"A sugar levy like tobacco?"... Small business owners and citizens angered by president's remark

- Input

- 2026-01-29 13:42:05

- Updated

- 2026-01-29 13:42:05

As President Lee Jae-myung's suggestion of "a sugar levy like tobacco" spread across social media, concerns have been mounting among small business owners and citizens, regardless of whether it becomes an official policy. Although no concrete roadmap has been presented, many say that the very term "sugar tax" evokes fears of higher prices and heavier living costs. Critics also point out that, because sugar is an everyday ingredient rather than a discretionary luxury, any price hike could shift the burden onto self-employed business owners and low-income households.

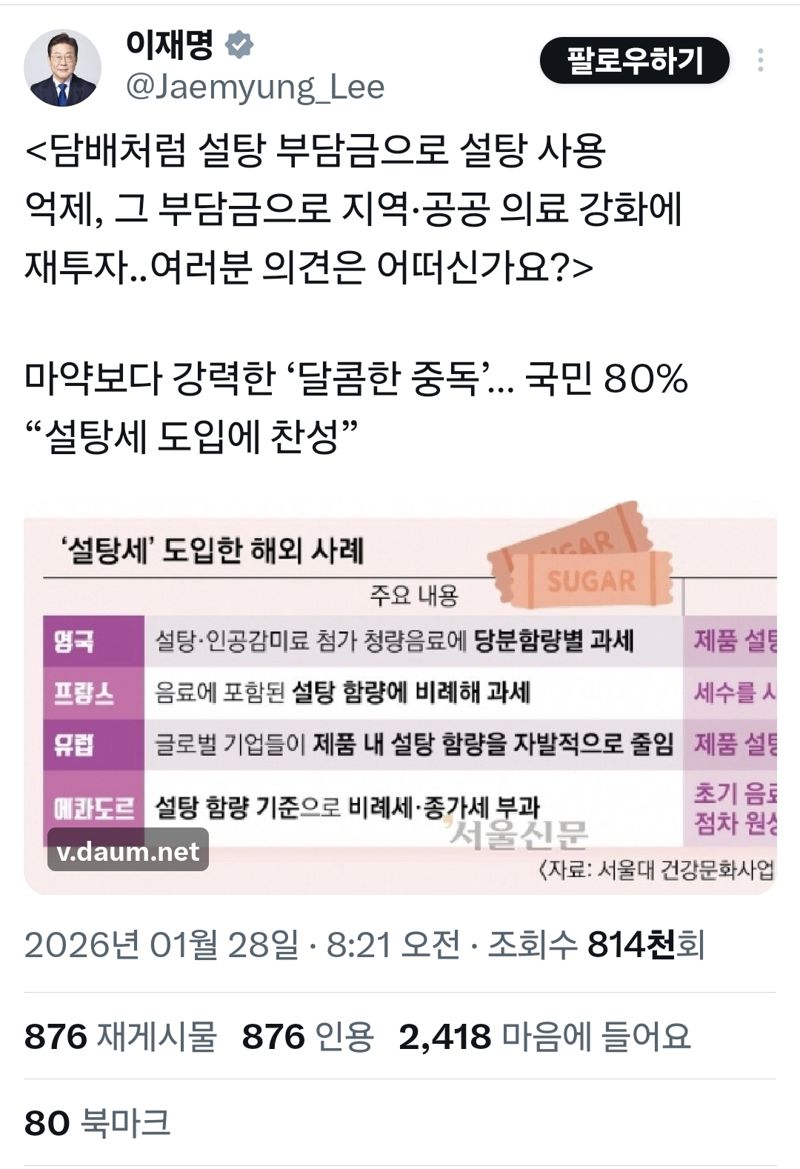

According to political sources on the 29th, President Lee Jae-myung wrote on X (formerly Twitter) on the 28th, asking, "What about curbing sugar use through a sugar levy similar to tobacco, and reinvesting the proceeds to strengthen local and public healthcare?" In response, Cheong Wa Dae (the Blue House) stressed that the idea is still at the discussion stage, stating that it plans to "gather opinions from various sectors on issues such as the public health implications of sugar consumption and the use of the levy as a funding source to reinforce local and public healthcare, and then review them."

However, reactions erupted almost immediately on online communities, social media, and message boards for self-employed workers once the proposal became known. Numerous posts appeared saying, "The economy is already tough, and now they're talking about a sugar tax," "Coffee and dessert prices will probably go up again," and "I won't even be able to buy instant coffee freely anymore." In some communities, people even coined the phrase "sugar tax = food costs going up."

Concerns are especially strong in sectors that use large amounts of sugar, such as cafes and bakeries. A 31-year-old who runs a small cafe in Seoul Special Metropolitan City said, "The prices of coffee beans and milk keep rising, and if a levy is added to sugar as well, raising menu prices will be unavoidable." The owner added, "Customers are already tightening their belts, so if I'm forced to raise prices again, I don't know if I can stay in business."

A 55-year-old bakery owner in Gyeonggi Province said, "Large franchise chains can raise prices without taking much of a hit, but for neighborhood shops, even a small increase drives customers away," and lamented, "In the end, small business owners will be the ones taking the direct hit."

Ordinary citizens are also deeply worried. A 29-year-old office worker living in Seocho District of Seoul Special Metropolitan City said with a sigh, "Because I'm busy, I often make do with bread or simple desserts for meals, and if a levy is imposed on sugar, it will effectively increase the burden on this kind of everyday consumption as well." A 40-year-old homemaker in Mapo District acknowledged, "It's true that children's sugar intake is a serious problem," but stressed, "If a sugar tax is introduced, there must be accompanying measures to ease the burden on ordinary households."

There are also growing warnings that a sugar levy could become a "regressive tax." Since sugar is a basic ingredient used widely in meals and snacks, rather than a selective consumption item for certain groups, the price increase could weigh more heavily on low-income households and self-employed workers. Some even argue that for low-income people, who must obtain high calories at low cost, a sugar tax could amount to a threat to their basic livelihood.

Eunhee Lee, a professor of consumer studies at Inha University, noted, "If sugar prices rise, it will inevitably lead to price increases across cafes, bakeries, and the broader food industry." She added, "In that process, the burden will first be passed on to self-employed business owners and companies, and as it is ultimately shifted to consumers, low-income groups are likely to feel the impact more acutely."

As the sugar levy is increasingly perceived not as a tool to promote public health but as "yet another tax" that will raise living costs, experts advise that the timing and design of any such measure require a cautious approach.

Kim Siwol, a professor of consumer studies at Konkuk University, said, "A sugar levy is an issue that must take into account the various types of consumers who purchase sugar, including end consumers and self-employed business owners." Kim emphasized, "In addition to thoroughly examining tax rates and policy effectiveness, the measure must be designed and publicly debated in a way that reflects the domestic consumption structure and the high share of self-employment."

yesji@fnnews.com Reporter Kim Yeji Reporter