Delay in Licensing Tokenized Securities Exchanges... "Reverse Discrimination Among Sandbox Alumni" [Crypto Briefing]

- Input

- 2026-01-25 12:54:59

- Updated

- 2026-01-25 12:54:59

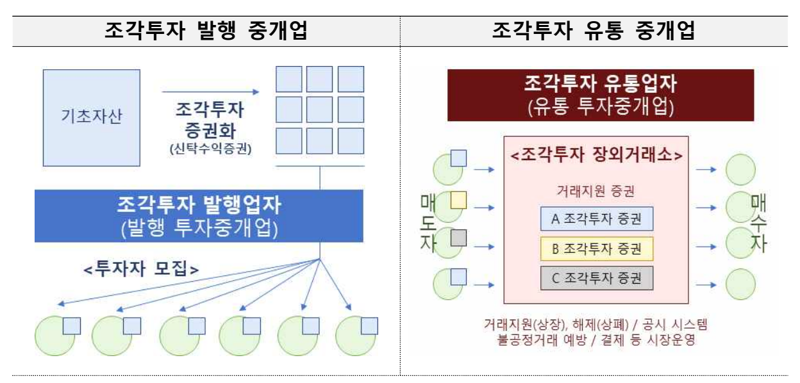

[The Financial News] Debate over preliminary approval for over-the-counter (OTC) markets and distribution platforms for fractional investments and tokenized securities is spreading among companies that came through the Financial Regulatory Sandbox. A conflict is emerging between startups that joined the Korea Exchange (KRX)-led "KDX Consortium" and the alternative trading system Nextrade’s "NXT consortium," and LucentBlock, which is leading a separate consortium. In the Security Token Offering (STO) industry, concerns are mounting that delays in preliminary and final approvals, and thus in opening the market, could cause Korea to miss the "STO golden time."

According to industry sources and financial authorities on the 25th, the Financial Services Commission (FSC) is expected to hold a regular meeting on the 28th to discuss the agenda for granting preliminary approval to STO distribution platforms, including those for fractional investments. The FSC was unable to put the STO distribution preliminary approval agenda on the table at its meeting on the 14th. This was because, even as the KDX Consortium and the NXT consortium were seen as front-runners, LucentBlock raised allegations of technology theft and argued that an innovative startup had been crushed by vested interests.

However, another fairness dispute has arisen among other companies that also came through the Financial Regulatory Sandbox. Except for LucentBlock, all of the startups are participating as part of consortia that include financial institutions and fintech firms. In the case of the NXT consortium, members include Musicow, Sejong DX, Stockeeper, and Together Art. Like LucentBlock, these firms also went through the regulatory sandbox process.

In an official statement, Musicow pointed out, "The NXT consortium includes four fractional investment operators, whereas the other consortium (LucentBlock) has only a single fractional investment operator." The company argued that, although firms that went through the sandbox like LucentBlock have formed consortia and built infrastructure in line with financial authorities’ guidelines, LucentBlock alone is presenting itself as the flagship startup symbolizing innovation.

The controversy has further escalated into a conflict between ministries after the Ministry of SMEs and Startups stepped into the licensing issue under the banner of "protecting startups." An STO industry official criticized, "The Ministry of SMEs and Startups (MSS) claims it is acting to protect startups, but in reality, other startups that have followed the rules and prepared to enter the formal system are being sidelined," adding, "This is not startup protection, but a structure of reverse discrimination among startups."

Another industry source also remarked, "Financial licensing decisions must be made independently, based on the fundamental principle of investor protection." In other words, supporting innovative companies through the sandbox and deciding on financial licenses should be treated as separate issues.

A representative of a financial technology (fintech) firm noted, "The essence of competition in tokenized securities is who designs and controls the capital market infrastructure," and warned, "Korea has completed the legislative framework, but if policy decisions keep being made without clear principles, global capital—and even domestic innovative companies—will lose trust in the Korean market."

elikim@fnnews.com Kim Mi-hee Reporter