past bull phases, trading value also rose quickly, but the market now entering the 50-trillion-won range is seen as an indicator that investment horizons are becoming increasingly short term. In fact, leadership stocks are rotating several times a day, and even within the same stock, intraday price swings have been repeatedly widening.

A securities industry official said, "The trading value breaking through 50 trillion won is both a confirmation that the upward trend is still intact and, in the short term, a signal that volatility is likely to expand," adding, "At this point, it is more important to look not only at the index level itself, but also at which stocks and sectors the trading value is concentrating on."

Market strategists generally agree that the future direction of the market will largely depend on whether the current level of trading value is sustained or contracts sharply. If high trading value is maintained while sector rotation continues, the uptrend could persist; but if trading value drops rapidly, accumulated short-term fatigue may surface just as quickly.

An official at a securities firm commented, "In the current phase, investors feel uneasy if the index does not rise, yet become even more anxious when it climbs too quickly, which is typical of the late stage of a liquidity-driven market," and advised, "Given the recent sharp pullback, it is more important to diversify and adjust the pace of investment than to chase the rally."

dschoi@fnnews.com Choi Doo-seon Reporter