Era of 8 Million SUVs in Korea... Full-Scale New Model Battle Among Carmakers

- Input

- 2026-01-27 06:59:00

- Updated

- 2026-01-27 06:59:00

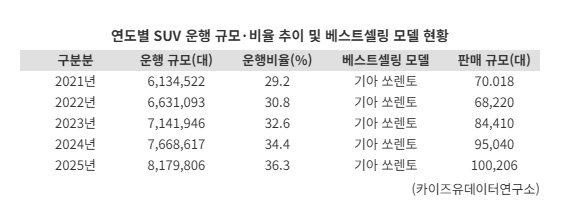

Data from the Kaizyu Data Research Institute on the 27th shows that the number of SUVs in operation last year reached 8,179,806. This represents a 6.7% increase, or 511,189 more vehicles, compared with the previous year and marks the first time the figure has surpassed 8 million. Annual SUV volume on the road has risen steadily from 6,134,522 units in 2021, growing by more than 2 million in just four years.

Their presence in the market is also expanding. Among passenger cars in Korea, the share of SUVs by body type rose from 29.2% in 2021 to 30.8% in 2022, 32.6% in 2023, and 34.4% in 2024, before climbing further to 36.3% last year.

Industry observers expect Korean consumers’ strong preference for SUVs to continue this year. The Kia Sorento was the only single model to sell more than 100,000 units in the domestic market last year, underscoring the popularity of SUVs. At the same time, the number of vehicles more than 10 years old surged from 8.98 million in 2023 to 9.93 million as of October last year, leading to projections that demand for SUVs will grow further as these aging vehicles are replaced.

Automakers are moving quickly to join the SUV race. Hyundai Motor plans to launch a fully redesigned Hyundai Tucson, its compact SUV, in the second half of this year, the first full model change since 2020. A facelifted Hyundai Santa Fe with enhanced safety and convenience features is also scheduled for release in the second half. Kia, which plans to roll out a full-change Kia Seltos in the first quarter, will additionally introduce a facelifted version of the Kia Niro, first launched in 2022, in the first half of the year.

Genesis will debut the Genesis GV90, its first large electric flagship SUV, as it pushes into the global luxury EV market. The brand also intends to steadily increase its domestic market share through a hybrid version of its core model, the Genesis GV80.

Imported brands are strengthening their competitiveness in the electric SUV segment. Mercedes-Benz, which plans to introduce ten new models to the Korean market this year, will add electric versions of its key SUV models, the Mercedes-Benz GLC and Mercedes-Benz GLB, in the second half. Volvo will launch the large electric SUV Volvo EX90 in the first half of the year, while Zeekr, a brand under Zhejiang Geely Holding Group making its Korean debut, has selected the midsize SUV Zeekr 7X as its first model for the domestic market.

Kwon Eun-kyung, a director at the Korea Automobile & Mobility Association (KAMA), said, "The replacement cycle has arrived for vehicles purchased in 2020, when the market recorded its all-time highest sales of 1.91 million units." She added, "With a wave of new models such as the Genesis GV90 and Kia Seltos coming to market, this will help support a recovery in demand."

eastcold@fnnews.com Reporter Kim Dong-chan Reporter