Zero inheritance tax on land worth 30 billion won? NTS to investigate loophole bakery cafés

- Input

- 2026-01-25 13:17:56

- Updated

- 2026-01-25 13:17:56

[The Financial News] The National Tax Service (NTS) will launch inspections of large bakery cafés with substantial assets, amid concerns that they may be abused as a means of avoiding inheritance tax. In particular, the agency plans to focus on large bakery cafés in Seoul and Gyeonggi Province that have recently surged in number, and will also open tax audits if suspicions of tax evasion are confirmed.

On the 25th, the NTS announced a plan for a fact-finding survey on the Business Succession Deduction. The agency stressed that this is not a tax audit aimed at collecting additional taxes, but a preemptive effort to understand how the deduction is being used, amid concerns that the system is being applied in ways that deviate from its original purpose.

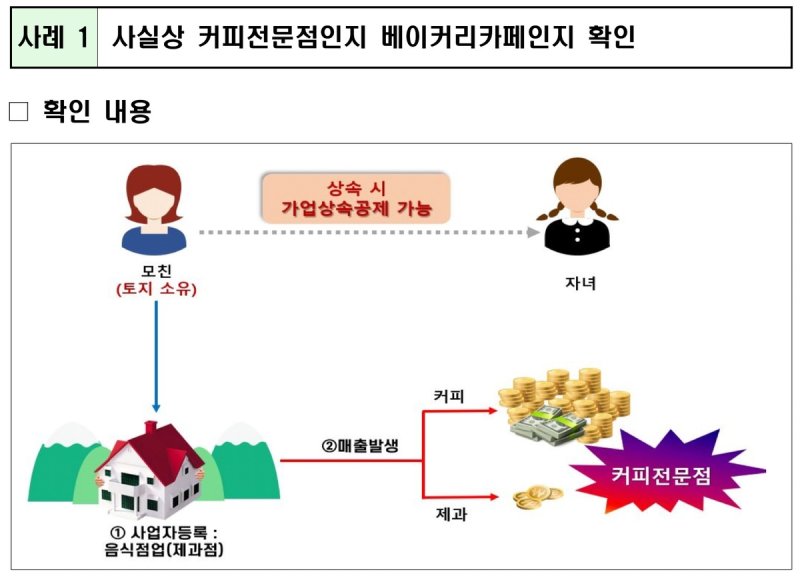

The first step of the survey is to verify whether businesses are properly classified as eligible for the Business Succession Deduction. Authorities will check for cases where a business is registered as a bakery café but, in reality, operates as a coffee shop: for example, where there is no baking facility, only a small quantity of finished cakes is purchased, and the share of beverage ingredients in total purchases is overwhelmingly high.

Another key focus is whether the assets at the business site truly qualify as business succession property eligible for the deduction. For instance, if a couple jointly runs a bakery café on a large plot of ancillary land that also includes a country house, the NTS plans to examine whether part of that land should be treated as residential land attached to the house rather than as business-use property.

Investigators will also closely examine whether the businesses are actually being operated as claimed. The NTS will analyze, in combination, the scale of sales relative to real estate asset values, the number of regular employees, detailed sales and purchase records, and who the real business owner is. As an example, if parents in their 70s who have long run an indoor golf practice range recently opened a large bakery café, and their child in their 40s quit a company job just before the opening, the agency says it needs to verify whether the parents are in fact the true business owners.

For bakery cafés operated in corporate form, the NTS will also look into shareholdings and whether the registered representative directors are genuinely involved in management. In a case where parents in their 80s with no employment or business history and their two children are all registered as joint representative directors, the agency will check whether the elderly parents are actually managing the corporation.

When taxpayers apply for the Business Succession Deduction, the NTS plans to use the findings of these surveys to assess eligibility more strictly. Even after the deduction is granted, it will continue to monitor whether post-approval requirements, such as maintaining the same line of business and preserving employment levels, are being met. In particular, if the survey uncovers suspicions of tax evasion, such as disguised gifts of start-up capital or unexplained funding sources, the agency will conduct rigorous tax audits under separate plans.

The Business Succession Deduction is a system designed to ease inheritance tax burdens and support the growth of small and medium-sized, as well as mid-sized, companies. If an heir takes over a business that the deceased operated for at least 10 years, up to 60 billion won can be deducted from the inherited estate, depending on the length of management.

Recently, bakery cafés classified under the eligible industry category of bakeries have drawn attention as a tax-saving tool. For example, if an only child inherits land worth about 30 billion won on the outskirts of Seoul, roughly 13.6 billion won in inheritance tax would normally be imposed.

However, if a large bakery café is opened on that land and operated for 10 years before being passed on, and the child keeps the business for another five years, a 30 billion won Business Succession Deduction can be applied, resulting in no inheritance tax. The NTS believes that including such cases within the scope of the deduction runs counter to the original intent of the system and is inconsistent with tax fairness.

syj@fnnews.com Seo Young-jun Reporter