"If Atlas is commercialized, operating profit will triple" Hyundai Mobis seen as biggest beneficiary... Samsung Electro-Mechanics boosted by AI server demand [Jutopia]

- Input

- 2026-01-26 11:00:00

- Updated

- 2026-01-26 11:00:00

The Financial News provides a summary of major brokerage reports from the morning of January 26.

Hyundai Mobis is projected to generate about 13 trillion won in operating profit from the Atlas humanoid robot in 2035 if 1.5 million units are mass-produced, roughly three times this year’s level. Samsung Electro-Mechanics is benefiting from strong demand driven by rising global investment in Artificial Intelligence servers, and this is already being reflected in its earnings. LG Chem is expected to post weak results for the fourth quarter of last year, but analysts see room for a meaningful earnings recovery from the second half of this year as cathode material shipments increase.

◆Hyundai Mobis (012330)― KB Securities / Analyst Kang Seong-jin

- Target price: Not provided

- Investment opinion: Not provided

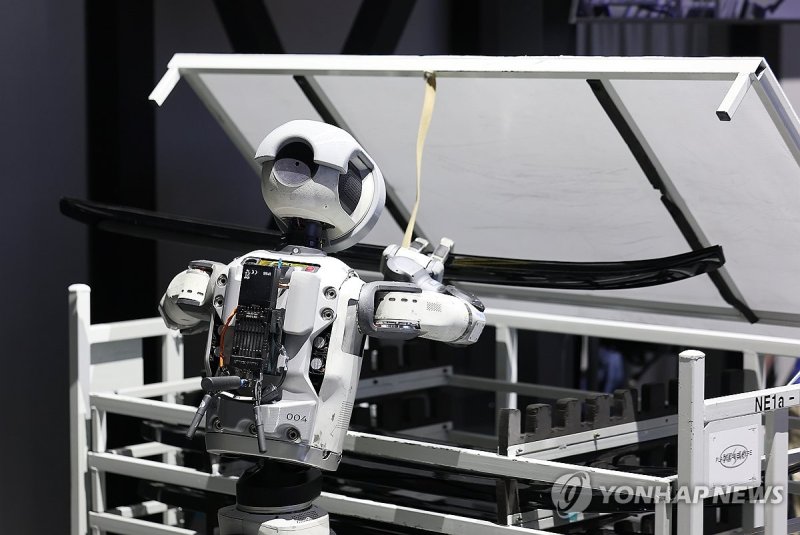

KB Securities projected that if Hyundai Motor Group mass-produces 1.5 million units of the Atlas humanoid robot in 2035, Hyundai Mobis’ related operating profit could reach 13 trillion won. Analyst Kang Seong-jin estimated that around 2030, Atlas could be commercialized at about 450 million won per unit and replace roughly 72 million won in annual labor costs. Kang emphasized that Atlas’ greatest strength lies in its overwhelming labor efficiency, as it can work faster than humans and effectively operate around the clock.※ Atlas humanoid robotThis refers to the humanoid robot developed by Boston Dynamics, the robotics affiliate of Hyundai Motor Group. It resembles the human form, walks on two legs, moves its arms and legs, and can perform tasks like a person. It can carry loads of up to 50 kilograms and rotate 360 degrees, enabling efficient, continuous work even in confined spaces.※ ActuatorThis is a core component that moves a robot’s joints and plays a role similar to human muscles. Hyundai Mobis supplies this part and is expected to serve as a key supplier in the humanoid robot market.

◆Samsung Electro-Mechanics (009150)― Hyundai Motor Securities / Analyst Kim Jong-bae

- Target price: 340,000 won (maintained)

- Investment opinion: Buy (maintained)

Hyundai Motor Securities forecast that Samsung Electro-Mechanics will post sales of 13.225 trillion won and operating profit of 1.29 trillion won this year, up 16.9% and 41.6% year-on-year, respectively, supported by strong demand stemming from expanded AI investment worldwide. Analyst Kim Jong-bae judged that demand for smartphones and PCs is likely to contract, but explained that concerns over IT demand will be offset by Artificial Intelligence-related demand.

◆LG Chem (051910)― Shinyoung Securities / Analyst Hongju Shin

- Target price: 430,000 won (lowered from 450,000 won)

- Investment opinion: Buy (maintained)

Shinyoung Securities noted that LG Chem’s overall business segments are underperforming and that fourth-quarter operating loss will likely fall short of consensus. However, it also projected a return to profit in the first quarter of this year, followed by a full-fledged earnings recovery from the second half. Analyst Hongju Shin explained that the performance of LG Energy Solution and cathode materials, which are the biggest drivers of LG Chem’s share price, is expected to improve from the second half onward.※ Cathode materialThis is one of the key materials in an electric vehicle battery and determines the battery’s capacity and performance. LG Chem produces cathode materials and supplies them to battery manufacturers.

[Jutopia]is an AI-based stock report briefing service that compiles and delivers major research reports from leading domestic securities firms. To continue receiving Jutopia, please subscribe to the reporter’s page.

sms@fnnews.com Reporter Seong Min-seo Reporter