How Was the Economy in January? Manufacturing Holds Up, Non-Manufacturing Lags

- Input

- 2026-01-27 06:00:00

- Updated

- 2026-01-27 06:00:00

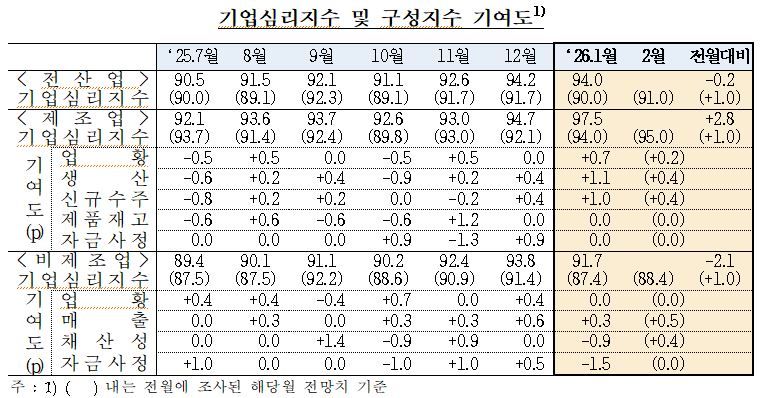

On the 27th, the Bank of Korea (BOK) released the "Results of the January 2026 Business Survey and Economic Sentiment Index (ESI)." The Composite Business Survey Index (CBSI) for all industries in January was 94.0. This was down 0.2 points from the previous month, but 4 points higher than the level of 90.0 that firms had expected in December.

The outlook for February was 91.0, revised up by 1.0 point from the January outlook of 90.0.

The Composite Business Survey Index (CBSI) is a sentiment indicator derived from five key manufacturing and four key non-manufacturing components of the Business Survey Index (BSI). The long-term average from January 2003 to December 2025 is set at 100. Readings above 100 are interpreted as more optimistic than the long-term average, while readings below 100 are seen as pessimistic. This survey covered 3,524 companies nationwide, and 3,255 responded, a response rate of 92.4% (1,815 manufacturers and 1,440 non-manufacturers).

The manufacturing CBSI stood at 97.5, up 2.8 points from the previous month. It also exceeded the earlier outlook of 94.0. The manufacturing CBSI outlook for the next month was 95.0, 1.0 point higher than the previous month’s outlook. Contributions from production, new orders, and business conditions were 1.1, 1.0, and 0.7 points, respectively, driving the improvement. However, because the index remains below 100, sentiment is still pessimistic compared with the long-term average.

Lee Hye-young, head of the Economic Tendency Survey Team at Economic Statistics Department 1 of the BOK, explained, "Manufacturing improved mainly in primary metals, other machinery and equipment, and rubber and plastics."

These improvements reflect, respectively, expanded exports to overseas automakers and the introduction of a steel export licensing system by the Chinese government; stronger demand from downstream industries such as semiconductors and shipbuilding; and seasonal demand increases in downstream sectors including cosmetics, retail, and food products.

The CBSI for large enterprises was 101.8, surpassing 100 for the first time in three years and seven months since June 2022, when it recorded 104.1. The CBSI for small and medium-sized enterprises was 91.8, up 1.7 points from the previous month.

The manufacturing outlook for February was 95.0.

The non-manufacturing CBSI was 91.7, down 2.1 points from the previous month. Deterioration in funding conditions and profitability contributed -1.5 and -0.9 points, respectively. Lee noted, "Factors included the collection of funds in sectors such as professional, scientific and technical services and information and communications, and in some industries where orders are concentrated at year-end, those orders tend to drop off at the beginning of the year."

The non-manufacturing outlook for February was 88.4, slightly higher than the previous month’s outlook of 87.4.

Looking more closely at the manufacturing BSI, the business conditions BSI was 73, up 3 points from the previous month. The outlook for the next month was 72, 1 point higher than a month earlier.

The production BSI (87), sales BSI (85), and new orders BSI (83) all rose by 5 points from the previous month. Their outlooks for the next month were 85, 81, and 81, respectively, each up 2 points.

The finished-goods inventory level BSI was 102, unchanged from the previous month, and the outlook for the next month (101) was also the same as a month earlier. The capital investment execution BSI was 92, up 1 point from the previous month, and the outlook for the next month (93) also rose by 1 point.

The profitability BSI was 78, up 2 points from the previous month, and the outlook for the next month (78) increased by 1 point. The funding conditions BSI was 81, unchanged from the previous month, and the outlook for the next month (80) was also the same as a month earlier.

In non-manufacturing, both the actual business conditions BSI for January (71) and the outlook for the next month (68) were unchanged from the previous month. The sales BSI was 79, up 1 point from a month earlier, and the outlook for the next month (77) rose by 2 points.

The profitability BSI in non-manufacturing was 78, down 2 points from the previous month. However, the outlook for the next month (77) was 1 point higher than a month earlier. The funding conditions BSI was 78, a decline of 3 points from the previous month, while the outlook for the next month (77) was unchanged.

The Economic Sentiment Index (ESI) for January was 94.0, up 0.5 points from the previous month. The ESI is a composite indicator that combines the Business Survey Index (BSI) and the Sentiment Consumer Index (SCI). The cyclical component of the ESI, which is calculated by removing seasonal and irregular factors from the original series, was 95.8, an increase of 0.6 points.

taeil0808@fnnews.com Kim Tae-il Reporter