Foreign Exchange Trading Hits Record High Since Statistical Revision: "Both Overseas and Inbound Investment Are Booming"

- Input

- 2026-01-23 12:00:00

- Updated

- 2026-01-23 12:00:00

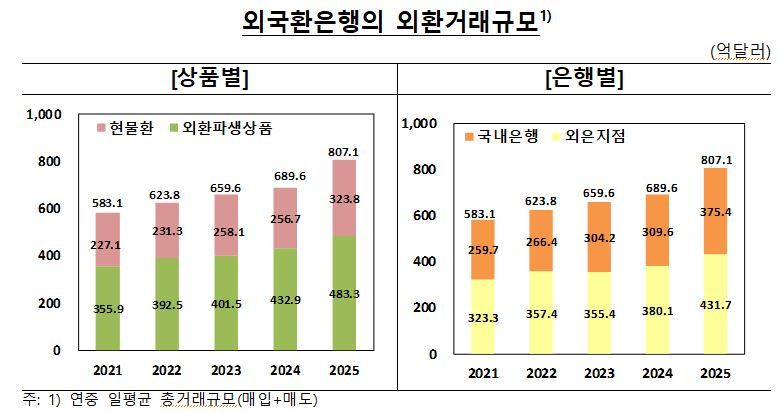

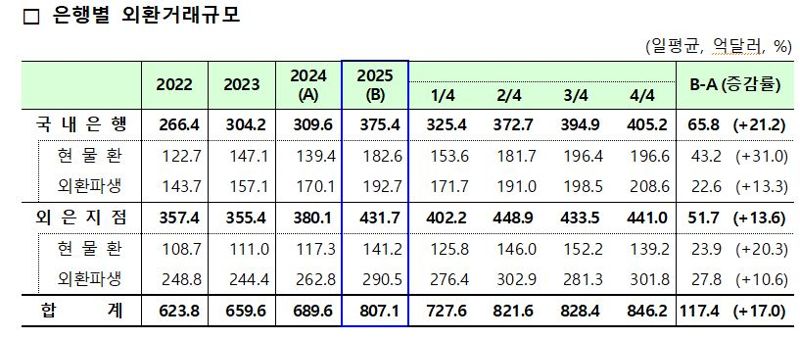

On the 23rd, the Bank of Korea (BOK) released a report titled "Trends in Foreign Exchange Transactions of Foreign Exchange Banks in 2025." The report showed that the average daily amount of foreign exchange transactions (spot and FX derivatives) by foreign exchange banks last year stood at 80.71 billion dollars. This represents an increase of 17.0% (11.74 billion dollars) from the previous year's 68.96 billion dollars, and it is also the largest volume since the statistical revision in 2008.

Both the absolute increase and the growth rate were the highest in 17 years since the revision.

BOK analyzed that the surge was driven by the extension of foreign exchange market trading hours implemented in July 2024, along with simultaneous increases in residents' overseas securities investment and foreign investors' investment in domestic securities.

In fact, residents' overseas securities investment jumped from 72.2 billion dollars in 2024 to 129.4 billion dollars in 2025. Over the same period, foreign investors' domestic securities investment more than doubled, rising from 22.0 billion dollars to 50.4 billion dollars.

By product, spot FX trading reached 32.38 billion dollars, up 25.1% (6.7 billion dollars) from a year earlier. By currency pair, won–dollar trading increased 26.0% (5.06 billion dollars) to 23.502 billion dollars, while won–yuan trading expanded 29.6% (710 million dollars) to 3.11 billion dollars.

By type of institution, trading by domestic banks rose 31.0% (4.32 billion dollars) to 18.26 billion dollars, and trading by foreign bank branches grew 20.3% (2.39 billion dollars) to 14.12 billion dollars.

By counterparty, interbank trading among foreign exchange banks reached 17.02 billion dollars, while transactions with domestic customers and non-residents came to 8.29 billion dollars and 7.07 billion dollars, respectively. These figures represent increases of 33.9% (4.31 billion dollars), 9.8% (740 million dollars), and 30.6% (1.66 billion dollars), in that order.

FX derivatives trading amounted to 48.33 billion dollars, up 11.6% (5.04 billion dollars) from the same period a year earlier. Forward trading totaled 14.5 billion dollars, an 8.1% increase (1.08 billion dollars) from the previous year, led mainly by growth of 750 million dollars in non-deliverable forward (NDF) transactions.

FX swap trading reached 32.26 billion dollars, rising 13.4% (3.82 billion dollars), driven largely by increased transactions with non-residents by foreign exchange banks, which grew by 2.0 billion dollars. Currency swap trading came to 1.36 billion dollars, up 5.2% (700 billion dollars), also mainly due to greater activity with non-residents, whose transactions increased by 120 million dollars.

By bank type, FX derivatives trading by domestic banks expanded 21.2% (6.58 billion dollars) to 37.54 billion dollars, while trading by foreign bank branches grew 13.6% (5.17 billion dollars) to 43.17 billion dollars.

taeil0808@fnnews.com Kim Tae-il Reporter