A bolt from the blue: "Earn 1 billion, pay back 800 million"—10 side effects of multiple-home ownership regulations in a chaotic market [Real Estate A to Z]

- Input

- 2026-01-31 15:00:00

- Updated

- 2026-01-31 15:00:00

[The Financial News] The concept of treating those who own two or more homes as owners of multiple homes dates back to the "August 10 Real Estate Comprehensive Measures" announced on August 10, 1988. At that time, the period required to qualify for capital gains tax reductions for households owning two homes was shortened from two years to six months for apartments and one year for detached houses.

Calls to overhaul this long-standing definition of multiple-home ownership have surfaced many times. Some argue the bar should be raised to three or more homes, while others say the standard should be based on property value rather than the number of units. Yet each time, the debate has gone nowhere, and the formula "two or more homes = owner of multiple homes" remains in place to this day.

Acquisition Tax 12%, Comprehensive Real Estate Holding Tax 5%, capital gains tax 75%

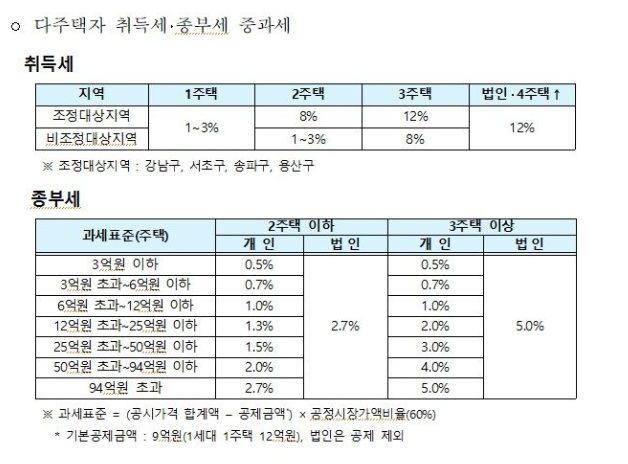

Under the current system, owners of multiple homes can face Acquisition Tax rates of up to 12%. For single-home owners, the rate ranges from 1% to 3%. By contrast, in an Area Subject to Adjustment, the rate is 8% for owners of two homes and 12% for those with three homes. For those with four or more homes and for corporations, a 12% rate applies regardless of whether the property is in a regulated area.

The Comprehensive Real Estate Holding Tax is also a heavy burden for owners of multiple homes. From three homes and up, a punitive rate applies, with a maximum of 5.0%, higher than the general rate of 0.5% to 2.7%. The basic deduction is 1.2 billion won for single-home owners, but only 900 million won for owners of multiple homes.

When punitive capital gains tax rates are applied, most of the profit from a sale ends up going to taxes. The basic capital gains tax rate ranges from 6% to 45%. However, in Areas Subject to Adjustment, an additional 20 percentage points are added for owners of two homes and 30 percentage points for those with three homes. For a three-home owner, the pure capital gains tax rate can reach 75%. Including local taxes, the burden rises to 82.5%.

According to an analysis by Woo Byung-tak, a specialist at Shinhan Bank's Shinhan Premier Pathfinder, a three-home owner who sells an apartment held for more than 10 years and realizes a capital gain of 1 billion won currently pays 328.91 million won in capital gains tax. If punitive capital gains taxation is reinstated and the long-term holding deduction is abolished, that tax bill would more than double to 750.48 million won.

An industry official commented, "If you look at the punitive capital gains tax rates, they are similar to the taxes imposed on speculative transactions such as the sale of unregistered real estate," adding, "There is nothing like this anywhere else in the world." On top of that, multiple layers of regulation apply, including lending restrictions and tighter rules on housing subscriptions.

Regulations on owners of multiple homes, and their 10 side effects

The government plans to end the temporary suspension of punitive capital gains tax rates this year. Officials explain that punitive capital gains taxation is not new but a long-standing system. The market is reacting sensitively because the end of this grace period is being read as a signal that tax-related regulations on owners of multiple homes may be tightened further.

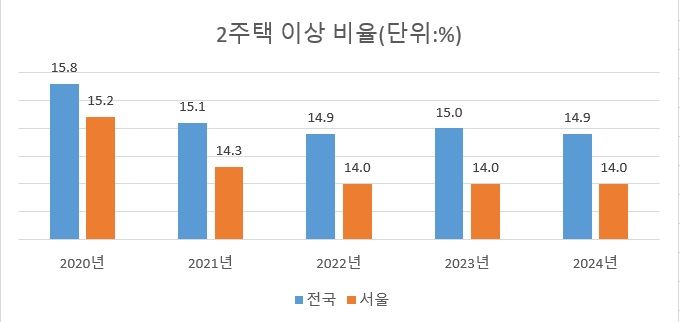

Government statistics show that, as of 2024, owners of multiple homes account for 14.9% of homeowners nationwide and 14.0% in Seoul. Compared with 2020, their share has declined. In 2020, the proportion of owners of multiple homes was 15.8% nationwide and 15.2% in Seoul. A series of regulatory tightening measures has translated into a drop in their share.

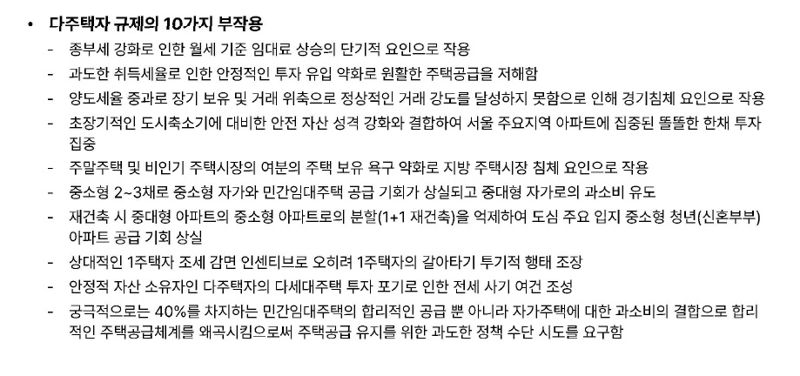

Industry observers say that tougher regulations on owners of multiple homes are causing numerous side effects, including a slump in regional housing markets and the rush into "a single prime property." The Comprehensive Real Estate Holding Tax, introduced as a tool to regulate owners of multiple homes, has also contributed to sharp increases in monthly rents.

According to the report "Current Conditions of the Real Estate Market and Policy Assessment in the Early Lee Jae-myung Administration" by Professor Chang-Moo Lee of Hanyang University (HYU), monthly rents rose by more than 20% during the Roh Moo-hyun administration (2003–2008), when the Comprehensive Real Estate Holding Tax was introduced. During the Moon Jae-in administration (2017–2022), monthly rents climbed by more than 30%.

Owners of multiple homes play a significant role in the private rental market for both monthly and deposit-based leases. A decline in multiple-home ownership can therefore become a serious destabilizing factor for the rental market.

A market insider warned, "Right now, the number of owners of multiple homes is falling, yet housing prices are rising even faster. Owners of multiple homes are not the main culprits driving up home prices," adding, "When the public sector is failing to adequately supply rental housing, if owners of multiple homes disappear, an explosion in rents will be unavoidable."

Professor Chang-Moo Lee of HYU stated, "With an Acquisition Tax of 12%, capital gains tax of 75%, and Comprehensive Real Estate Holding Tax of 5%, there is no other country that imposes regulations as harsh as ours." In his report, he warned that regulations on owners of multiple homes could trigger 10 different side effects.

ljb@fnnews.com Lee Jong-bae Reporter