Number of stock accounts tops 100 million, debt‐fueled investing exceeds 30 trillion won, investor deposits surpass 100 trillion won

- Input

- 2026-01-31 10:51:29

- Updated

- 2026-01-31 10:51:29

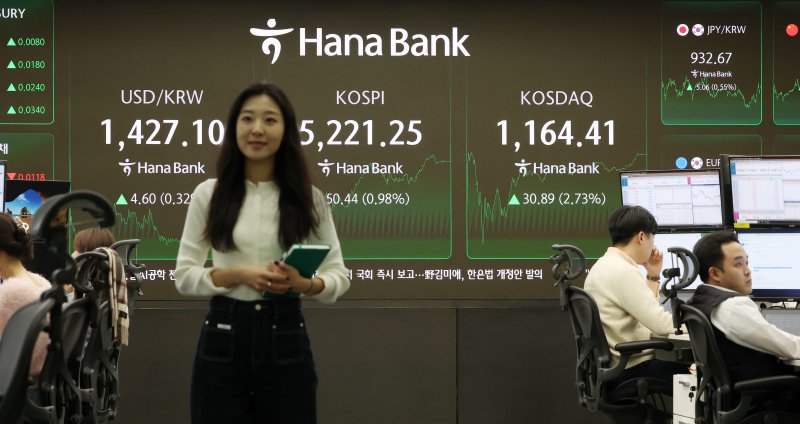

[The Financial News] As the domestic stock market has been on a strong upward trend, hitting milestones such as KOSPI 5,000 and KOSDAQ Index 1,000, more investors are participating in stock trading.

According to the Korea Financial Investment Association (KOFIA) on the 31st, the number of active stock trading accounts stood at 100,020,450 as of the 29th. This is an increase of nearly 1.73 million from 98,291,148 at the end of last year in just about a month.

Active stock trading accounts refer to accounts that are actually used for stock transactions. They are brokerage or securities savings accounts with at least 100,000 won in assets on deposit and at least one transaction in the past six months. Accounts with no trading activity are excluded, making this a useful gauge of the real investor base.

The scale of so‐called debt‐fueled investing, where investors borrow money to buy stocks, has also reached an all‐time high. Outstanding margin loans came to 30.0925 trillion won as of the 29th.

Outstanding margin loans represent the amount investors have borrowed from securities firms to purchase stocks and have not yet repaid. It is a key indicator of how much individual investors are relying on borrowed funds to invest.

Investor deposits exceeded 100 trillion won for the first time on the 27th, reaching 100.2826 trillion won, and continued to hit new highs, rising to 103.7072 trillion won as of the 29th.

Investor deposits are funds that investors have placed in their brokerage accounts to buy stocks, or proceeds from stock sales that have not yet been withdrawn. Because this money can flow into the market at any time, it is viewed as cash waiting on the sidelines.

Brokerage analysts expect these inflows to fuel rotational buying into stocks beyond the existing market leaders.

Jung Hae-chang, a researcher at Daishin Securities, noted, “The KOSPI has firmly broken above 5,000, and as the fourth‐quarter earnings season gets into full swing, inflows are spreading from leading stocks to related names.” He projected, “This catch‐up rotation between expectations already priced into share prices and actual earnings will unfold at an even faster pace.”

yimsh0214@fnnews.com Lim Sang-hyuk Reporter