Office worker in his 30s says, "I run out of cash paying my card bill, so I use the card again... Where did it all go wrong?" [Personal Finance Q&A]

- Input

- 2026-02-01 05:00:00

- Updated

- 2026-02-01 05:00:00

[The Financial News] Mr. A, an office worker in his fifth year and in his 30s, has become trapped in what he calls "the shackles of credit cards." As he relied on his credit card for everyday spending, his expenses grew, and he eventually turned to loans. After borrowing once or twice, his monthly repayments reached a level he could no longer comfortably afford. Each payday, he first pays down his loans, and by the time his card payment is due, there is no money left, forcing him to use the card again. This vicious cycle keeps repeating.

Fortunately, his company provides housing, so he does not pay rent. Even so, he finds it hard to get by without using a credit card. He tries to cut back on card use, but it has not been easy. He feels increasingly anxious, thinking he must pay off his loans as quickly as possible. He has several loans with one to three years remaining on each, and he wants to clear his debts as soon as he can and start saving. As his worries deepened, he decided to seek financial counseling.

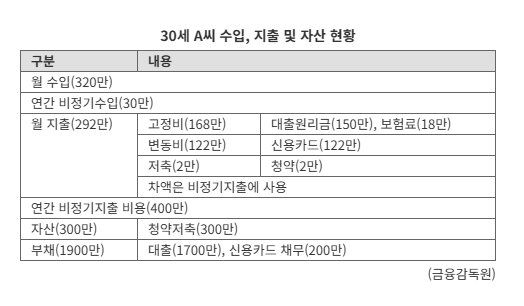

Mr. A earns 3.2 million won per month. His irregular annual income amounts to 300,000 won. His monthly expenses total 2.92 million won. Fixed costs come to 1.68 million won, including 1.5 million won in loan principal and interest and 180,000 won in insurance premiums. Variable expenses include 1.22 million won in credit card spending. For savings, he contributes 20,000 won per month to a housing subscription account. The remaining amount is used for irregular expenses. His only asset is 3 million won in that subscription savings account. His liabilities consist of 17 million won in loans and 2 million won in credit card debt. His irregular expenses total 4 million won per year.

According to the Financial Supervisory Service (FSS) on the 1st, using a credit card is like a "double-edged sword." It is convenient, but excessive reliance can trap you in a cycle of debt.

In principle, spending should stay within the limits of one’s income. However, because credit card payments are debited in a lump sum, it is hard to keep spending under control unless you plan your budget carefully in advance.

Mr. A said that as his credit card use increased, his cash on hand steadily dwindled. When he did not have enough to cover his card bill, he took out loans to fill the gap. Because he failed to cut his spending, his borrowing grew, and the burden of repaying principal and interest only got heavier. As loan repayments and living costs left him short of cash, he fell into a fixed pattern of turning back to his credit card. In the process, he lost track of his own spending habits. Still, he is now determined to rein in his excessive expenses.

An FSS official said, "First, he needs to break down his spending in detail and identify which items were excessive, then draw up a loan repayment plan," adding, "The good news is that Mr. A’s loan balance and irregular expenses are not overly large, so it appears he could pay off all his loans within a year."

Because Mr. A has multiple loans, it is better to set priorities when repaying them. He should first clear the 2 million won in credit card debt, then pay off the smaller balance loans among his principal-and-interest loans to gradually increase his monthly surplus cash.

During the one year he focuses on repayment, he needs to cut irregular expenses and food and personal spending as much as possible. Irregular expenses should be reduced from the current 4 million won a year to 1 million won, and food and personal spending should be kept to a combined 700,000 won per month. If he divides his living expenses into weekly amounts of 175,000 won, it will be easier to control his spending. By tightening his living costs, his monthly surplus cash will rise to 600,000 won, and he should use this for four months to first pay off the 2 million won in credit card debt.

From the fifth month, he should concentrate on repaying the remaining 17 million won in loans. On top of the existing 1.5 million won in monthly principal and interest payments, he should allocate 500,000 won out of the 600,000 won surplus each month to further reduce the outstanding balance. The remaining 100,000 won per month, along with the 300,000 won in irregular annual income, should be reserved for irregular expenses and emergency funds.

If he pays off his loans quickly within a year, he can start building savings from the second year. The 1.5 million won that had been going toward principal and interest each month can be redirected into savings, and his monthly surplus can be set aside in advance to cover irregular expenses, which can then be raised back to 4 million won a year. After subtracting fixed costs (180,000 won in insurance premiums) and variable costs (700,000 won for food and personal spending, 100,000 won for telecommunications, and 100,000 won for transportation) from his monthly income of 3.2 million won, he will have about 25 million won a year in surplus funds. After deducting irregular expenses of 4 million won, he will be able to save roughly 21 million won annually.

If you type "FINE financial consumer portal" into an internet search engine or call Financial Supervisory Service Call Center 1332 (press 7 for financial advisory services), you can receive free, customized financial consumer counseling.

nodelay@fnnews.com Reporter Park Ji-yeon Reporter