AI data centers are snapping up memory chips, pushing price hikes through 2027

- Input

- 2026-01-27 02:59:39

- Updated

- 2026-01-27 02:59:39

Sassine Ghazi, chief executive officer of Synopsys, recently told Consumer News and Business Channel (CNBC) in an interview that a memory-focused semiconductor supply crunch is likely to continue through 2026 and 2027. “Most of the memory volumes from top suppliers are going straight into AI infrastructure,” he said, adding, “Other products also need memory, but there is no spare production capacity, so those markets are essentially starved.”

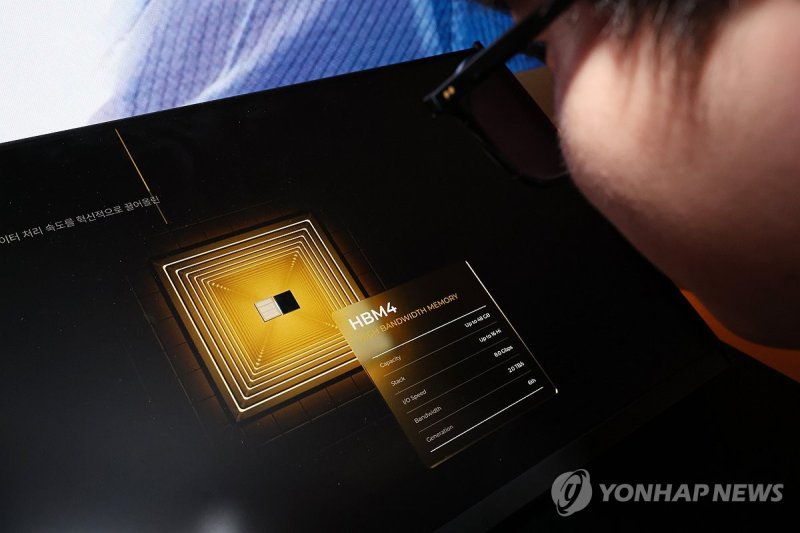

Memory chips are core components in consumer devices such as smartphones and laptops. More recently, they have become indispensable for AI data centers and servers as well. Demand for high-bandwidth memory (HBM) in particular has surged, intensifying the pressure felt across the market.

Tens of billions of dollars continue to pour into data center infrastructure. As companies keep adding servers for AI model training and inference, memory demand has shot up to what some describe as a “sky-high” level, and prices have climbed at an unprecedented pace. Analysts expect this price uptrend to continue this year.

Expanding supply will not be easy. Samsung Electronics, SK hynix, Micron Technology and other major players that dominate the memory market are moving to add capacity, but Ghazi noted that it takes “at least two years” before new plants actually come online. In other words, the supply-demand imbalance will be difficult to resolve in the short term.

Memory prices have traditionally followed a cyclical pattern of recurring shortages and gluts. However, some in the industry have begun calling the current trend a “supercycle.” Ghazi described the present moment as “a golden time for memory companies.”

The burden of higher costs is likely to be passed on to finished-product makers. Winston Cheng, Chief Financial Officer (CFO) of Lenovo Group Limited, also pointed to a shortfall in supply relative to demand, saying, “Memory prices are going to go up.” He added, “In this cycle, I am very confident that we will be able to pass the costs on to product prices.”

Smartphone makers have likewise flagged the possibility of price hikes. China’s Xiaomi Corporation predicted last year that higher prices for mobile devices could start to show up in 2026. Even so, Synopsys CEO Ghazi stressed that “price increases are already happening.”

Lenovo Group Ltd. said it can mitigate some risks by diversifying its supply chain, leveraging its 30 production facilities worldwide. At the same time, CFO Cheng acknowledged that the consumer device segment is “taking a bit of a hit in terms of price-sensitive demand.”

Even so, demand to replace PCs and laptops remains intact, according to his assessment. Cheng noted that PC users are continuing to upgrade to Windows 11, released by Microsoft (MS) in 2021, and said, “The replacement cycle is very real.” He predicted that price increases will first start to affect lower-priced product segments in the electronics market.

\r\n

pride@fnnews.com Lee Byung-chul Reporter