Bank loan delinquency rate at 0.60% at end-November, up 0.02 percentage points from previous month

- Input

- 2026-01-28 08:30:21

- Updated

- 2026-01-28 08:30:21

[The Financial News] The delinquency rate on won-denominated loans at domestic banks in November last year inched up from the previous month. The Financial Supervisory Service (FSS) plans to strengthen management of asset soundness through measures such as writing off and selling non-performing loans, while guiding banks to secure sufficient loss-absorbing capacity by building up loan-loss provisions.

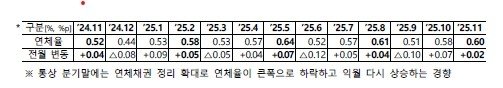

According to the FSS on the 28th, the delinquency rate on won-denominated loans at domestic banks, based on principal and interest overdue by one month or more, stood at 0.60% at the end of November last year. This was an increase of 0.02 percentage points from the end of the previous month.

The delinquency rate had fallen by 0.10 percentage points to 0.51% in September last year, but then rose for two consecutive months in October and November. However, the pace of increase slowed compared with the previous month, when it climbed 0.07 percentage points.

Typically, delinquency rates drop sharply at the end of each quarter as banks step up efforts to clear overdue loans, and then tend to rise again in the following month.

Newly generated delinquencies in November amounted to 2.6 trillion won, down 300 billion won from the previous month.

The volume of resolved delinquent loans came to 1.9 trillion won, an increase of 600 billion won from the previous month.

The FSS said, "Despite a decrease in newly generated delinquent loans and an increase in the amount of delinquent loans resolved, the delinquency rate still rose slightly compared with the previous month."

Delinquency rates increased across all segments.

The corporate loan delinquency rate was 0.73%, up 0.04 percentage points from the end of the previous month. For large corporations it was 0.16%, and for small and medium-sized enterprises it was 0.89%, rising 0.02 and 0.05 percentage points, respectively.

The household loan delinquency rate rose 0.02 percentage points from the end of the previous month to 0.44%. The mortgage loan delinquency rate edged up 0.01 percentage points to 0.30%, while unsecured and other non-mortgage loans climbed 0.05 percentage points to 0.90%.

gogosing@fnnews.com Park So-hyun Reporter